PZ Correlation

- Indicators

- PZ TRADING SLU

- Version: 2.2

- Updated: 21 October 2020

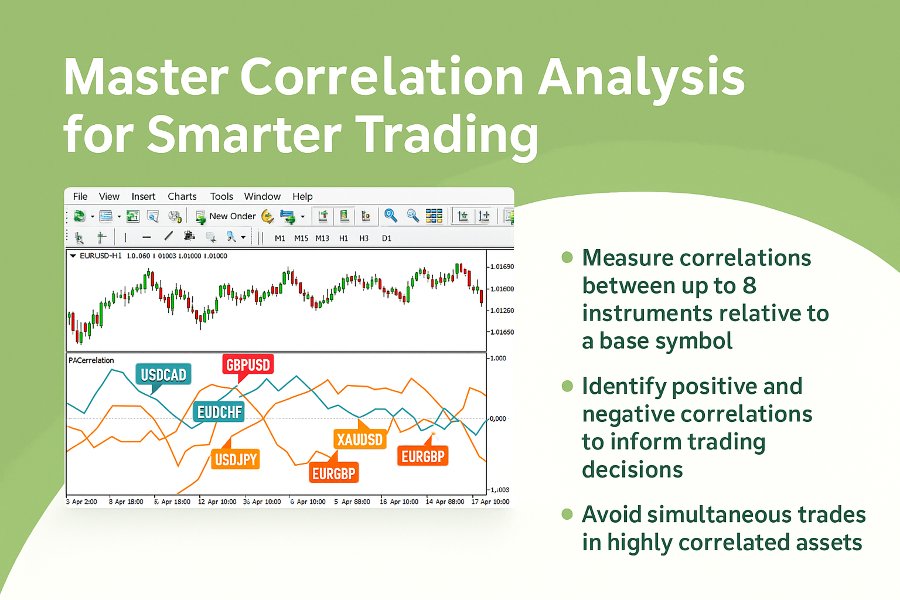

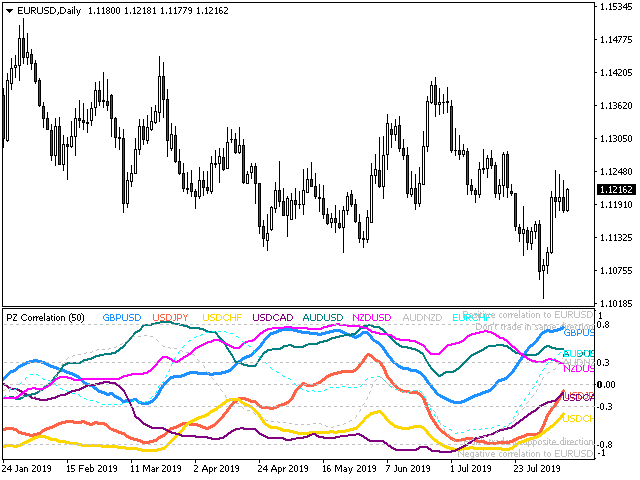

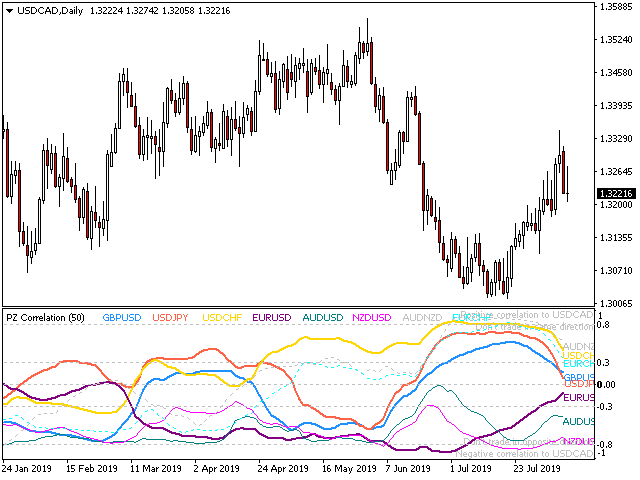

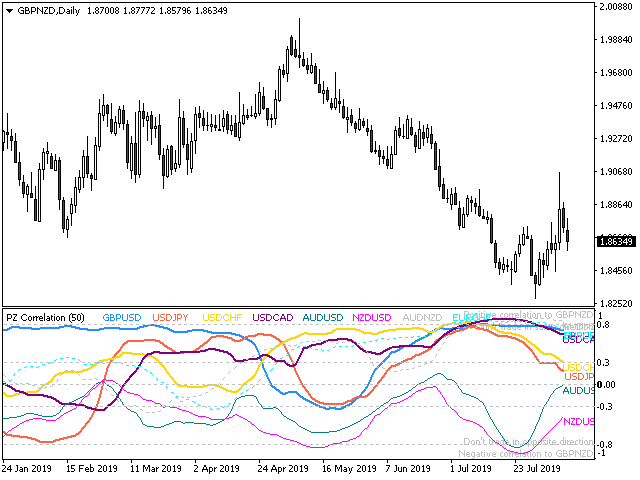

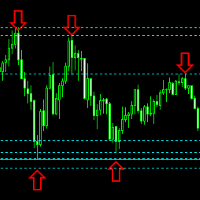

In the world of finance, correlation is a statistical measure of how two securities move in relation to each other. Correlations are used in advanced portfolio management. This indicator measures how different securities move in relation to a reference one, thus making portfolio management easier. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Avoid concurrent trades in highly correlated instruments

- Find trading opportunities among highly correlated instruments

- Correlation is positive when two securities rise in price together

- Correlation is negative when one security increases and the other decreases

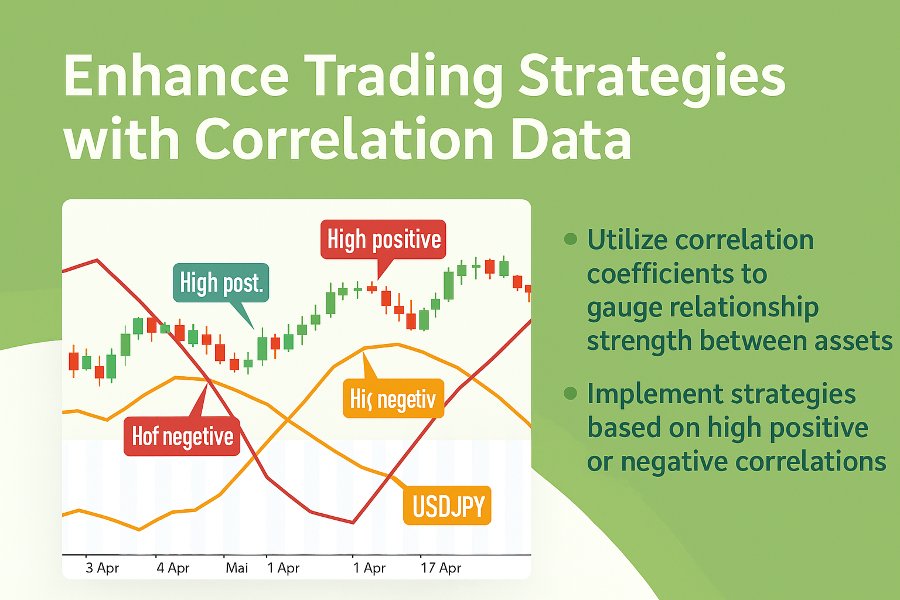

The correlation between two securities is measured by a correlation coefficient.

- A coefficient of zero is neutral correlation

- A coefficient of 0.3 is low positive correlation

- A coefficient over 0.8 is high positive correlation

- A coefficient of -0.3 is low negative correlation

- A coefficient over -0.8 is high negative correlation

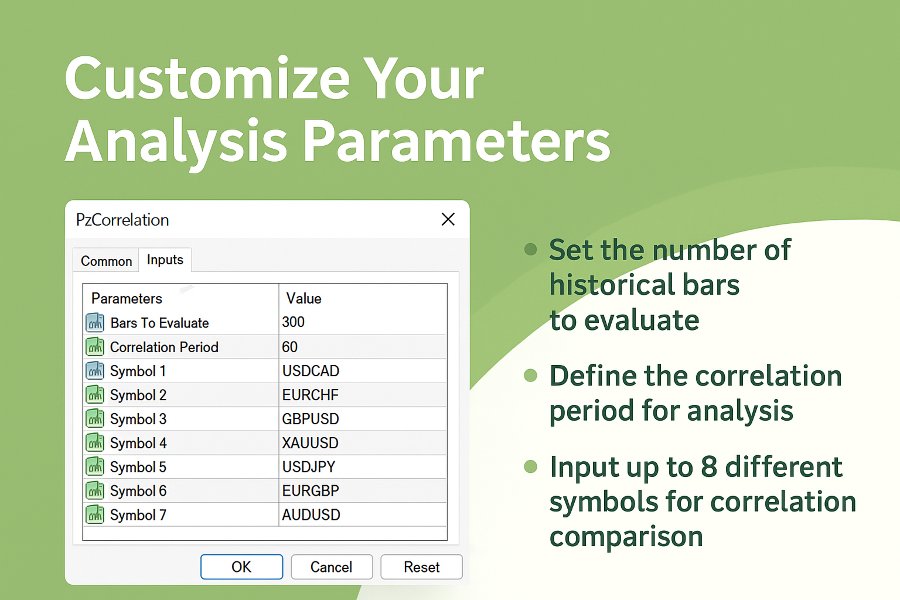

Input Parameters

- Max History Bars: Amunt of bars to evaluate to the past upon loading.

- Correlation Period: Amount of bars to use to calculate the correlation.

- 1st Symbol to 8th Symbol: Enter the symbols to calculate the correlation.

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

Индикатор PZ correlation представляет информацию о корреляциях между валютными парами во времени в графическом виде, что позволяет мгновенно оценить ситуацию. Спасибо автору, вещь хорошая.