Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.24 12:08

Weekly Outlook: 2016, September 25 - October 02 (based on the article)

The Fed came and went and so did the BOJ, leaving a mixed picture after the high tension. Speeches from Yellen and Draghi among others, US Consumer Confidence, Durable Goods orders and GDP data from the US, UK, and Canada, stand out. These are the highlights on forex calendar.

- German Ifo Business Climate: Monday, 8:00. Economists’ forecast German business climate will reach 106.3 in September.

- Mario Draghi speaks: Monday, 14:00. Market volatility is expected. He may provide more details about how QE will evolve, something he did not do in the post-rate decision presser.

- Stephen Poloz speaks: Monday, 23:10. BOC Governor Stephen Poloz will give a talk in Washington DC.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence is expected to reach 98.6 this time.

- US Durable Goods Orders: Wednesday, 12:30. Durable orders are expected to decline by 1.0% and core orders are predicted to decrease by 0.5% on August.

- US Crude Oil Inventories: Wednesday, 14:30. Some analysts claim U.S. crude stockpiles are still too high and prices could come under pressure again.

- Haruhiko Kuroda speaks: Thursday, 6:35. Bank of Japan Governor Haruhiko Kuroda will speak in Tokyo. Market volatility is expected.

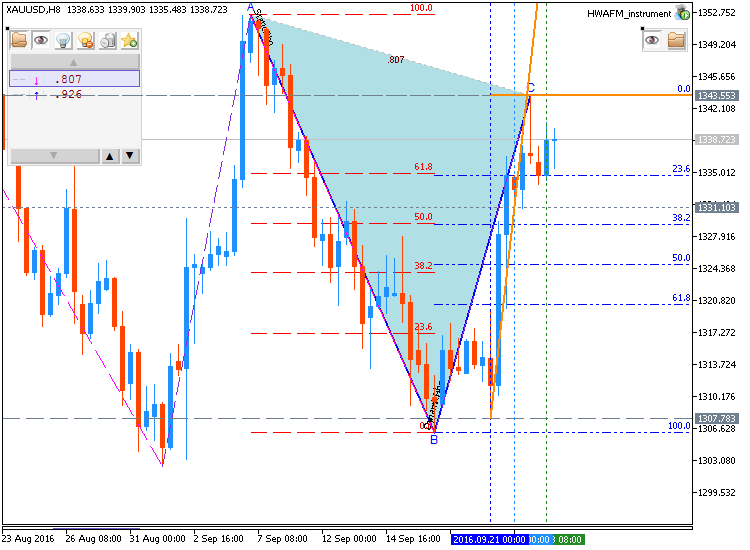

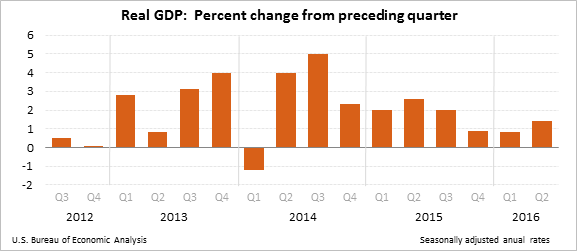

- US GDP data: Thursday, 12:30. The final growth rate for the second quarter is expected to be 1.3%.

- US Unemployment Claims: Thursday, 12:30. The number of new unemployment claims is expected to be 260,000 this week.

- FED Chair Janet Yellen speaks: Thursday, 20:00. Federal Reserve Chair Janet Yellen will give a talk at the Minority Bankers Forum in Kansas City. Market volatility is expected.

- Canadian GDP data: Friday, 12:30.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.26 17:07

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. New Home Sales

2016-09-26 14:00 GMT | [USD - New Home Sales]

- past data is 659K

- forecast data is 598K

- actual data is 609K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - New Home Sales] = Annualized number of new single-family homes that were sold during the previous month.

==========

From Market Watch article: New-home sales slip in August but top forecast

- "Sales of newly-constructed homes dropped 7.6% in August but beat forecasts, according to data released Monday."

- "New home sales ran at a 609,000 seasonally adjusted annual rate, the Commerce Department said. That was 20.6% higher compared to a year ago."

==========

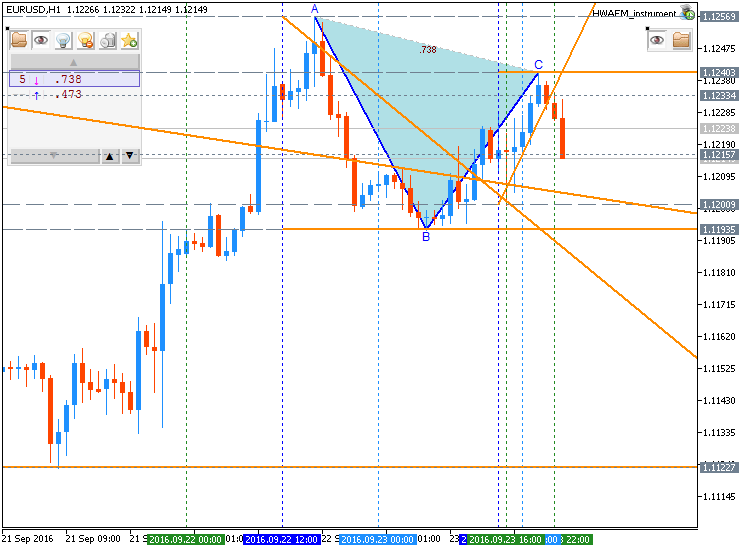

EUR/USD M5: 10 pips range price movement by U.S. New Home Sales news events

==========

USD/CAD M5: 38 pips range price movement by U.S. New Home Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.27 16:35

Intra-Day Fundamentals - EUR/USD and USD/CAD: The Conference Board Consumer Confidence

2016-09-27 14:00 GMT | [USD - CB Consumer Confidence]

- past data is 101.8

- forecast data is 99.0

- actual data is 104.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

==========

EUR/USD M5: 18 pips price movement by The Conference Board Consumer Confidence news events

==========

USD/CAD M5: 40 pips price movement by The Conference Board Consumer Confidence news events

Thanks for your share...

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.29 15:25

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. Gross Domestic Product

2016-09-29 12:30 GMT | [USD - GDP]

- past data is 1.1%

- forecast data is 1.3%

- actual data is 1.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

EUR/USD M5: 24 pips price movement by U.S. Gross Domestic Product news events

==========

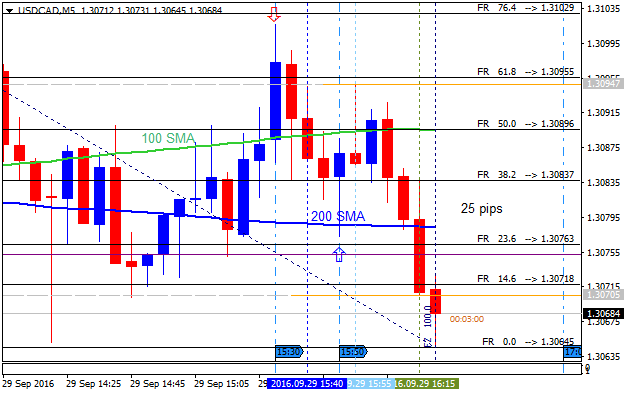

USD/CAD M5: 25 pips range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.30 14:54

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 68 pips price movement

2016-09-30 12:30 GMT | [CAD - GDP]

- past data is 0.6%

- forecast data is 0.3%

- actual data is 0.5% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

=========="Real gross domestic product grew 0.5% in July, led by higher output in the mining, quarrying, and oil and gas extraction sector. The rise in July followed a 0.6% increase in June, which had essentially offset an equivalent decline in May."

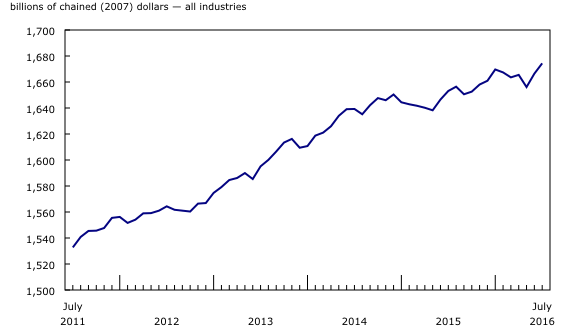

Real gross domestic product grows in July:

==========

USD/CAD M5: 68 pips price movement by Canada's Gross Domestic Product news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located above Ichimoku cloud in the bullish area of the chart: the price is on ranging within the following support/resistance levels:

Absolute Strength indicator is estimating the ranging condition to be continuing, and Trend Strength indicator are evaluating the trend as the primary bullish in the near future.

If D1 price breaks 1.2999 support level on close bar so the reversal of the price movement from the ranging bullish to the primary bearish market condition will be started.

If D1 price breaks 1.3253 resistance level on close bar from below to above so the bullish trend will be resumed.

If not so the price will be on bullish ranging within the levels near bearish reversal area.

SUMMARY : ranging

TREND : bullish