AUDUSD Technical Analysis 2016, 03.07 - 10.07: Senkou Span breaking to above for the daily bullish reversal

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.04 08:08

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and 25 pips price movement

2016-07-04 01:30 GMT | [AUD - Building Approvals]

- past data is 3.3%

- forecast data is -3.5%

- actual data is -5.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

- The trend estimate for total dwellings approved rose 0.9% in May and has risen for six months.

- The seasonally adjusted estimate for total dwellings approved fell 5.2% in May after rising for two months.

==========

AUD/USD M5: 25 pips price movement by Australian Building Approvals news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.05 07:56

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 41 pips price movement

2016-07-05 04:30 GMT | [AUD - Cash Rate]

- past data is 1.75%

- forecast data is 1.75%

- actual data is 1.75% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

The Sydney Morning Herald article:

- "The Reserve Bank of Australia left the cash rate on hold at 1.75 per cent on Tuesday, although governor Glenn Stevens hinted at cuts ahead if inflation remains low."

- "Although downplaying the global impact of

Britain's shock vote to leave the European Union and ignoring the

possible fallout from Saturday's federal election, Mr Stevens slightly altered the tone of his statement from last time to point to another possible rate cut in the current cycle. "Taking

account of the available information, the Board judged that holding

monetary policy steady would be prudent at this meeting," he said. "Over the period ahead, further information should allow the Board to

refine its assessment of the outlook for growth and inflation and to

make any adjustment to the stance of policy that may be appropriate." The RBA's decision to hold rates for now was widely expected, with

futures market pricing on Tuesday giving a July cut only a 4 per cent

chance. However, the market and most economists see an August

reduction, to 1.5 per cent, as much more likely. A cut by the November

board meeting is now fully priced in."

==========

AUD/USD M5: 41 pips price movement by RBA Cash Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.08 11:00

Technical Targets for AUD/USD by United Overseas Bank (based on the article)

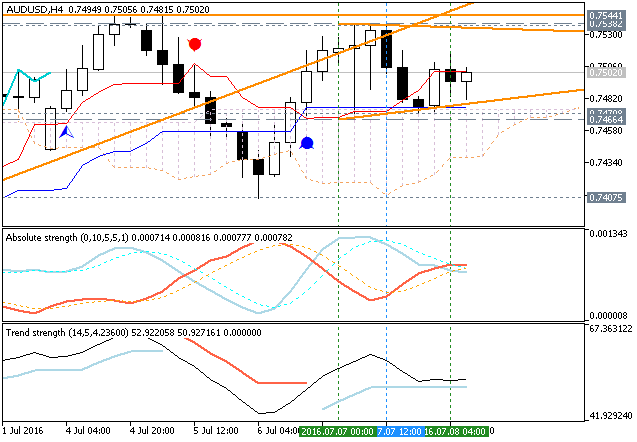

H4 price

is on ranging to be above Ichimoku cloud in the bullish area of the chart. The price is located within the following key support/resistance levels:

- 0.7544 resistance level located above Ichimoku cloud and Senkou Span line in the bullish area of the chart, and

- 0.7466 support level located near senkou Span on the border ebtween the primary bullish and the ranging bearish trend.

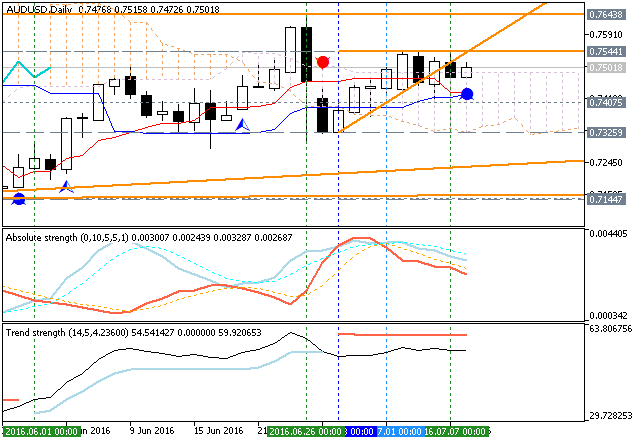

Daily

price. United Overseas Bank is considering for AUD/USD price to be continuing with the bullish market condition with 0.7560/0.7600 possible bullish targets:

- If daily price breaks 0.7544 resistance level

on close bar so the primary bullish trend will be continuing.

- If daily price breaks 0.7407 support level on close bar so the reversal of the price movement from the primary bullish to the ranging bearish market condition will be started: the price will be located inside Ichimoku cloud.

- If daily price breaks 0.7325 support level on close bar so the reversal of the daily price movement from the ranging bearish to the primary bearish trend will be started.

- If not so the price will be ranging within the levels.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on breaking Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart: the price is breaking this line at 0.7486 for the reversal of the price movement from the ranging bearish to the primary bullish market condition with 0.7643 as a nearest daily bullish target. Absolute Strength indicator is estimating the bullish trend to be started, and Chinkou Span line is indicating the possible bullish breakout in the near future.

If D1 price breaks 0.7486 resistance level on close bar so the bullish reversal will be started.

If D1 price breaks 0.7304 support level on close bar so the bearish trend will be resumed.

If not so the price will be on bearish ranging within Ichimoku cloud.

SUMMARY : possible breakout

TREND : daily bullish reversal