- Traders Joking

- margin level calculation

- Strange occurrences.

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2016.06.30 08:03

Margin Call: What Happens When A Margin Call Takes Place and How to Avoid (adapted from the article)

To understand the cause of a margin call is the first step. The second

and more beneficial step is learning understanding how to stay far away

from a potential margin call. The short answer as to understand what

causes a margin call is simple, you’ve run out of usable margin.

The second and promised more beneficial step is to understand what

depletes your usable margin and stay away from those activities. In risk

of oversimplifying the causes, here are the top causes for margin calls

which you should avoid like the plague (presented in no specific

order):

- Holding on to a losing trade too long which depletes Usable Margin

- Overleveraging your account combined with the 1st reason

- An underfunded account which will force you to over trade with too little usable margin

What Happens When A Margin Call Takes Place?

When a margin call takes place, you are liquidated or closed out of your

trades. The purpose is two-fold: you no longer have the money in your

account to hold the losing positions and the broker is now on the line

for your losses which is equally bad for the broker.

How to Avoid Margin Calls

Leverage is often and fittingly referred to as a double-edged sword. The

purpose of that statement is that the larger leverage you use to hold a

trade greater than some large multiple of your account, the less usable

margin you have to absorb any losses. The sword only cuts deeper if an

over-leveraged trade goes against you as the gains can quickly deplete

your account and when your usable margin % hits, zero, you will receive a

margin call. This only gives further credence to the reason of using

protective stops while cutting your losses as short as possible.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.30 08:08

How to Trade - Forex Leverage (based on the article)

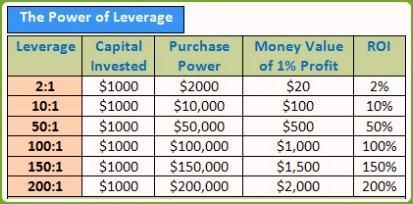

Leverage in forex is expressed as ratios - for example as the following: 1:1, 1:50, 1:100, 1:200, 1:400.

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

"Leverage has been in use from the early dawn of our civilization

primarily to cope up with daily necessities. In the medieval era

leverage was employed probably just to lift heavy stones to build

houses. But in the modern era leverage has been used extensively in

finance and commerce. When I am buying

one million dollar house with only 10% down payment, I am essentially

using leverage. Leverage adds glamor to forex trading. It is what makes

so many traders gravitate to forex trading as compared

to equities and other securities market."

"Hence, leverage in forex is the secret behind huge wind fall profits in forex trading. Be that as it may, leverage can magnify losses in losing trades. This is also why leverage is considered double edged sword. If I make winning trades using leverage then my profits are huge. Likewise if I make losing trades my losses are also huge."

Margin just allows you to trade; irrevalent. Stop out happens when you have no more free margin. Control your risk.

-

Risk depends on your initial stop loss, lot size, and the value of the symbol. It does not depend on margin and leverage. No SL means you have infinite risk. Never risk more than a small percentage of your trading funds, certainly less than 2% per trade, 6% total.

-

You place the stop where it needs to be — where the reason for the trade is no longer valid. E.g. trading a support bounce the stop goes below the support.

-

AccountBalance * percent/100 = RISK = OrderLots * (|OrderOpenPrice - OrderStopLoss| * DeltaPerLot + CommissionPerLot) (Note OOP-OSL includes the spread, and DeltaPerLot is usually around $10/pip but it takes account of the exchange rates of the pair vs. your account currency.)

-

Do NOT use TickValue by itself - DeltaPerLot and verify that MODE_TICKVALUE is returning a value in your deposit currency, as promised by the documentation, or whether it is returning a value in the instrument's base currency.

MODE_TICKVALUE is not reliable on non-fx instruments with many brokers - MQL4 programming forum 2017.10.10

Is there an universal solution for Tick value? - Currency Pairs - General - MQL5 programming forum 2018.02.11

Lot value calculation off by a factor of 100 - MQL5 programming forum 2019.07.19 -

You must normalize lots properly and check against min and max.

-

You must also check FreeMargin to avoid stop out

Most pairs are worth about $10 per PIP. A $5 risk with a (very small) 5 PIP SL is $5/$10/5 or 0.1 Lots maximum.

-

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use