Depends on the strategy, and the risk you are prepared to take.

There's no fixed number for that.

1:30 isn't much i changed brokers because of that.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.07.31 18:54

The Basics of Forex Leveraging :

Leverage in trading simply refers to the ability to increase the size of your trade or investment by using credit from a broker. When trading using leverage, you are effectively borrowing from your broker, while the funds in your account act as collateral. This collateral is referred to as margin.

The amount of leverage available is based on the margin requirement of the broker. Margin requirement is usually shown as a percentage, while leverage is expressed as a ratio. For example, a broker might require a minimum margin level of 2%. This means that the customer must have at least 2% of the total value of an intended trade available in cash before opening the position. A 2% margin requirement is equivalent to a 50:1 leverage ratio. In practical terms, using 50:1 leverage, having $1,000 in your account would allow you to trade up to $50,000 worth of a given financial instrument. At a 50:1 leverage, a 2% loss in the instrument traded completely wipes out a fully leveraged account. Conversely, a 2% gain doubles the account.

Leverage by Market and Instrument

Leverage available differs substantially depending on what market you are trading and from which country you are based. For example, the degree of leverage available for trading stocks is relatively low. In the United States, investors typically have access to 2:1 leverage for trading equities, a margin level of 50%.

The futures market offers much higher degrees of leverage, such as 25:1 or 30:1, depending on the contract traded.

The leverage available in the forex market is higher still at 50:1 in the U.S. and as high as 400:1 offered by brokers internationally.

Leverage in Forex Trading

High leverage availability, coupled with a relatively low minimum balance to open an account, has added to the allure of the forex market to retail traders. However, excessive use of leverage is often and correctly cited as the primary reason for traders blowing out their accounts.

The danger that extreme leverage poses to investors has been recognized and acted on by the U.S. regulatory bodies, which have created restrictions on the amount of leverage available in forex trading. In August 2010, the Commodity Futures Trading Commission (CFTC) released final rules for retail foreign exchange transactions, limiting leverage available to retail forex traders to 50:1 on major currency pairs and 20:1 for all others.

As of 2013, brokers outside the U.S. continue to offer leverage of 400:1 and higher.

Examples of Leveraged Trades in the Forex Market

In our first example, we'll assume the use of 100:1 leverage

In this case, to trade a standard $100K lot you would need to have

margin of $1K in your account. If, for example, you make a trade to buy 1

standard lot

of USD/CAD at 1.0310 and price moves up 1% (103 pips) to 1.0413, you

would see a 100% increase in your account. Conversely, a 1% drop with a

standard 100K lot would cause a 100% loss in your account.

Next, let's assume you are trading with 50:1 leverage and 1 standard

$100K lot. This would require you to have margin of $2K (2% of 100K).

In this case, if you buy 1 standard lot of USD/CAD at 1.0310 and price

moves up 1% to 1.0413, you would see a 50% increase in your account,

while a 1% drop with a standard 100K lot would equal a 50% loss in your

account.

Consider here that 1% moves are not uncommon and can even happen in a

matter of minutes, especially after major economic releases. It could

only take one or two losing trades using the leverage described in the

examples above to wipe out an account. While it's exciting to entertain

the possibility of a 50% or 100% increase in your account

in a single trade, the odds of success over time using this degree of

leverage are extremely slim. Successful professional traders often

suffer a string of multiple losing trades but are able to continue

trading because they are properly capitalized and not overleveraged.

Let's now assume a lower leverage of 5:1. To trade a standard $100K lot

at this leverage would require margin of $20K. An adverse 1% move in the

market in this case would cause a far more manageable 5% loss.

Fortunately, micro lots enable traders to use lower leverage levels such as 5:1 with smaller accounts. A micro lot is equivalent to a contract for 1,000 units of the base currency. Micro lots allow flexibility and create a good opportunity for beginning traders, or traders starting with smaller account balances, to trade with lower leverage.

Margin Calls

When you enter a trade, your broker will keep track of your account's Net Asset Value (NAV). If the market moves against you and your account value falls below the minimum maintenance margin, you may receive a margin call. In such an event, you could receive a request to add funds to your account, or your positions could simply be flattened automatically by the broker to prevent further losses.

The Use of Leverage and Money Management

The use of extreme leverage is fundamentally antithetical to the conventional wisdom on money management in trading.

Among the widely accepted tenets on money management are to keep leverage levels low, to use stops and to never risk more than 1-2% of your account on any one trade

The Bottom Line

Data disclosed by the largest foreign-exchange brokerages as part of the Dodd-Frank financial reform legislation has shown that a majority of retail customers lose money trading. A substantial if not leading cause is the misuse of leverage.

However, leverage has key benefits, providing the trader with greater flexibility and capital efficiency. The absence of commissions, tight spreads and available leverage are certainly beneficial to active forex traders, creating trading opportunities not available in other markets.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.30 08:08

How to Trade - Forex Leverage (based on the article)

Leverage in forex is expressed as ratios - for example as the following: 1:1, 1:50, 1:100, 1:200, 1:400.

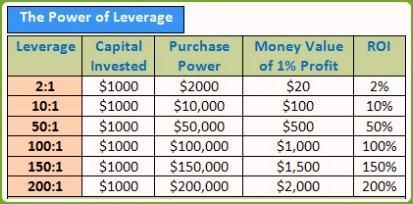

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

"Leverage has been in use from the early dawn of our civilization

primarily to cope up with daily necessities. In the medieval era

leverage was employed probably just to lift heavy stones to build

houses. But in the modern era leverage has been used extensively in

finance and commerce. When I am buying

one million dollar house with only 10% down payment, I am essentially

using leverage. Leverage adds glamor to forex trading. It is what makes

so many traders gravitate to forex trading as compared

to equities and other securities market."

"Hence, leverage in forex is the secret behind huge wind fall profits in forex trading. Be that as it may, leverage can magnify losses in losing trades. This is also why leverage is considered double edged sword. If I make winning trades using leverage then my profits are huge. Likewise if I make losing trades my losses are also huge."

Depends on the strategy, and the risk you are prepared to take.

There's no fixed number for that.

1:30 isn't much i changed brokers because of that.

I does simple trade without complex, but I still think 30:1 is a high leverage and someday looking work without leverage, but my main question is what is best sustainable lot size as start for 22k balance

.05, .010 or .20?

what is best sustainable lot size as start for 22k balance

As I recall, the Turtle traders used 2% of equity per trade.

I've heard of risk-averse traders who use less, like 1 to 1.5%.

Re-calculate the math every trade.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

What is best lot size as start with 22k $ account and trading with FCA regulated broker with 1:30 and also planning to cut down leverage at 1:20

I know here many Philosophers and expert peoples with having good experience, I'm looking comments and from traders who knows what is benefits of low leverage

Thanks