Discussion of article "Exploring Trading Strategy Classes of the Standard Library - Customizing Strategies"

- championship.mql5.com

- championship.mql5.com

Articles, usually can be seen also as an "expanding" of documentation.

All the essential that you need to know about such trading and EA style with Wizard mechanism, is in this article and in the interview linked above,

if one seeks more, is just the trader/programmer behalf of his/her 'trading-mind' phantasy and skills.

Dear Harvester,

I am not very sure about one thing in Section "Implementing Patterns". Hopefully you can confirm it here.

denote: strength=sum(m_pattern_X*weight of the pattern)/n.

in Case A: the calculated strength is 67, in Case B the calculated strength is -3. In Case C:strength=3. in Case D: strength=-67.

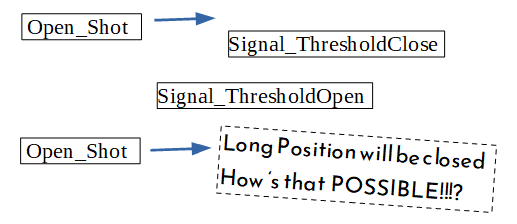

2. if strength >60, open long position.and close short position.

4. if strength< -60 : open short position and close long position.

5. if strength >-40 and strength<40, no action will be taken.

|

|---|

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Exploring Trading Strategy Classes of the Standard Library - Customizing Strategies is published:

This article is intended for novice/beginner users who want to approach some kind of customization with functionality and without writing an EA from scratch.

In MetaTrader 5 we have a great possibility of expert trading with a minimal or zero knowledge (and skills) about programming language and coding of sources, thanks to the one MetaEditor feature: MQL5 Wizard. The Wizard (we are not going to explain its detailed working here in this article) is intended to generate finished programs (.mq5 and .ex5 files), algorithms and code. It benefits from using MQL5 Standard Library and its Trading Strategy Classes (which are great resources).

There are lots of trading strategy classes present in the Standard Library actually, some of them are already very good and come from more-or-less famous studies about financial markets and profitability analysis. There is at least one strategy for each indicator from the standard set of indicators that come with MetaTrader 5.

Author: Harvester