What do you prefer or feel more comfortable with ?

Slow and steady growth with low risk wins the race in long term.

Yes thats true what matters is the combination between both terms but what i wanted to know is the preference while building a strategy of the community because when you try to grow one of them (winrate or reward:risk ratio) the other decrease. And to be honest results are surprising me because i though most of people prefered the high winrate martingale systems.

Slow and steady growth with low risk wins the race in long term.

Yes thats true what matters is the combination between both terms but what i wanted to know is the preference while building a strategy of the community because when you try to grow one of them (winrate or reward:risk ratio) the other decrease. And to be honest results are surprising me because i though most of people prefered the high winrate martingale systems.

Most people prefers winning strategies.

Forum on trading, automated trading systems and testing trading strategies

Simon Gniadkowski, 2013.05.27 10:20

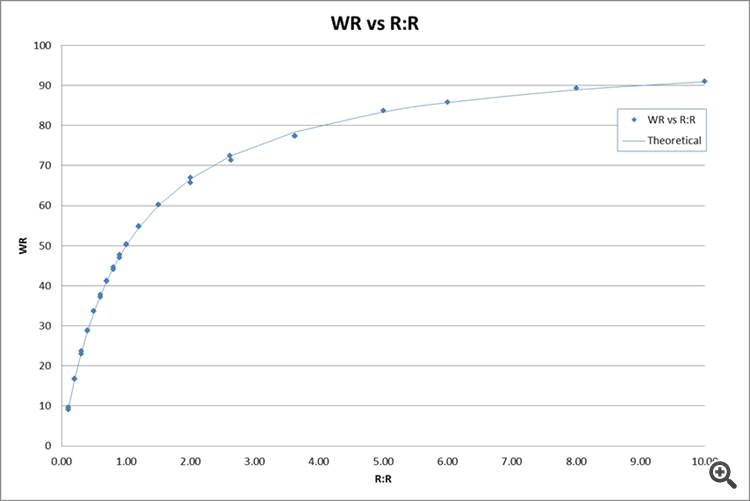

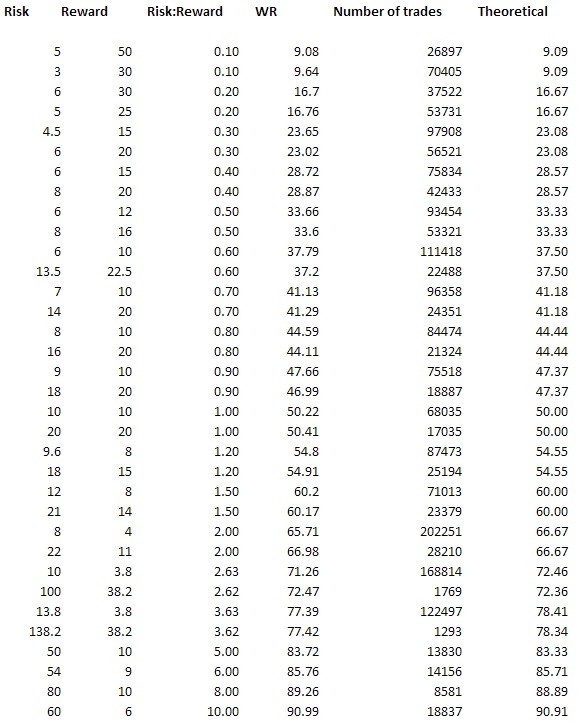

The BE Win Rate the the win rate needed to break even. It is illustrated by this chart . . .

. . . so you calculate the Risk:Reward and read off the BE Win Rate from the chart. Assuming your have a test run with a representative sample set of trades you can use the Average Loss:Average Win for the R:R

You can also calculate the BE WR as follows: Average loss / (Average loss + Average win) this is how the theoretical line was calculated . . .

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use