Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.26 07:57

Forex Weekly Outlook Sep 28 - Oct 2 (based on forexcrunch article)

A turbulent week has seen the dollar dive but recover quite nicely. US Consumer Confidence, ADP jobs release, Canadian GDP, Janet Yellen’s speech, and a buildup to the highly important US monthly jobs report are the highlights of this week. Here is an outlook on the market movers on Forex calendar.

The dollar suffered for while, on unimpressive durable goods orders. The pain was especially strong against the euro, that received only normal dovish words from Draghi. Yet the fate changed as Yellen surprised with a hawkish tone, stressing that a 2015 hike is certainly on the cards. The final GDP estimate for the second quarter in the US beat forecasts with a better than expected reading of 3.9% annual growth. Elsewhere, the Aussie struggled with another weak Chinese figure and USD/CAD reached an 11 year high, yet these commodity currencies recovered.

- William Dudley speaks: Monday, 12:30. William Dudley, president of the New York Federal Reserve will give an interview for the Wall Street Journal and talk about the rate hike issue and about inflation expectations. In his former talks, Dudley spoke against a rate rise in September amid international and financial market developments, but noted he hopes the Fed will still raise rates this year. Market volatility is expected.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence edged up in August, rebounding after a sharp fall in July. The Conference Board consumer confidence index increased to 101.5 from a revised 91.0 in the prior month mainly due to an improved view of the labor market. Current conditions were more favorable in terms of the job market viewing jobs as “plentiful” increased from 19.9% in July to 21.9% in August. Those who viewed jobs as “hard to get” decreased from 27.4% in July to 21.9% in August. Analysts believe the strong reading will support stronger consumer spending in the following months. US consumer confidence is expected to reach 96.2 this time.

- US ADP Non-Farm Payrolls: Wednesday, 12:15. The U.S. private sector continued to increase the pace of hiring in August, despite global financial market turmoil. The ADP Report showed private payrolls increased 190,000 from 177,000 in July. The reading was below economists’ expectations but was in line with the growth trend of the first seven months of this year. Furthermore, strong data from manufacturing and domestic activity show a pick-up in economic activity. Economists expect ADP release will show a 191,000 job gain.

- Canadian GDP: Wednesday, 12:30. Canada’s economy expanded 0.5% in June, after a 0.2% contraction in the previous month. However, this positive reading could not offset the negative growth in the second quarter as a whole. On an annualized basis, the economy shrank 0.5% in the April-to-June period, following 0.8% annual pace contraction in the first three months of 2015. Policymakers were concerned about the possibility of a recession, but recent data suggests a growth trend in the third quarter. Canadian GDP for July is expected to reach 0.2%.

- Janet Yellen speaks: Wednesday, 19:00. Federal Reserve Chair Janet Yellen is scheduled to speak in St. Louis. Following the important Fed meeting in September where the Federal Reserve postponed the rate hike move, Fed Chair Janet Yellen said the U.S. central bank is still prepared to raise interest rates this year for the first time in nearly a decade. Yellen said that recent inflationary weakness is temporary, caused by a strong dollar and low oil prices, which are likely to pass. She said U.S. economic prospects appear solid suggesting a rate hike is near. Market volatility is expected.

- US Unemployment Claims: Thursday, 12:30. The number of applications for unemployment benefits, filed last week, rose less than expected, reaching 267,000, indicating the growth trend in the US economy continues. Economists expected the number of claims to reach 268,000. The four-week moving average dropped by 750 to the lowest level in more than a month, reaching 271,750. The number of people continuing to receive jobless benefits was little changed at 2.24 million. The number of new claims is expected to rise to 273,000 this week.

- US ISM Manufacturing PMI: Thursday, 14:00. The U.S. manufacturing sector expanded at the slowest pace since May 2013, reaching 51.1 after posting 52.7 in July. New orders fell 4.8% to 51.7, also the lowest level since May 2013. The employment index declined to 51.2 from 52.7 in July. The weak employment reading indicates a mild slowdown in factory payroll gains in August. Economists expect manufacturing PMI to reach 51.3 in September.

- US Non-Farm Payrolls: Friday, 12:30. U.S. job growth moderated in August, but the unemployment rate declined to a near 7-1/2-year low while wages increased. Nonfarm payrolls increased 173,000 in August after an upwardly revised addition of 245,000 jobs in July. August’s increase was the smallest in five months amid job loss in the manufacturing sector. Despite the mixed report, the general trend remains positive indicating that the U.S. economy remains strong. Analysts expect a jobs gain of 202,000 in September with an unemployment rate of 5.1%. Monthly wages are expected to rise by 0.2%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.28 07:53

What To Expect Into This Week: US NFP - Barclays (based on efxnews article)

"We expect, in line with consensus, an increase of 200k in the headline number (190k for the private payroll), a steady unemployment rate of 5.1%, and a 2.4% y/y increase in wages. We see these figures as robust indicators of tighter labor market conditions and supportive of inflation in the months to come."

==========

2015-10-02 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

- past data is 173K

- forecast data is 202K

- actual data is n/a according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

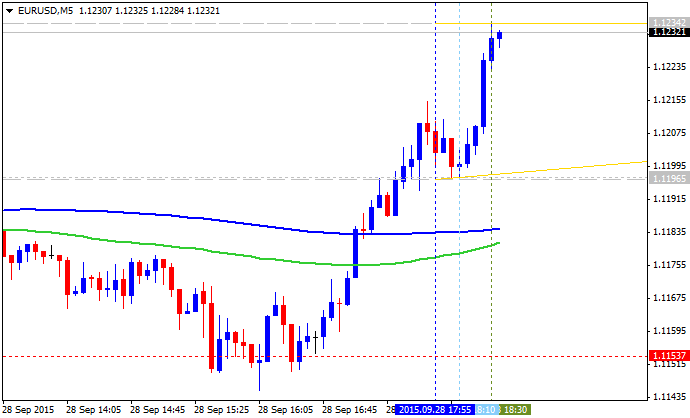

EURUSD M5: 100 pips ranging price movement by USD - Non-Farm Employment Change news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.28 17:37

Bullish intra-day reversal based on negative data for Pending Home Sales news event (adapted from realtor.org article)

The price for EUR/USD M5 timeframe broke 100-SMA and 200-SMA from below to above together with symmetric triangle pattern and stopped below 1.1234 resistance level. The price was reversed from the bearish to the bullish market condition because of negative data for Pending Home Sales news event. If this level is broken so the bullish trend will be continuing on this timeframe.

"Pending home sales retreated in August but remained at a healthy level of activity and have now risen year–over–year for 12 consecutive months, according to the National Association of Realtors®. A modest increase in the West was offset by declines in all other regions."

"The Pending Home Sales Index, a forward–looking indicator based on contract signings, decreased 1.4 percent to 109.4 in August from 110.9 in July but is still 6.1 percent above August 2014 (103.1)."

"Lawrence Yun, NAR chief economist, says even with the modest decline in contract signings, demand continues to outpace housing supply and elevate price growth in numerous markets. "Pending sales have leveled off since mid–summer, with buyers being bounded by rising prices and few available and affordable properties within their budget," he said. "Even with existing–housing supply barely budging all summer and no relief coming from new construction, contract activity is still higher than earlier this year and a year ago."

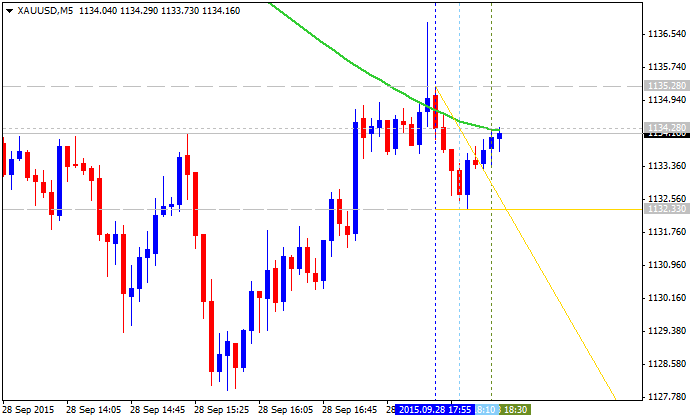

As to the GOLD (XAU/USD) so M5 price was on bear market rally within the primary bearish market condition for trying to break 100-SMA to come to the ranging area of the chart. The key 'reversal' resistance for this timeframe is 1135.28, and if the price breaks this level so we may see the ranging condition with the good possibility to the bullish reversal in the near future.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.02 14:44

2015-10-02 13:30 GMT | [USD - Non-Farm Employment Change]- past data is 173K

- forecast data is 201K

- actual data is 142K according to the latest press release

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

- "Total nonfarm payroll employment increased by 142,000 in September, and the unemployment rate was unchanged at 5.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and information, while mining employment fell."

- "In September, the unemployment rate held at 5.1 percent, and the number of unemployed persons (7.9 million) changed little. Over the year, the unemployment rate and the number of unemployed persons were down by 0.8 percentage point and 1.3 million, respectively."

==========

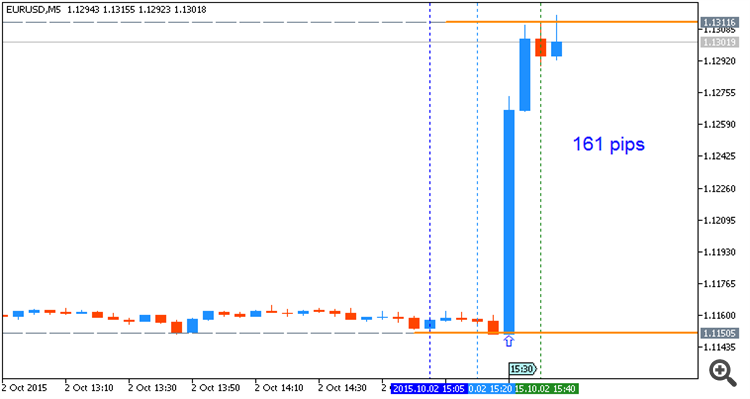

EURUSD M5: 161 pips price movement by USD - Non-Farm Employment Change news event:

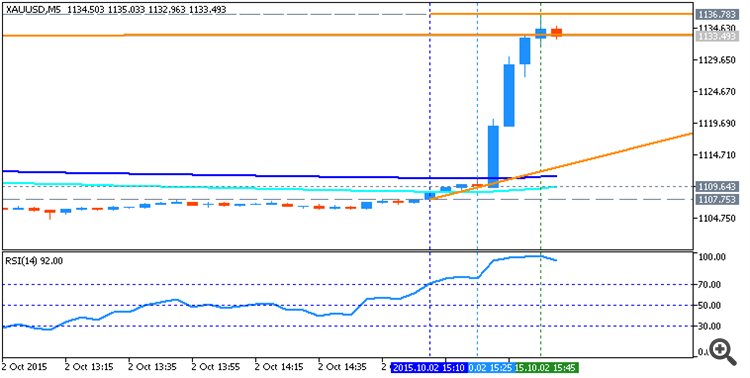

Gold (XAU/USD) went to the bullish market condition - on close bar for M5 timeframe, and on open bar on H4 chart:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.03 08:08

Forex Weekly Outlook October 5-9 (based on forexcrunch article)

US ISM Non-Manufacturing PMI, Trade Balance, Mario Draghi’s speech, rate decision in Japan, Australia and the UK, US Unemployment Claims, FOMC Meeting Minutes, Canadian employment data and Stephen Poloz’ speech are the main events on Forex calendar. Here is an outlook on the market movers for this week.

Last week U.S. major job report for September was a big disappointment, showing a lukewarm job gain of 142,000 positions, far below the 201,000 reading forecasted by analysts. Meanwhile, the unemployment rate remained unchanged at 5.1% due to a further deterioration in the labor force participation rate, plunging to 62.4%, the worse rate since October 1977. Furthermore, wages remained flat, indicating subdued inflationary pressures. The negative report cools expectations for a near-term rate hike.

- US ISM Non-Manufacturing PMI: Monday, 14:00. The U.S. service sector expanded more than expected in August, showing a solid growth rate, but was weaker than July’s reading. Non-manufacturing purchasing managers index declined to 59 in August from 60.3 in the prior month. July’s reading was the highest since 2008. The upbeat release indicates solid growth in the US domestic economy. The non-manufacturing purchasing managers index is expected to decline further to 58.0 this time.

- Australian rate decision: Tuesday, 3:30. The Reserve Bank of Australia kept the cash rate at 2% for the fourth month in a row, after a quarter of a percentage point cut performed in May. Market volatility in China and fears its negative economic effects were the main reason for maintaining rates unchanged. Most analysts expected the RBA to maintain its monetary policy until the end of the year. However, some economists said the RBA could cut the cash rate for the third time this year in November.

- US Trade Balance: Tuesday, 12:30. The U.S. trade deficit contracted in July to $41.9 billion, its lowest level in five months, indicating the US economy continues to strengthen, despite a global growth slowdown. Economists expected the trade gap to reach $43.2 billion. Exports increased 0.4% to $188.5 billion, the first increase since April. Imports of consumer goods declined in July. U.S. trade deficit is expected to reach $42.2 billion.

- Mario Draghi speaks: Tuesday, 17:00. ECB President Mario Draghi is scheduled to speak in Frankfurt. He may talk about the recent ECB downgrade of the Eurozone’s economic outlook as well as the continuous deterioration in inflation levels. Clues about further QE measures may be enclosed. Market volatility is expected.

- Japan rate decision: Wednesday. The Bank of Japan maintained its monetary policy in September, admitting Japan’s economic growth was held back by the slowdown in emerging economies, but the BOJ believes advanced economies continue to grow at a moderate pace despite the slowdown of emerging economies. Therefore, the general growth trend remains positive. The BOJ will also expand the monetary base at about $667 billion a year to boost inflation.

- UK rate decision: Thursday, 11:00. The Bank of England voted to keep interest rates on hold in its September meeting. The Central Bank also lowered its estimate for the UK’s economic growth in the third quarter from 0.7% to 0.6%. Policy makers also claimed that the slowdown in Chinese economy and in emerging economies could badly affect UK’s economic growth. However, despite this, the MPC remained optimistic about the UK economy. A bank is expected to raise rates gradually starting from the first half of 2016.

- US Unemployment Claims: Thursday, 12:30. U.S. jobless claims increased by 10,000 to 277,000 last week, but remained near 15-year lows. Economists expected the number of claims to reach 273,000. The four-week moving average declined 1,000 to 270,750. The total number of people receiving jobless benefits is 2.19 million. The labor market continues to strengthen hand in hand with economic growth. Analysts expect the number of jobless claims to reach 274,000 this week.

- US FOMC Meeting Minutes: Thursday, 18:00. Federal Reserve policymakers said in July, they are nearing the central bank’s first interest rate hike in almost a decade but require further improvement in the economy and the labor market. Despite encouraging economic data releases, the FOMC decided to postpone September’s rate hike. The current minute’s data will provide further insight as to the reasons for this dramatic delay.

- Canadian employment data: Friday, 12:30. Canada labor market added an unexpected 12,000 jobs in August, while expected to contract by 4,800. However, the unemployment rate rose to a one-year high of 7% as the participation rate edged up to 65.9% from 65.7%. Overall, the rise in full-time work showed a positive improvement in the Canadian job market, which can offset the rise in the unemployment rate.

- Stephen Poloz speaks: Saturday, 18:45. BOC Governor Stephen Poloz is due to speak at the Institute of International Finance, in Lima. In a recent speech, Polozs said he believes Canada will bounce back from oil plunge despite current hardships. Companies may scale back investment and production amid lower prices, but this will boost demand, which eventually will lead to a price increase.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price just broke Ichimoku cloud from below to above with good bullish breakout and came to the bullish area of the chart. Price was stopped by 1156.65 resistance level for the ranging market condition to be started on Friday with the following key support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following: 1156.65 bullish resistance and 1121.25 bearish support level.

D1 price - ranging bullish:

If D1 price will break 1098.68 support level on close D1 bar so we may see the bearish market condition.

If D1 price will break 1170.06 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

SUMMARY : bullish

TREND : ranging