EURUSD Technical Analysis 2015, 27.09 - 04.10: between bearish and bullish waiting for direction - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.02 14:44

2015-10-02 13:30 GMT | [USD - Non-Farm Employment Change]- past data is 173K

- forecast data is 201K

- actual data is 142K according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

==========

EURUSD M5: 161 pips price movement by USD - Non-Farm Employment Change news event:

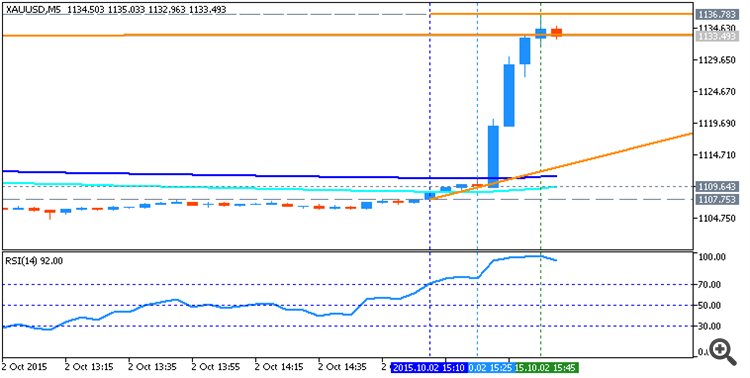

Gold (XAU/USD) went to the bullish market condition - on close bar for M5 timeframe, and on open bar on H4 chart:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.03 08:08

Forex Weekly Outlook October 5-9 (based on forexcrunch article)

US ISM Non-Manufacturing PMI, Trade Balance, Mario Draghi’s speech, rate decision in Japan, Australia and the UK, US Unemployment Claims, FOMC Meeting Minutes, Canadian employment data and Stephen Poloz’ speech are the main events on Forex calendar. Here is an outlook on the market movers for this week.

Last week U.S. major job report for September was a big disappointment, showing a lukewarm job gain of 142,000 positions, far below the 201,000 reading forecasted by analysts. Meanwhile, the unemployment rate remained unchanged at 5.1% due to a further deterioration in the labor force participation rate, plunging to 62.4%, the worse rate since October 1977. Furthermore, wages remained flat, indicating subdued inflationary pressures. The negative report cools expectations for a near-term rate hike.