Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.30 16:25

USD, EUR, CAD, AUD, NZD For The Coming Week by Morgan Stanley (based on efxnews article)

Morgan Stanley is continuing weekly forecast for the pairs based on fundamental analysis related to the direction of the trading.

USD: Bullish.

"We see scope for USD strength to continue. However, we distinguish

between the performance of USD against low yielding funding currencies,

where we see less scope for depreciation, and against commodity

currencies and EM, where we expect strength to be focused. Even the

risks of a more dovish Fed are unlikely to drive USD to depreciate

against this latter group of currencies, as growth prospects in the rest

of the world remain below those of the US."

EUR: Bullish.

"We see scope for EUR to make further gains over the next few weeks as

risk remains bid amidst an environment of uncertainty. EUR was used as a

funding currency for many risk-on trades; as these are unwound the

currency should see support. The main risk from our bullish EUR view

stems from the upcoming ECB meeting, where there is a risk of a more

dovish tone from the central bank in light of recent currency

depreciation."

CAD: Bearish.

"Bearish CAD is one of our higher conviction trades in G10. We believe

that there is a risk the central bank will need to take a more dovish

tone, weighing on the currency. Latest comments from the BoC that

macroprudential tools are addressing financial instability suggest that

monetary policy will be free to focus on low growth and inflation. An

environment of weak oil prices is unlikely to offer support to CAD as

well."

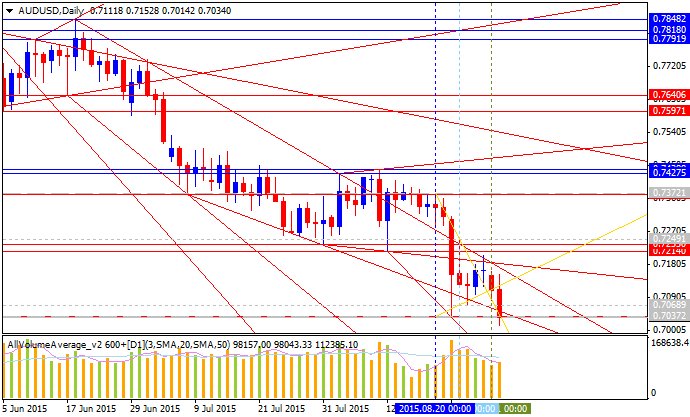

AUD: Bearish.

"A weak commodity picture and concerns about growth in Asia are likely

to weigh on AUD in the near term, and we would expect it to continue to

underperform. Ongoing weakness in capex highlights the risks surrounding

the currency. The main upside risks stem from the central bank, which

has been more hawkish, most recently highlighting the risks of running

easy monetary policy for too long. We will watch the upcoming RBA

meeting closely."

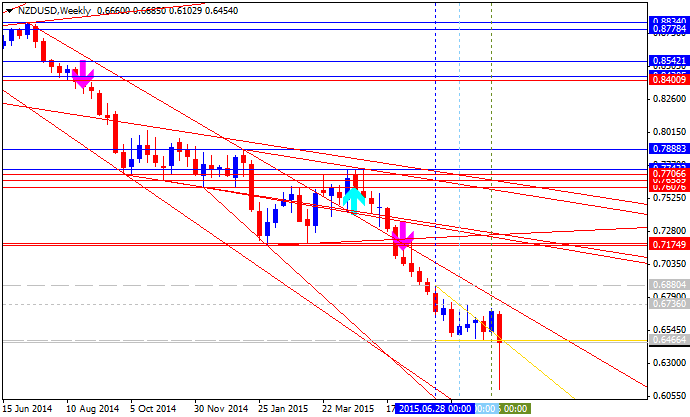

"With macro prudential measures expected to further reduce heightened financial system risk and help moderate the Auckland housing market, the RBNZ has left the door open for more significant easing. Weak commodities prices, a struggling dairy sector, and soft global demand should weigh on the small, open New Zealand economy. We expect NZD to continue depreciating as both growth and rate differentials move against the Kiwi."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.31 05:37

Where To Buy? - Credit Suisse (based on efxnews article)

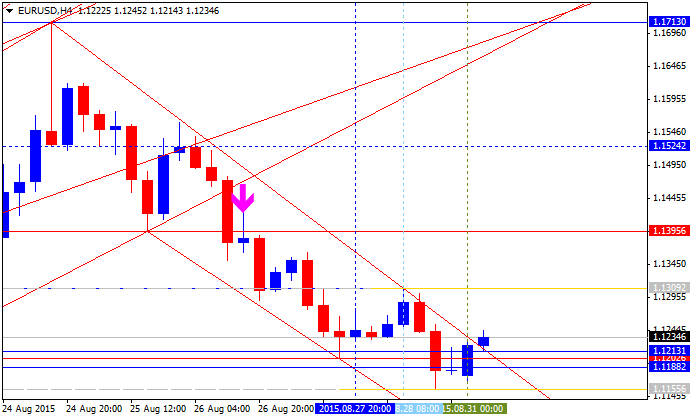

- "While resistance at 1.1397 caps, the immediate risk is seen staying lower, and a conclusive break below 1.1214 would warn the recent break higher and completion of a base was "false", to target the 61.8% retracement level at 1.1155 next, then the 21- and 55-day averages at 1.1125/07."

- "Resistance moves to 1.1308 initially, then 1.1364. Above the “neckline” to last week’s small top at 1.1397 is needed to turn attention back to the 1.1714 breakout high."

CS runs a limit order to buy EUR/USD at 1.1108, with a stop at 1.1018 and a target at 1.1520.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.31 12:41

EUR/USD To Recover Friday Losses (based on actionforex article)

- 'What we're looking out for this week is the dollar strengthening back again given that Fischer has failed to rule out a September rate hike.' - Bank of New Zealand Ltd (based on Bloomberg)

- "EUR/USD increased pressure on bulls as it decided to retreat below the monthly R1 at 1.1196 on Friday. However, an immediate recovery above this important support during the weekend and on Monday is raising hopes a recovery will take place in the nearest future. At first, the common currency is required to consolidate above the Aug 28 opening price of 1.1242, while the next resistance is represented by the same day's high at 1.1309. Meanwhile, additional demand is also created by the 20-day SMA, currently at 1.1215, as well as strongly bullish daily technical indicators."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.31 16:30

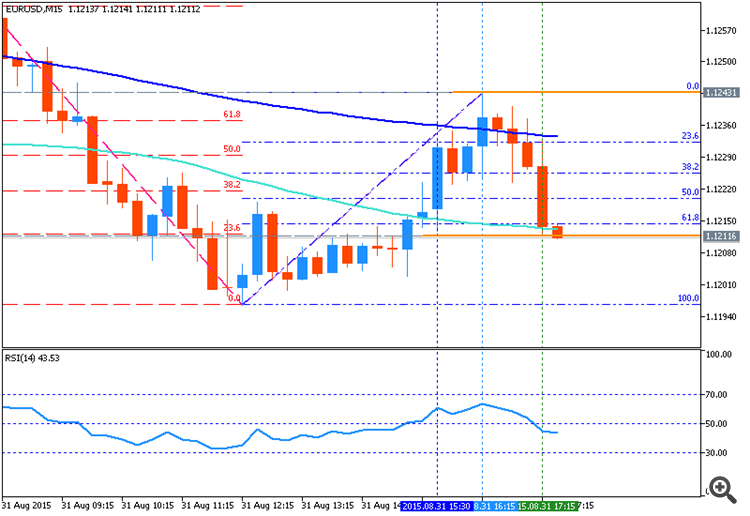

EURUSD back above 1.1200 after probe below (based on forexlive article)

- "A dip below 1.1200 didn't last long and the buyers have taken it back above, albeit by just a few pips."

- "1.1210 provides resistance ahead of 1.1230. We may seem some minor resistance at 1.1220 also."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 12:54

Non-Farm Payrolls: actual data forecasting related to September hike - BNP Paribas (based on efxnews article)

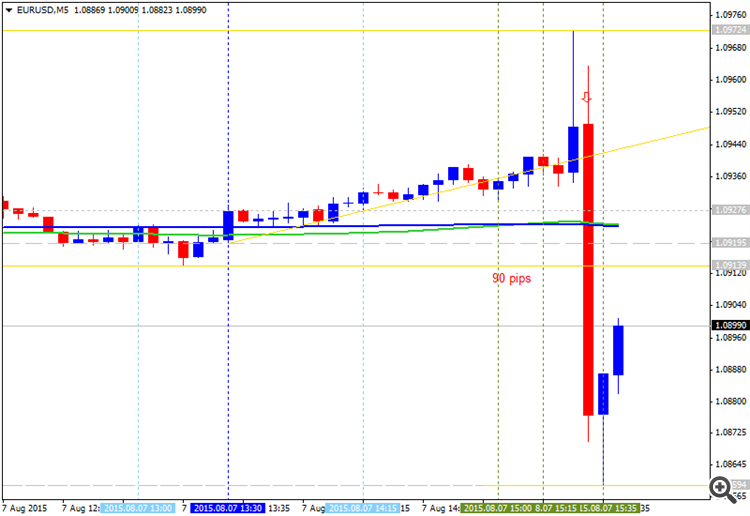

2015-09-04 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Payrolls]

- past data is 215K

- forecast data is 220K

- actual data is n/a

If actual > forecast = good for currency (for USD in our case)

[USD - Non-Farm Payrolls] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

BNP Paribas made the comments on Friday's NFP related to September Fed hike and actual data forecasting. As we know - the forecast data is 220K, and if actual data is more than 220K for example so the USD to be more stronger in this case. Concerning EUR/USD, we can see that it may be bearish condition to be ibncrease for this pair during and immediate after this high impacted news event:

- "Our economists expect an above-consensus 230K increase in jobs and a steady unemployment rate of 5.3%."

- "Although this probably won’t be enough to force a September hike, there is scope for the US yield curve to turn more USD supportive if markets have greater conviction in the strength of the US economy and the Fed’s ability to pursue a sustained policy normalization cycle."

==========

EURUSD M5: 90 pips range price movement by USD - Non-Farm Employment Change news event:M5 chart

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 15:17

What Fed Officials Are Saying About a September Rate Increase (based on wsj article)

"Federal Reserve officials made clear in recent days they have not agreed on when to start raising short-term interest rates, and the possibility of a September move remains on the table. The odds of a rate increase next month have appeared to diminish amid worries about China’s economic slowdown and turmoil in financial markets. Some officials want to see more economic data before deciding, while others think they’ve waited long enough. The most powerful decision maker, Chairwoman Janet Yellen, has not commented on the topic in the past few days. Here are some key quotes from those who have."

- Fed Vice Chairman Stanley Fischer: "I will not and indeed cannot tell you what decision the Fed will reach by Sept. 17."

- New York Fed President William Dudley: "At this moment, the decision to begin the normalization process at the September [Federal Open Market Committee] meeting seems less compelling to me than it did several weeks ago."

- St. Louis Fed President James Bullard: "I’m willing to respect the volatility in markets and see how it shakes out here. But just sitting here today, I’m not seeing how this is going to change the forecast and therefore I think the contours of monetary policy are about the same today as they were a couple weeks ago."

- Cleveland Fed President Loretta Mester: "I think the economy can support a modest increase in interest rates. I want to take the time I have between now and the September meeting to evaluate all the economic information that's come in, including the recent volatility in the markets and the reasons behind that. But it hasn't so far changed my basic outlook that the U.S. economy is solid and it could support an increase in interest rates."

- Kansas City Fed President Esther George: "In my own view, the normalization process needs to begin and the economy is performing in a way that I think it is prepared to take that."

- Atlanta Fed President Dennis Lockhart: "We are sort of anxious to get going, but given the events of the last several weeks, a risk factor has arisen” …“It has to be considered an open question whether we move now or wait a little while."

- Minneapolis Fed President Narayana Kocherlakota: "It’s definitely premature to be thinking about the removal of accommodation in the form of lifting off, at least based on my current outlook for inflation."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 18:11

Trade Ideas For EUR/USD, AUD/USD - UBS (based on efxnews article)

EUR/USD: "has traded bid since yesterday and it looks

like 1.1200 is going to act as a base. We expect selling interest to

show up on any move closer to 1.1400, so play the intraday moves and

fade a 70 to 80 pip move in either direction, with stops at 1.1150 and

1.1425."

AUD/USD: "continues to trade sideways.We still see AUDUSD heading lower, but are a bit cautious as the pair seems to struggle below 0.7100. This could be due to seasonal demand, and we will have to see if the sharp bounce in oil will support other commodities. Sell rallies between 0.7180 and 0.7250, with a stop above 0.7325."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.02 07:40

Deutsche Bank: bullish condition for EUR/USD during and immediate after NFP (based on efxnews article)

BNP Paribas made the forecast for NFP to be more than 220K on Friday: "Our economists expect an above-consensus 230K increase in jobs and a steady unemployment rate of 5.3%."

By the way, Deutsche Bank is expecting for NFP to be significantly below 220K expectation:

- "To be clear, we do not believe that underlying momentum in the labor market has meaningfully deteriorated. As we have previously noted, August employment has historically tended to disappoint consensus expectations. The last four August payroll reports were all weaker than expected; they were on average 55k below consensus."

- "The data are even more compelling if we go back further in time. Since 1988, when our sample begins, August nonfarm payrolls have disappointed the financial markets in 21 of the last 27 years, or 78% of the time. The average forecasting error has been -61k. The range of misses, though, has been large. The median forecast error has been -42k."

So, we can expect the following concerning EUR/USD for example:

- BNP Paribas - bearish condition for this pair during and immediate after this high impacted news event.

- Deutsche Bank - bullish condition for this pair during and immediate after this high impacted news event.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

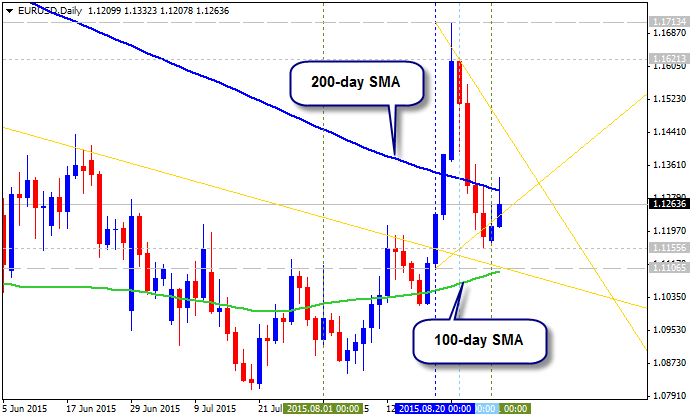

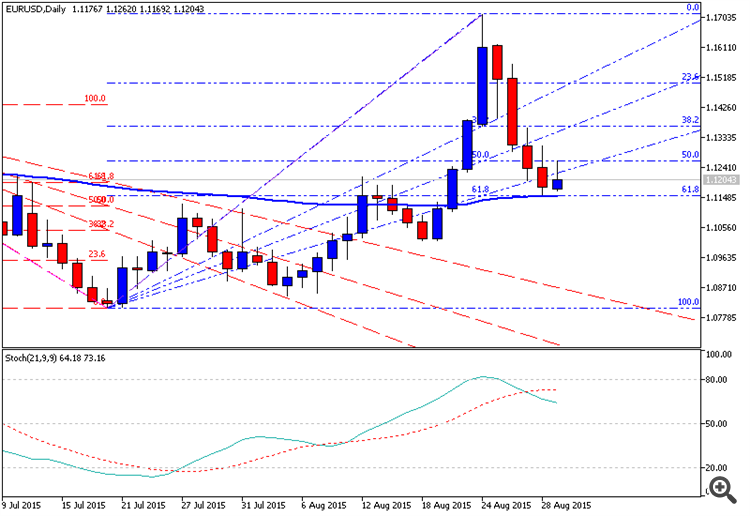

Daily price is on primary bullish for secondary correction which was started in the beginning of the last week: the price is trying to break Ichimoku cloud from above to below with Chinkou Span line to be moved close to the price for good possible breakdown. The key resistance level for the bullish trend to be continuing is 1.1713; the key support level for the price to be fully reversed to the bearish market condition is 1.0807.

D1 price - correction:

W1 price is on bearish market condition with secondary ranging between 1.0807 bearish support level and 1.2199 bullish resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0807 support level on close D1 bar so we may see the reversal of the price movement to the primary bearish market condition.

If D1 price will break 1.1713 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

SUMMARY : correction

TREND : ranging