Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.16 19:09

Weekly Outlook for USD, EUR, JPY, GBP, AUD by Morgan Stanley (based on efxnews article)

Morgan Stanley is continuing to make a weekly forecast for the

currency pairs making on technical analsysi, fundamental analysis and

for some Morgan Stanley's expectation about what they want for us to do for example sorry.

As we see - the expectation for EUR is bearish and for AUD is bearish too (USD is for bullish condition).

USD: "We believe USD strength will be focused against EM and commodity currencies going forwards, with AxJ particularly underperforming. This is largely a result of the CNY move, but also reflects growth differentials and structurally lower commodity prices. However, we would expect the path against other G10 currencies to be driven more by data into September, as the market watches the Fed closely."

EUR: "We believe EUR could benefit from the latest developments in China. CNY moves could spill over into general asset market volatility. This would support currencies with current account surpluses that have been used to fund risky holdings, as investors unwind their risky positions. EUR is such a currency. In addition, many investors have hedged their European equity holdings, and as these positions are unwound, this will lead to buying back of hedges, supporting EUR."

JPY: "We believe JPY is likely to face conflicting forces following the developments in China. On the one hand, this increases deflationary risks for Japan, as a weaker CNY could lead to disinflationary pressure in Japan. It also challenges Japanese competitiveness, given the impact on the REER. On the other hand, uncertainty on CNY is likely to de-stabilize risk appetite, leading to repatriation and supporting JPY. Overall, we expect the latter effect to win out in impact, but recognize the risks."

GBP: "The dovish inflation report and risk appetite getting hit has provided some headwinds for GBP. However with China developments still playing on markets’ minds and the Fed coming back into play, we believe GBPUSD is going to be driven more by the USD side of the pair. The BoE is still one of the central banks heading towards a hike next year so GBP should gain some relative strength. Here we like to buy against the more vulnerable commodity currencies (CAD, NOK and AUD)."

AUD: "We believe AUD is likely to be an underperformer following the developments in China this week, though stabilization in the near term could provide some relief for the currency. However, given China’s close trade relations with China, any CNY weakness will lead to de facto AUD REER appreciation, which may be countered by AUDUSD weakness in order to maintain competitiveness."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.17 08:18

Goldman Sachs - Elliot Wave technical analysis on the daily EUR/USD (based on forexlive article)

Goldman Sachs made Elliot Wave technical analysis on the daily EUR/USD and those are the following comments (below their chart):

- "Has finally sustained a break above its 55-dma and the July '14 downtrend".

- "Both of these levels have been very relevant to recent price action. The 55-dma in particular held the entire decline from the May '13 high to early-Apr. '15. It should now act as important support at 1.1095."

- "The next big pivot to focus on is 1.1168; an ABC from the Jul. 20 th low. A close above will open potential for a 1.618 extension target to 1.1366. This also happens to be close to the previous two highs from May/June (1.1438-68) and a 0.618 extension from March (1.1432)."

- "Overall, seems the next two big levels are 1.1168 and then 1.1366-1.1468."

If we look at the other patterns so we can see just two situations around: short-term (forming bearish patterns) and long-term (forming bullish patterns).

Short-term scenario

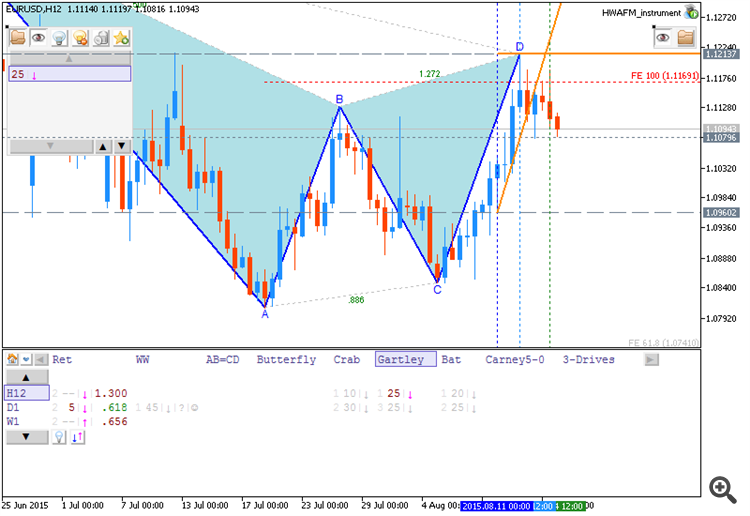

This is forming bearish gartley for H12 timeframe:

This is the forming bearish retracement pattern for H8 timeframe:

Long-tern situation with bullish

Forming bullish butterfly pattern and forming bullish 3-Drives pattern for MN1:

Thus, we can confirm for EURUSD to be in bearish market condition in short-term situation up to 2015 year-end for example, and in bullish condition in long-term in 2016.Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.17 09:53

BNP Paribas for USD - 'We expect to be a choppy second half of August' (based on efxnews article)

BNP Paribas are forecasting the strong USD but with the secondary ranging market condition - just because of China news on Fed expectations:

-

"The underlying effective Fed funds rate has also been drifting higher

over the past two weeks, reaching 15bp and suggesting some of the move

in rates market pricing could reflect expectations for a move within the

target range rather than a hike in the target."

-

"The minutes to the Fed’s July meeting on Wednesday will be

closely watched for more insight into Committee thinking on the timing

of hikes, while a speech from San Francisco Fed President John

Williams on Thursday from a conference in Indonesia may give some

insight into how Fed thinking has been affected by CNY developments."

- "We remain patiently bullish on the USD through what we expect to be a choppy second half of August."

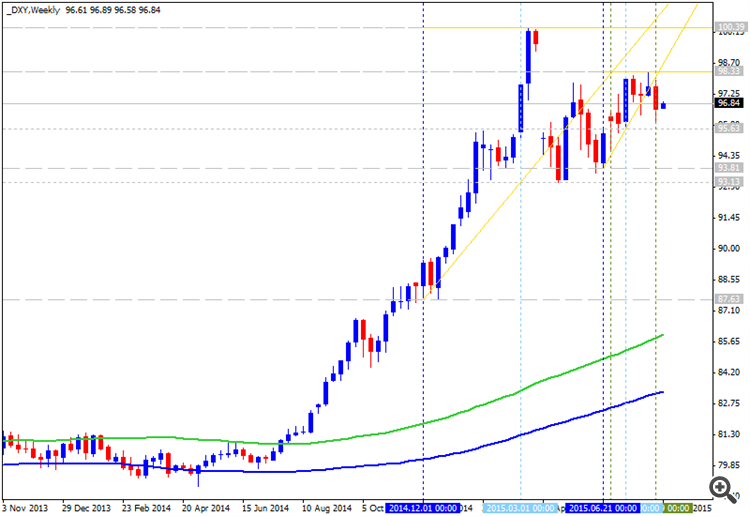

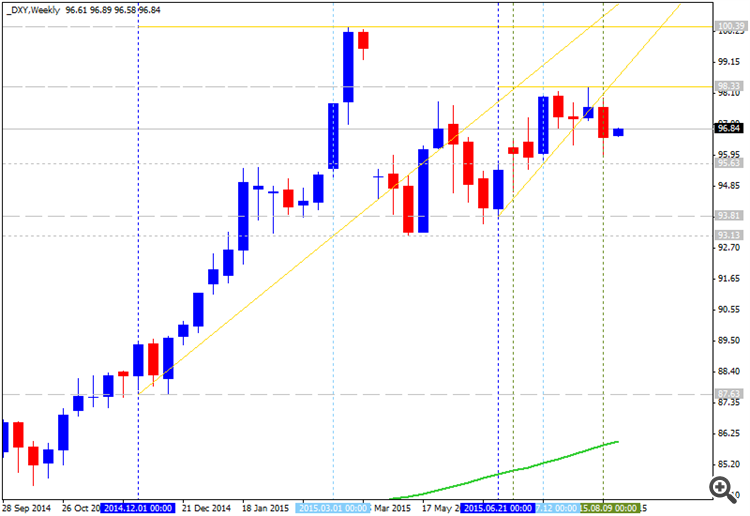

As we see from the chart - Dollar Index Future (DXY) is located above 100-SMA/200-SMA for bullish condition and, seems, this bullish condition will be continuing in August as well. But the choppy market was started in the end of April this year and there is no any indication that this choppy condition will be finished by the beginning of September. Thus, we can confirm the forecast made by BNP Paribas.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.17 20:02

Friday held the MA. Today more below. (based on forexlive article)

"The EURUSD closed last week by keeping the 100 hour MA (blue line in the chart below) as a support level. Today in the Asia-Pacific session, the price dipped below that moving average level, and has stayed below (at least on a closing basis) since that time. The weaker than expected Empire manufacturing has push the price back above the moving average, but last hours closing price could still not close above it. So there is some reluctance to have a momentum shift to the upside. The current 100 hour moving average comes in at 1.11147."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.18 10:21

FOMC Meeting Minutes expectations by Barclays and September Fed hike (based on efxnews article)

Barclays made a forecast for high impacted fundamental news events which will be on Wednesday at 19:00 GMT. The bank is telling that Federal Open Market Committee is already made a decision concerning a September Fed hike. Besides, Barclays is expecting the USD dollar to gain strength because "fears around China and weak commodity prices should keep pushing investors out of risky assets":

- "We do not expect a material change and we anticipate that the document will echo the latest comments from different FOMC members. We think they will want to keep options open and will probably signal the data dependency of their decisions ahead. We believe that the FOMC has already made up their mind about their next move, absent any market disruptive events in the months ahead. Our base case remains a September Fed hike."

- "Furthermore, we argued that the actual path of the normalization process will be more important for FX markets. The pace at which the Fed could tighten monetary conditions should depend heavily on price measures."

-

"We expect the USD to be supported in the next weeks mainly due to external factors.

Fears around China and weak commodity prices should keep pushing

investors out of risky assets, benefiting the USD under different

scenarios."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.18 20:21

BNP Paribas: 2 Things To Look For At FOMC Minutes (based on efxnews article)

-

"The key message will probably be that ‘lift-off’ is approaching and

that we moved a step closer in July. A majority of FOMC participants

probably still expected ‘lift-off’ to be appropriate sometime this year.

As markets are already pricing this in, the minutes should present few

surprises."

-

"Two things to look for: (1) what “some” further labor-market

improvement means and (2) why there was no progress report on being

“reasonably confident” in the inflation outlook."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.19 06:54

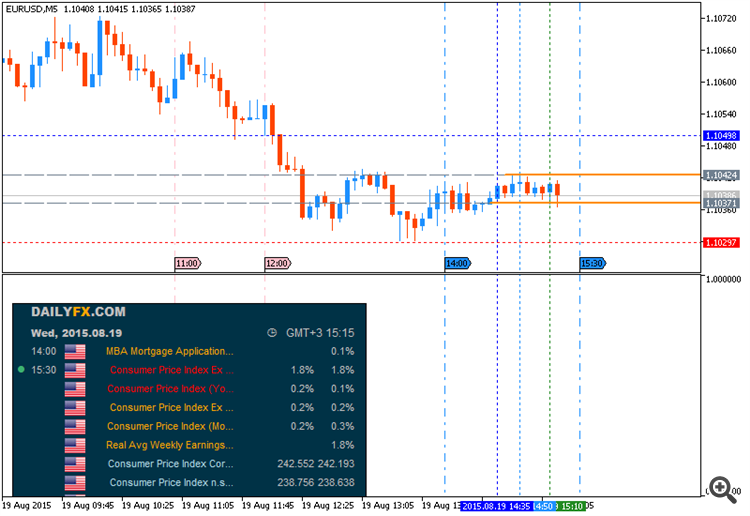

The Royal Bank of Scotland - FOMC Meeting Minutes and Consumer Price Index (CPI) (based on efxnews article)Chair Yellen is not speaking at the Jackson Hole Symposium this year:

-

"While our economist Michelle Girard thinks the Fed may

disappoint on giving a “firm” signal, which would fit with their data

dependent outlook, she sees a risk that the FOMC minutes begin to put a

greater emphasis on the pace of hikes being gradual. A clear discussion

along those lines may be a “soft signal” that an earlier start to rate

hikes, giving more assurance that a gradual pace can be taken, is the

preferred path of the FOMC’s majority."

-

"Because the meeting took place before China’s devaluation, that

discussion should not come up in the FOMC July minutes."

- "It’s also too early for that impact to be seen in the July CPI, which is the key data release tomorrow in the US ahead of the FOMC minutes. Our economists see the risks to the y/y rate as slightly on the upside – a “high” 0.2% m/m edge up in the core CPI index could push the y/y rate up from 1.8% to 1.9% y/y."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.20 08:34

Time To Turn Bullish On EUR - Credit Suisse (based on efxnews article)

EUR will be on bullish, and the main reason for CS to decide it is the still-high risk that the ECB may have to re-enter the easing fray down the line:

"For example, as Exhibit 2 shows, European inflation breakevens have also been falling recently. With the ECB's credibility is on the line as it proceeds with its QE program, it is hard to imagine it standing pat for long and allowing sustained EUR strength to provide a fresh reason for these indicators to push still lower."

By the way - EUR/USD was already turned to bullish in intra-day basis:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located in exact 'reversal' Sinkou Span lines of Ichimoku indicator between the following s/r levels:

Chinkou Span line is above the price indicating the ranging market condition by direction.

D1 price - ranging with waiting for direction:

W1 price is on bearish market condition with secondary ranging between 1.0807 (W1) support level with 1.0461 as the next target, and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0807 support level on close D1 bar so we may see good bearish breakdown of the price movement with next target as 1.0461.

If D1 price will break 1.1215 resistance level so the price will be reversed to the primary bullish market condition.

If not so the price will be on ranging between the levels.

SUMMARY : reversal

TREND : ranging