Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.27 20:30

Forex Weekly Outlook Mar 30-Apr 3 (based on forexcrunch article)

Canadian GDP, US Consumer Confidence, Trade Balance and important employment data including ADP Non-Farm Employment Change and the all-important Non-Farm Payrolls. Join us as we explore the top events of this week.

Last week, US labor market continued to improve with a decline in the number of jobless claims, reaching 282,000. Robust job creation and better employment conditions have strengthen the labor market spurring growth. However, the final GDP release for the fourth quarter of 2014 slightly disappointed remaining unchanged at 2.2%, below the 2.4% forecast. Despite a 4.4% jump in consumer spending, the economy shrank at an annual rate of 2.1% in the first quarter due to severe winter storms. Nevertheless, economists forecast stronger growth in the coming months, as the labor market continues its positive expansion trend.

- Canada GDP: Tuesday: 12:30. The Canadian economy expanded 0.3% in December, exceeding analysts’ expectations for a 0.2% gain. The reading was preceded by a 0.2% contraction in November. On a yearly base, GDP edged up 2.5% in 2014. The annual growth rate in the fourth quarter reached 2.4%, below the 3.2% posted in the third quarter. Household spending continued to be the main force in the Canadian economy increasing consumption expenditure by 2.0% on an annualized basis. Exports of goods fell 2.5%, exports of crude oil declined 6.5% and exports of refined petroleum products slumped 36.3%. Economists forecast a 0.2%growth rate in January.

- US CB Consumer Confidence: Tuesday, 14:00. Consumer confidence declined more than expected in February reaching 96.4 from 103.8 in January. Economists expected a smaller drop to 99.6. Current declined to 110.2 from a revised 113.9 in January. Consumer outlook for the next six months dropped to 87.2 from a revised 97.0. Consumers were less optimistic about job prospects. However, despite the lower figures, the general level show positive trend. Consumer confidence is predicted to reach 96.6 in March.

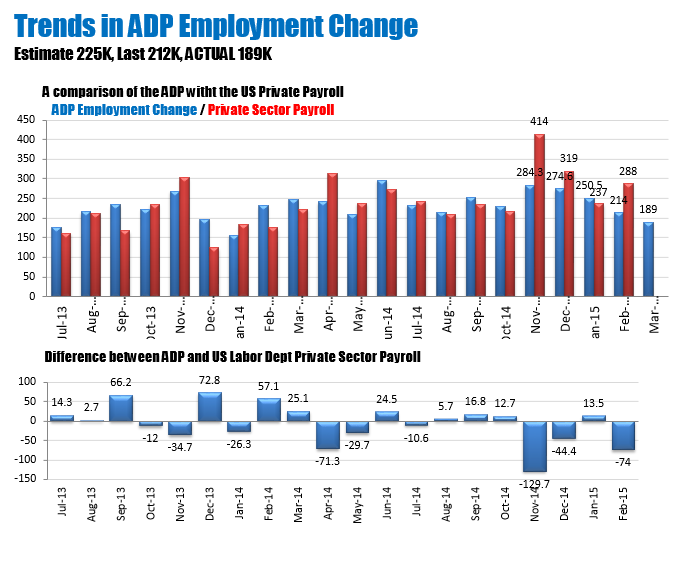

- US ADP Non-Farm Employment Change: Wednesday, 12:15. U.S. private sector gained 212,000 jobs in February following an upwardly revised reading of 250,000 in the previous month. The release was below expectations. The manufacturing and the services sectors improved the most. However, despite the weaker job gain, the private sector’s outlook remains bright. Analysts expect a 231,000 job gain in the US private sector for March.

- US ISM Manufacturing PMI: Wednesday, 14:00. US manufacturing sector weakened in February, dropping 0.6 points to 52.9. The reading was worse than the 53.4 points forecasted by analysts, however, the reading remained above the 50 point line, indicating continued growth. New orders fell 0.4 points to 52.5 while factory activity dropped from 56.5 in January to 53.7. Manufacturing employment also slipped from 54.1 to 51.4. Manufacturing exports continued to contract in February to 48.5, while imports softened, from 55.5 to 54. US manufacturing PMI is expected to reach 52.5 this time.

- US Trade Balance: Thursday, 12:30. The U.S. trade deficit narrowed in January to $41.8 billion amid weakening in exports and imports. The 8.3% fall was broadly in line with market forecast. Imports contracted due to lower oil prices and labor strikes disrupting shipping of goods. Exports fell $5.6 million to $189.4 billion while imports dropped $9.4 billion to $231.1 billion. However, domestic production increased due to low oil prices and petroleum imports fell 23% to $17.7 billion. The U.S. trade deficit is expected to contract further to $41.5 billion.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined more than expected last week, reaching 282K after a 291,000 addition in the prior week. The 9,000 drop continues to suggest an ongoing improvement in the US job market despite the recent volatility due to the harsh weather, softer global demand and the strong dollar. The four-week moving average fell 7,750 to 297,000 last week. The number of jobless claims is expected to reach 285,000 this week.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. U.S. job creation strengthened in February rising 295,000 and lowering jobless rate to a more than 6-1/2 year low of 5.5%. Job gain was stronger despite harsh weather conditions disrupting activity. The report supported the Fed’s rate hike move planned in June. Average hourly earnings edged up by three cents and further gains are expected. The participation rate in the US labor market has been steady at a 5-1/2 year high of 59.3%. US private sector is expected to gain 251,000 positions while the unemployment rate is expected to remain at 5.5%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.28 18:51

EUR/USD forecast for the week of March 30, 2015, Technical Analysis

The EUR/USD pair

tried to rally during the course of the week, but as you can see

struggled at the 1.10 handle. This is an area that continues offer

resistance, and the fact that we pulled back to form a shooting star of

course is a very negative sign. If we can break down below the bottom of

the shooting star, we feel that the market then heads to the 1.05

handle. Below there, we go to the parity level, but we are not quite

ready to do that yet and we feel that the return trip is about to start

this week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.30 09:49

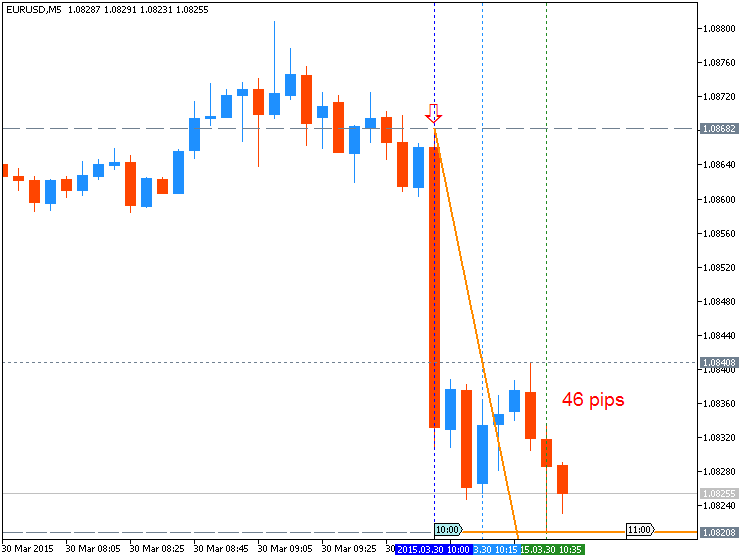

2015-03-30 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Spanish CPI]EURUSD M5: 46 pips price movement by Spanish CPI news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.29 06:44

Forex Technical Analysis: EURUSD Ending the week higher but neutral technically

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.29 15:01

Forex - Weekly outlook: March 30 - April 3 (based on investing.com article)

The dollar ended the week lower against a basket of other major currencies on Friday as a lukewarm report on U.S. economic growth and comments by Federal Reserve Chair Janet Yellen weighed.

The Commerce Department reported Friday that the U.S. economy expanded at an annual rate of 2.2% in the fourth quarter, unchanged from the preliminary estimate and below economists’ forecasts for an upward revision to 2.4%.

Another report showed that the final reading of the University of Michigan’s consumer sentiment index ticked down to 93.0 this month from a final reading of 95.4 in February.

The dollar showed little reaction after Fed Chair Janet Yellen struck a cautious note on interest rates. In a speech, the Fed chief said a rate hike may be warranted later this year, but added that weakening inflation pressures could force the Fed to delay.

The speech echoed the Fed’s latest policy statement, released on March 18, which indicated that it may raise interest rates more gradually than markets had expected.

EUR/USD was little changed at 1.089 late Friday and ended the week with gains of 0.6%.

USD/JPY was flat at 119.14 to end the week down 0.74%, while USD/CHF was steady at 0.9624.

The pound pushed higher with GBP/USD up 0.29% to 1.4893 in late trade.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the week down 0.66%, the second consecutive weekly decline.

In the week ahead, investors will be focusing the U.S. employment report for February, due out on Friday and Monday’s data on personal spending for further indications on the path of monetary policy. Tuesday’s euro zone inflation report will also be closely watched.

Monday, March 30

- Japan is to publish preliminary data on industrial production.

- In the euro zone, Germany and Spain are to release preliminary data on consumer price inflation.

- Switzerland is to publish its KOF economic barometer.

- The U.K. is to produce data on net lending.

- Canada is to release data on raw material price inflation.

- The U.S. is to release reports on personal spending and pending home sales.

Tuesday, March 31

- New Zealand is to produce reports on building consents and business confidence.

- Japan is to report on average cash earnings.

- The euro zone is to release preliminary data on consumer inflation and the monthly employment report. Germany is to report on retail sales and the unemployment rate.

- The U.K. is to produce data on the current account.

- Canada is to publish its monthly report on gross domestic product.

- The U.S. is to release data on consumer confidence.

Wednesday, April 1

- Japan is to publish the results of the Tankan manufacturing and non-manufacturing indexes.

- Australia is to release data on building approvals.

- China is to publish its official manufacturing index.

- The U.K. is to release survey data on manufacturing activity.

- The U.S. is to release the ADP nonfarm payrolls report, which outlines private sector jobs growth, while the Institute of Supply Management is to release data on manufacturing activity.

Thursday, April 2

- Australia is to release data on the trade balance.

- The U.K. is to release survey data on construction activity.

- Both Canada and the U.S. are to report on their trade balances. The U.S. is also to release data on initial jobless claims and factory orders.

Friday, April 3

- Markets in Australia, New Zealand, Europe, the U.K., U.S. and Canada will be closed for the Good Friday holiday.

- The U.S. is to round up the week with what will be a closely watched government report on non-farm payrolls, the unemployment rate and average earnings.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.31 14:41

2015-03-31 13:00 GMT (or 15:00 MQ MT5 time) | [USD - FOMC Member Lacker Speech]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Lacker Speech] = Due to speak about the economic outlook at the Greater Richmond Chamber of Commerce's Spring Regional Forum. Audience questions expected. Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy

==========

- Consumer spending has increased in recent months, bolstered by improvements in the labor market and in households’ balance sheets.

- The economy still faces some challenges, including a sluggish housing market, potentially weaker exports and declines in government spending.

- GDP growth is likely to average between 2 and 2 ½ percent during 2015.

- Inflation is currently below the FOMC’s goal of 2 percent, in part due to lower energy and import prices. These effects are transitory, however, and inflation expectations remain stable, making it likely that inflation will move back toward 2 percent this year.

- Given the improvements in the labor market and other indicators, June will likely be an appropriate time to raise the federal funds rate target.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 40 pips price movement by USD - FOMC Member Lacker Speech news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.31 20:06

Trade Ideas For EUR/USD, USD/JPY, USD/CAD - UBS (based on efxnews article)

The following are UBS' latest short-term (mostly intraday) trading strategies for EUR/USD, USD/JPY, and USD/CAD.

EUR/USD: remains heavy after breaking below 1.0800 as the dollar headed higher overnight. We are happy to sell rallies to 1.0830-40 with stops above 1.0890.

USD/JPY: With the dollar strengthening across the board, we would look to buy USDJPY on dips to 119.70 with a stop below 119.10. First resistance lies at 120.50 ahead of 121.30.

USDCAD: Square longs and buy below 1.2450, sticking to the strategy of buying spot on dips rather than chasing it higher at the wrong levels.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.01 07:30

EUR/USD nearing important downside pivots (based on dailyfx article)

- EUR/USD has come under steady pressure since failing last week at Gann resistance in the 1.1040 area

- Our near-term trend bias will turn negative on the euro on a close below 1.0760

- A move back through 1.0900 is needed to trigger a renewed push higher in the exchange rate

- A minor turn window is eyed on Thursday

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.0585 | 1.0685 | 1.0740 | 1.0800 | 1.0900 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.03.29 19:21

EUR/USD weekly outlook: March 30 - April 3 (based on investing.com article)

The euro ended the week higher against the softer dollar on Friday, following lukewarm U.S. economic reports, including on economic growth, and cautious sounding comments by Federal Reserve Chair Janet Yellen.

EUR/USD was little changed at 1.089 late Friday and ended the week with gains of 0.6%.

Sentiment on the dollar was hit after data on Friday showed that the U.S. economy grew slightly less than forecast in the fourth quarter and another report showing that consumer sentiment deteriorated this month.

The Commerce Department reported that the U.S. economy expanded at an annual rate of 2.2% in the fourth quarter, unchanged from the preliminary estimate and below economists’ forecasts for an upward revision to 2.4%.

Another report showed that the final reading of the University of Michigan’s consumer sentiment index ticked down to 93.0 this month from a final reading of 95.4 in February.

The dollar remained subdued after Fed Chair Janet Yellen struck a cautious note on interest rates. In a speech on Friday, the Fed chief said a rate hike may be warranted later this year, but added that weakening inflation pressures could force the Fed to delay.

The speech echoed the Fed’s latest policy statement, released on March 18, which indicated that it may raise interest rates more gradually than markets had expected.

In the euro zone, Greece put forward new reform plans for approval late Friday, as part of a bailout extension review.

Officials from the European Union, the International Monetary Fund and the European Central Bank were to examine the measures after earlier proposals were not accepted.

Elsewhere, EUR/JPY was little changed at 129.73 late Friday.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the week down 0.66%, the second consecutive weekly decline.

In the week ahead, investors will be focusing the U.S. employment report for February, due out on Friday and Monday’s data on personal spending for further indications on the path of monetary policy.

Tuesday’s euro zone inflation report will also be closely watched.

Monday, March 30

- Japan is to publish preliminary data on industrial production.

- In the euro zone, Germany and Spain are to release preliminary data on consumer price inflation.

- The U.S. is to release reports on personal spending and pending home sales.

Tuesday, March 31

- The euro zone is to release preliminary data on consumer inflation and the monthly employment report. Germany is to report on retail sales and the unemployment rate.

- The U.S. is to release data on consumer confidence.

Wednesday, April 1

- The U.S. is to release the ADP nonfarm payrolls report, which outlines private sector jobs growth, while the Institute of Supply Management is to release data on manufacturing activity.

Thursday, April 2

- The U.S. is to release data on the trade balance, initial jobless claims and factory orders.

Friday, April 3

- Markets in Australia, New Zealand, Europe, the U.K., U.S. and Canada will be closed for the Good Friday holiday.

- The U.S. is to round up the week with what will be a closely watched government report on non-farm payrolls, the unemployment rate and average earnings.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.01 17:07

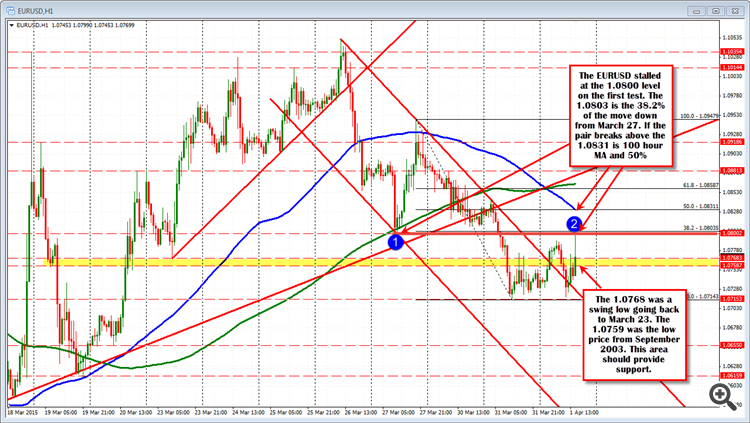

Forex technical analysis: EURUSD rallies after weaker than expected ADP employment (based on forexlive article)

The EURUSD has moved higher after the March ADP employment report came in weaker than expectations at 189K vs estimate of 225K. Note that although weaker then expectations, it does not necessarily follow the Labor departments measure for private payroll. In the month of November, the Labor Department reported a gain of 414K. While ADP was down at 284K - a130K difference. In December, the difference was 44.4K. In 3 last 4 months, the ADP has understated the Labor Department's data (January data showed ADP at 250K vs 237K or 13.5K difference - see chart below)).So, although the number is week, it must be taken in context with the recent history.

Nevertheless, the EURUSD has moved to new session highs on the initial move (it has since come off a bit). However, on the move to the upside, the price did stall at the 1.0800 resistance target level (high came in at 1.0799). This level corresponds with the low price from last week's trading (at 1.08003). The 38.2% retracement of the move down from the high on March 27 (see chart below), comes in near that level as well (at 1.08035).

If the price is to move higher in trading today - and look to test the next upside target at the 100 hour moving average and 50% retracement level at the 1.0831 level - this area needs to be broken (the EURUSD back down in the 1.0768 currently).dsdsd

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bearish ranging between 1.0461 support and 1.1533 resistance levels

MN price is on bearish for breaking 1.1097 support level on open MN1 bar

If D1 price will break 1.0551 support level on close D1 bar so the primary bearish will be continuing

If D1 price will break 1.1051 resistance level so we may have the market rally within the primary bearish market condition

If not so the price will be ranging between 1.0551 and 1.1051 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-03-30 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Spanish CPI]

2015-03-30 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PCE]

2015-03-30 23:15 GMT (or 01:15 MQ MT5 time) | [USD - FOMC Member Fischer Speech]

2015-03-31 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2015-03-31 07:55 GMT (or 16:00 MQ MT5 time) | [EUR - German Unemployment Change]

2015-03-31 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2015-03-31 14:00 GMT (or 16:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2015-04-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2015-04-01 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2015-04-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing]

2015-04-02 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Trade Balance]

2015-04-03 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging