- Increase volume while following Signal

- I have problem with volume of trade, help me !!!

- order size on copy signals

Nguyen Quoc Viet :

Forum on trading, automated trading systems, and simulation of trading strategies.

Miguel Angel Vico Alba , 2019.07.23 11:22

Good day,

I am attaching an excerpt from the following article, which I advise you to read carefully: https://www.mql5.com/en/articles/618

Greetings!

Fund management or how to choose the volume of a transaction?

One of the most important issues concerns how the subscriber's deposit will be processed in the transaction. In addressing this issue, we have been guided by the same principles as the entire service: maximum protection for every participant in the process. As a result, we are able to offer subscribers a very secure solution.

After integrating signals into their terminal and subscribing to one of them, the subscriber faces the dilemma of exactly how much of their deposit to use for signal tracking. Previously, there was an alternative option to establish a ratio between the supplier's and subscriber's position sizes. However, this system could not guarantee the security of the subscriber's deposit. For example, suppose the supplier's deposit was $30,000, and the subscriber's was $10,000, and a 1:1 ratio was chosen. If the supplier simply waits for the loss reduction with a fairly large order, the subscriber may lose all their money and be stopped out. Or, in an even worse situation, if the supplier's balance changes unexpectedly (funds are replenished or withdrawn from the account), while the previously established volume ratio remains unchanged.

To avoid this, a percentage allocation system has been chosen for the portion of the deposit used for trading through signals. This system is quite complex technically, as it takes into account the deposit currencies, their conversion, and leverage.

Let's see how the management system works with an example:

- Supplier: balance 15,000 USD, leverage 1:100

- Subscriber 1: balance 40,000 EUR, leverage 1:200, deposit usage percentage 50%

- Subscriber 2: balance 5,000 EUR, leverage 1:50, deposit usage percentage 35%

- EURUSD rate = 1.2700

Calculation of the ratio of the volumes of the supplier's and subscriber's operations:

- Proportion of balances taking into account the percentage of deposit usage:

Subscriber1: (40,000 * 0.5) / 15,000 = 1.3333 (133.33%)

Subscriber2: (5,000 * 0.35) / 15,000 = 0.1166 (11.66%) - After considering leverage:

Subscriber1: Subscriber1's leverage (1:200) is higher than that of the supplier (1:100), so the leverage correction is not performed.

Subscriber2: 0.1166 * (50 / 100) = 0.0583 (5.83%) - After correction taking into account the exchange rate of the deposits at the time of calculation:

Subscriber1: 1.3333 * 1.2700 = 1.6933 (169.33%)

Subscriber2: 0.0583 * 1.2700 = 0.0741 (7.41%) - Total percentage after rounding (rounding is done according to a scaled algorithm):

Subscriber1: 160% or a coefficient of 1.6

Subscriber2: 7% or a coefficient of 0.07

In this way, under these conditions, the Supplier's operation with a volume of 1 lot will be copied:

- on the account of Subscriber2 with an amount of 7% - and a volume of 0.07 lots

Be careful not to confuse the deposit usage percentage with the trading volume ratio. The trading terminal specifies the deposit usage percentage, from which the trading volume ratio is deducted. This information is necessarily included in the log, and in our example, it will look like this:

Subscriber1 :

2012.11.12 13:33:23 Signal '1277190': percentage for volume conversion selected according to the ratio of balances and leverages, new value 160%

2012.11.12 13:27:55 Signal '1277190': signal provider has balance 15 000.00 USD, leverage 1:100; subscriber has balance 40 000.00 EUR, leverage 1:200

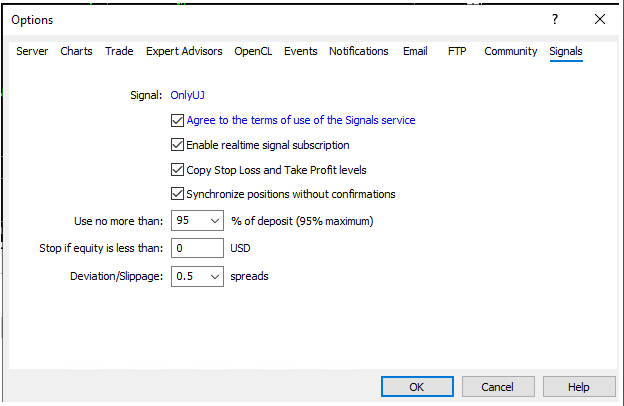

2012.11.12 13:27:54 Signal '1277190': money management: use 50% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

Subscriber2 :

2012.11.12 13:33:23 Signal '1277191': percentage for volume conversion selected according to the ratio of balances and leverages, new value 7%

2012.11.12 13:27:55 Signal '1277191': signal provider has balance 15 000.00 USD, leverage 1:50; subscriber has balance 5 000.00 EUR, leverage 1:50

2012.11.12 13:27:54 Signal '1277191': money management: use 35% of deposit, equity limit: 0.00 EUR, deviation/slippage: 1.0 spreads

*Automatically translated from Spanish to English.

So that means if I reduce the leverage lower than Subscriber and both Subscriber and Supplier are USD then Subscriber's volume will be exactly proportional to Supplier's volume right?

- Supplier: balance 3500 USD, leverage 1:100

- Subscriber 1: balance 1000 USD, leverage 1:200, deposit usage percentage 50%

Calculation of the ratio of the volumes of the supplier's and subscriber's operations:

- Proportion of balances taking into account the percentage of deposit usage:

Subscriber1: (1000 * 0.95) / 3500 = 0.27(27%) - After considering leverage:

Subscriber1: Subscriber1's leverage (1:200) is higher than that of the supplier (1:100), so the leverage correction is not performed. - After correction taking into account the exchange rate of the deposits at the time of calculation:

Subscriber1: 0.27* 1 = 0.27(27%) - Total percentage after rounding (rounding is done according to a scaled algorithm):

Subscriber1: 27% or a coefficient of 0.27

In this way, under these conditions, the Supplier's operation with a volume of 1 lot will be copied:

- on the account of Subscriber1 with an amount of 27% - and a volume of 0.27lots

Am I right?

So that means if I reduce the leverage lower than Subscriber and both Subscriber and Supplier are USD then Subscriber's volume will be exactly proportional to Supplier's volume right?

- Supplier: balance 3500 USD, leverage 1:100

- Subscriber 1: balance 1000 USD, leverage 1:200, deposit usage percentage 50%

Calculation of the ratio of the volumes of the supplier's and subscriber's operations:

- Proportion of balances taking into account the percentage of deposit usage:

Subscriber1: (1000 * 0.95) / 3500 = 0.27(27%) - After considering leverage:

Subscriber1: Subscriber1's leverage (1:200) is higher than that of the supplier (1:100), so the leverage correction is not performed. - After correction taking into account the exchange rate of the deposits at the time of calculation:

Subscriber1: 0.27* 1 = 0.27(27%) - Total percentage after rounding (rounding is done according to a scaled algorithm):

Subscriber1: 27% or a coefficient of 0.27

In this way, under these conditions, the Supplier's operation with a volume of 1 lot will be copied:

- on the account of Subscriber1 with an amount of 27% - and a volume of 0.27lots

Am I right?

Yes, that is right.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use