- Please need help on stop loss not working

- Help need modifying this EA

- Help need modifying this EA

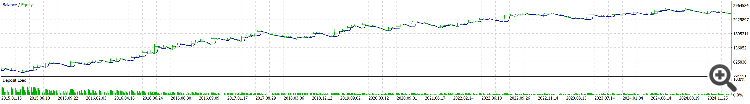

URGENT HELP NEEDED !! I have an ea uses grid like strategy, it places orders above and below pricea at a configured distance, it worked magicaly on the first 3 months of 2025, but since the late of march, it underperformed dramaticaly across the majority of pairs, i have a spread filter, and if i modified it( depending on the pair), it works good until the period of losses and it stops trading ,which means it filters the losing period perfectly, the objective is i want to find a solution in order to trade even on the losing months rn, even if the market conditions changes, please help if anyone faced the same issue, here are some screenshots of the backtesting graph and the setfiles as well, thank you.

Market conditions changed - grid strategies fail in trending markets.

Add trend filters or dynamic parameters.

URGENT HELP NEEDED !! I have an ea uses grid like strategy, it places orders above and below pricea at a configured distance, it worked magicaly on the first 3 months of 2025, but since the late of march, it underperformed dramaticaly across the majority of pairs, i have a spread filter, and if i modified it( depending on the pair), it works good until the period of losses and it stops trading ,which means it filters the losing period perfectly, the objective is i want to find a solution in order to trade even on the losing months rn, even if the market conditions changes, please help if anyone faced the same issue, here are some screenshots of the backtesting graph and the setfiles as well, thank you.

Are you using "Every tick based on a real tick"?

yes exaclty , i am using 'Every tick base on real ticks ' , and when i use every tick indeed it performs normal as fabio said, is there anything i can do in order to make it profitable ??

The reply is simple but you will not like it: The system is not profitable in a real or similar real environement.

Only scenarios in which it was profitable into backtest is using rounding data method, which for your EA is not good because it demonstrated that it's very delicate to different ticks.

Solutions:

- Download ticks with external sources of the whole period you will want to test. (In this way you can test the EA in a more correct environment, even if I already explained how hard is to trust a backtest of a system that can be affected by ticks quality)

- Or rebuild your EA to make it less ticks-prone, for example using only closed bar informations, never using Ask/Bid in functions (like trailing), use market trade and not pendings. (Just to name 3 of common problems that make a system too strictly related to ticks).

URGENT HELP NEEDED !! I have an ea uses grid like strategy, it places orders above and below pricea at a configured distance, it worked magicaly on the first 3 months of 2025, but since the late of march, it underperformed dramaticaly across the majority of pairs, i have a spread filter, and if i modified it( depending on the pair), it works good until the period of losses and it stops trading ,which means it filters the losing period perfectly, the objective is i want to find a solution in order to trade even on the losing months rn, even if the market conditions changes, please help if anyone faced the same issue, here are some screenshots of the backtesting graph and the setfiles as well, thank you.

if it does as you say "filters the losing period perfectly", then, you have the closest thing you can get to a "holy grail". Use it as it is.

I have an ea uses grid like strategy,

This strategy description seems a bit obtuse to me. Is it hedging? Here's a grid strategy that stacks trades in a netting account (10 years):

Maybe consider stacking based on the grid. The idea is that the runners are multiplied more while the losers are multiplied less.Grid or Martingale will never make you sustainable...

Exactly. That's why I mentioned an anti-Martingale strategy. Some call it pyramiding. It stacks profitable trades.

Although it's "grid like," it's not the Grid nor Martingale strategy which presumably hedges and/or stacks losing trades.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use