It depends! We need more information!

- Are you back testing with real tick data?

- Is the strategy based on very low time-frames making it very sensitive to spread and other trading fees?

- Are you simulating the trading fees like commission and swaps correctly?

- Is it trading during news events or is it sensitive to high volatility or low liquidity?

It depends! We need more information!

- Are you back testing with real tick data?

- Is the strategy based on very low time-frames making it very sensitive to spread and other trading fees?

- Are you simulating the trading fees like commission and swaps correctly?

- Is it trading during news events or is it sensitive to high volatility or low liquidity?

Ok,

- Back testing on open prices - EA runs on newbar (based on iTime as opposed to Bars) not tick data.

- This particular EA runs on the M5 timeframe, i have a function to stop trading if the spread gets over 3 pips.

- I think I'm simulating fees correctly, ill add it to the list to verify (i do use the built in commission settings *pic attached).

- It trades right through news events yes, i don't think it's particularly sensitive.. it stops trading if spreads get out of the normal range.

Does this help narrow it down any?

Then you need to start using real tick data testing for the most realistic result.

Even if you are placing the order at the open of the bar, you still need realisting spread information for the opening price.

And if you are using a stop-loss and take-profit that is irrespective of the "new bar" condition, then you definitely need to use real tick data for accurate stops.

Make use of the simulate delays to test out the robustness of your strategy. On a real accounts, orders are not filled immediately, so the delays will help simulate that.

You will need to use the real tick data if you wand accurate spread analysis for your condition.

Make sure it matches the specifications of your live account.

In order to properly analyse and respond to your spread conditions, you will need to use real tick data testing.

Use extra large or random delays to simulate the conditions of trading during high impact news events.

Make sure it matches the specifications of your live account.

In order to properly analyse and respond to your spread conditions, you will need to use real tick data testing.

Use extra large or random delays to simulate the conditions of trading during high impact news events.

Is there any data providers you recommend? I think i briefly used tick data suite once upon a time, that seemed good? just very large files to store.

On MT5, tick data is provided by your broker. You don't need to source it from a 3rd party. Just make sure that the test period you use is within the available tick data time range.

The tick data provided is usually less than the OHLC M1 data that the brokers provide. So make sure to check the available tick data and only test within that range, otherwise it will just generate simulated tick data for the missing time range.

On MT5, tick data is provided by your broker. You don't need to source it from a 3rd party. Just make sure that the test period you use is within the available tick data time range.

The tick data provided is usually less than the OHLC M1 data that the brokers provide. So make sure to check the available tick data and only test within that range, otherwise it will just generate simulated tick data for the missing time range.

Ok awesome thanks for the help Fernando!

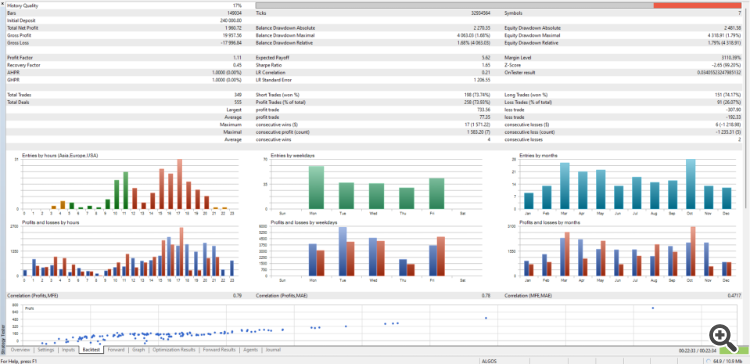

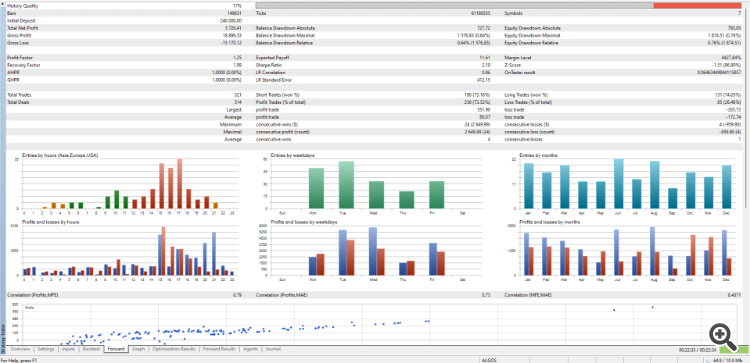

I ran some tick data single back tests for fun, it was quite similar to open prices thankfully. If you zoom in the last recent little part of the equity chart it sure does resemble my most recent little drawdown that has me all wound up lol.

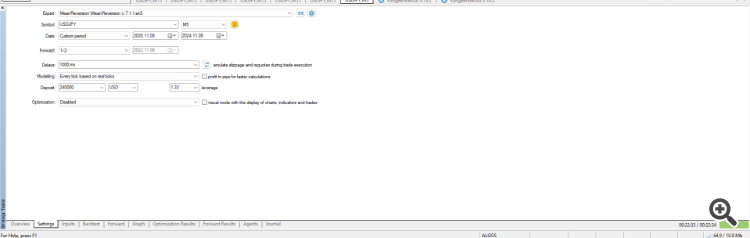

For now, use a fixed delay for your tick back-test, and please show screenshots for the following:

- Date range (Settings)

- Modelling (Settings)

- History quality bar (Backtest report)

For now, use a fixed delay for your tick back-test, and please show screenshots for the following:

- Date range (Settings)

- Modelling (Settings)

- History quality bar (Backtest report)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I had something interesting happen, i optimized an EA up until the start of september and I figured I would re optimize it. just for fun i ran a single backtest up to the present date (a month and a half out of sample) and the results were great, i was starting to wonder if I even had to reoptimize it (starting to do it periodically lately). Then i figured I would check the most recent performance through myfxbook (using their EA to track stats) and I was quite shocked to see the huge discrepancy between the two sets of results, if you look in the picture i've line up the dates so you can get an idea. Has anyone had this happen before?

any suggestions I can make or stuff I can learn so I don't have this happen anymore??

Thanks in advance!