That is called "nedging" or hedging on the same symbol. That is a total waste of money and you pay twice the fees (spread, commission, etc.).

Having two positions open in the opposite direction is equivalent to cancelling each other out, and you can see that clearly on a "netting" account instead of a "hedging" account.

The correct way, is to simply wait for your confirmation of the trend and only then open the position.

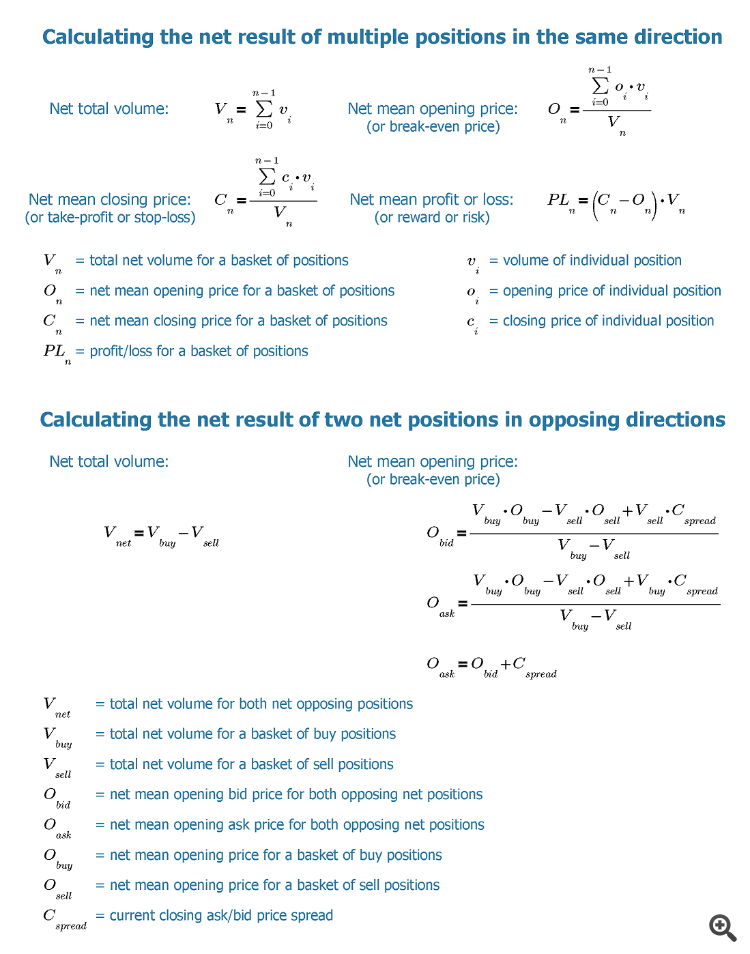

Learn the maths ...

Since 2009, hedging is not permitted for US traders.

NFA Enforces FIFO Rule, Bans Forex Hedging in US Forex Accounts - Trading Heroes (2016)

FAQ: FIFO in the Forex Market - BabyPips.com (2011)

"Hedging" in Forex trading -Why do it? - Trading Systems - MQL5 programming forum (2017)

This is profitable only during high impact news, where volatility is suddenly very high, making sure the profit is higher than the loss of the opposite trade. Otherwise it is not worth it.

my experiment was to build an EA which corners the market with the sell and buy above and below (stop orders). It is profitable if the broker allows hedging. Straight away any system is unprofitable if it isn't refined. It gets scientific with the distance of the order placement to the BID/ASK, then the expiry time, and how the orders should update, when the orders should update etc.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Well you open two positions at the same time and price. So you close the loss/negative one as soon as you realized the trend.

I can only think of swap if it took too long to find the trend.