sell order's take profit?

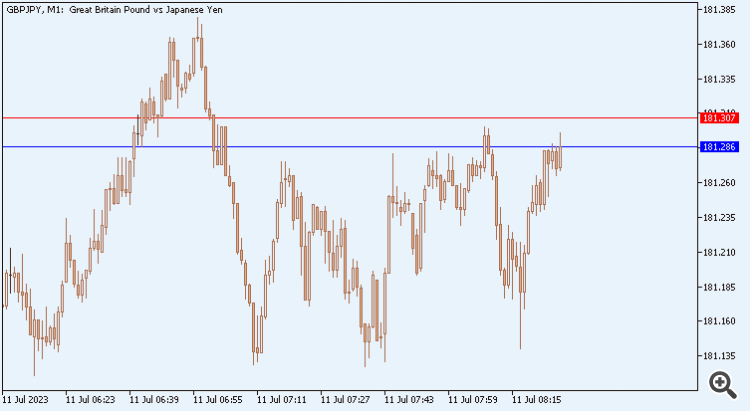

I am not sure but I think that It may be related to ask/bid price.

-----------------

Details:

Sell order's TP/SL will be triggered when the Ask / OrderClosePrice reaches it.

The charts show Bid prices only.

more: post #1

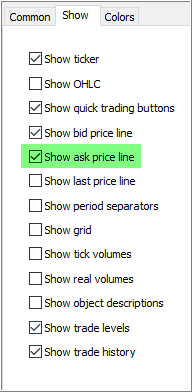

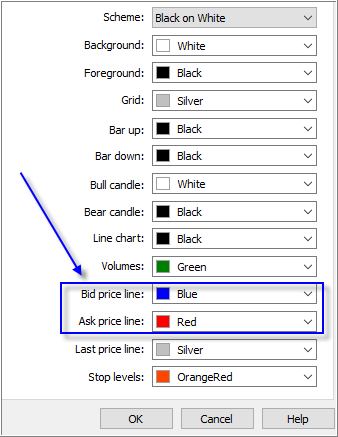

To see ask price: MT5 - right mouse click on the chart - Proterties - Show ask price line.

Example:

You assume. It becomes a market order.

Yeah, if tp is a market order it explains the behavior (i thought it was some kind of stop order, just like the sl). But being a limit order would make much more sense in my opinion, as it is on the other platforms I've worked with. Is there an explanation somewhere on why mt5 devs chose this over a limit order? Read all around the documentation and didn't find anything.

I mean, considering the existence of this article, I'm certainly not the only one who finds this weird. Also, as I said, the workaround this article presents doesn't help much, due to performance issues with executing many OrderSend functions.

This slippage reduces my profit a lot and is not desirable.

sell order's take profit?

I am not sure but I think that It may be related to ask/bid price.

-----------------

Details:

Sell order's TP/SL will be triggered when the Ask / OrderClosePrice reaches it.

The charts show Bid prices only.

more: post #1

To see ask price: MT5 - right mouse click on the chart - Proterties - Show ask price line.

Example:

Wouldn't make sense, actually. If the bid/ask hits the take profit, if it was a limit order, the tp should be executed at the exact same level it was placed, regardless of slippage (none in this case), spread, bid/ask, etc.

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Title.

My question comes from the following situation: when a tp level is reached, it is commonly not executed at the price it was placed. Take the following as an example.

We see that the take profit was reached (127,105). However, the execution price was at 127,115. In this market, this instrument tick size is 5, so I ended up losing two ticks in this case.

One can say 'that's the slippage'. However, I would expect so that the take profit was a limit pending order. No slippage should occur in this case.

Also, the MT5 documentation doesn't say anything about this, as I could research.

Is it a limit order? Why there's a 'slippage effect' on it?