Is there a pattern to the chaos? Let's try to find it! Machine learning on the example of a specific sample. - page 23

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The target can be changed, but for what, any ideas?

I have been experimenting mostly with TP/SL so far. Just in pips or from volatility, so that at night I don't put the same TP/SL as during the day.

The markup for the teacher is easy to do. Trades often.

But still the same 50/50 at best with a slight edge. I.e. 0,00005 from a deal can be obtained.

But slippages are not taken into account at all, spreads are taken into account, but they are known only minimum per bar, and in reality will be more. Swaps. All of the above will eat up this measly 0.00005.

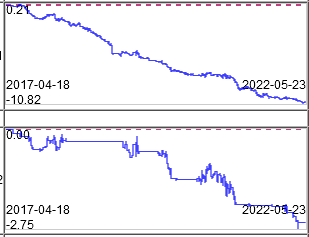

All this at TP/SL 300...500, i.e. drawdowns are huge up to 1000 losses in a row if on M5. Drawdowns last up to 2 years. You need a huge deposit for such drawdowns. We risk a loss of 300pts*1000 times, and we get 5 on average. Which will add up.

With a profit of 5 pts, it would be good to risk 50-100 pts, but there is a flat (almost straight) line down.

No normal predictors for TP/SL to give at least 0.00020 per trade.

Also looking for new chips and targets.I've mostly experimented with TP/SL so far. Just in pips or from volatility, so that at night I don't put the same TP/SL as during the day.

The markup for the teacher is easy to do. Trades often.

But still the same 50/50 at best with a slight edge. I.e. 0,00005 from a deal can be obtained.

But slippages are not taken into account at all, spreads are taken into account, but they are known only minimum per bar, and in reality will be more. Swaps. All of the above will eat up this measly 0.00005.

All this at TP/SL 300...500, i.e. drawdowns are huge up to 1000 losses in a row if on M5. Drawdowns last up to 2 years. You need a huge deposit for such drawdowns. We risk a loss of 300pts*1000 times, and we get an average of 5. Which will add up.

With a profit of 5 pts, it would be good to risk 50-100 pts, but there is a flat (almost straight) line down.

No normal predictors for TP/SL to give at least 0.00020 per trade.

Also looking for new chips and targets.I think that it is more difficult to train a model that answers the question "how the price will move" than to answer the question "where the price will go". Accordingly, having defined the boundaries to which the price is more likely to reach or not, you need to choose a strategy. I think that the horizon should be "till the end of the day" with 3-5 control points (different models ?) which are activated either by event or by time. Having a general expected plan for the day and you can trade, maybe then a big stop loss will be justified.

I think it is more difficult to train a model that answers the question "how will the price move" than to answer the question "where will the price go". Accordingly, having determined the boundaries to which the price is more likely to reach or not, you should choose a strategy. I think that the horizon should be "till the end of the day" with 3-5 control points (different models ?) which are activated either by event or by time. Having a general expected plan for the day and you can trade, maybe then a big stop loss will be justified.

Not only is the SL big there, the TP=SL. Or close to it.

Not only is SL big there, TP=SL. Or close to it.

I am talking about this approach (look at the picture below), there is an area of uncertainty - marked in red here, there are levels 23,6 - at these levels a signal is generated and the model should decide whether the price will reach the level 61,8 or not, stop at reaching the zero level (opening price of the day).

I am talking about this approach (look at the picture below), there is an area of uncertainty - marked in red here, there are levels 23,6 - at these levels a signal is generated and the model should decide whether the price will reach the level of 61,8 or not, stop at reaching the zero level (opening price of the day).

I prefer easier targets. I mark TP/SL for each bar. The model itself decides which ones it can successfully trade.

Simpler targets - as you say - do not work.

It just turns out that the nearest transition bar will be classified negatively, and the next one positively - and the predictors will not change much during this time, which complicates the training.

That's the approach I'm taking,

shift the design to the right by 5-6 hours (or how many hours you get) for minimum volumes - just 0:00 on the server does not mean anything at all, and there is a reasonable reference point there

shift the design to the right by 5-6 hours (or how many hours you get) for minimum volumes - just 0:00 on the server does not mean anything at all, and there is a reasonable reference point there

I have different observations.

I have a different observation.

and these are not personal observations :-) it is mathematics and statistics. calculate the optimal location of the diagonal grid and its nodes will "lie" exactly so

and these are not personal observations :-) this is maths and statistics. calculate the optimal location of the diagonal grid and its nodes will "lie" just like that.

I'm even curious, how do I calculate it?