Please do some research on how leverage works and how the margin requirements are calculated and applied.

Also learn about free margin, deposit load, margin call-out and margin stop-out.

These concepts are part of the trading basics that all traders should know and learn about.

Search the web as there are many websites that offer free lessons on these trading basics.

ok, found some useful info from the links above.

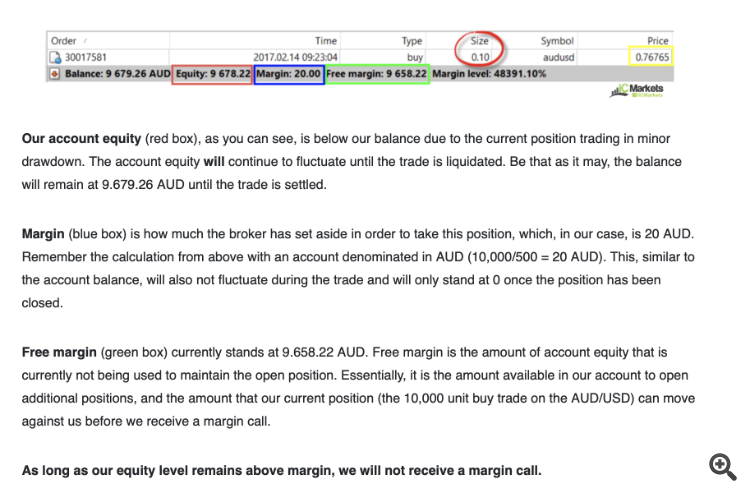

With a deposit $300 lets assume you have some open positions with your total margin as 552.42 USD and your positions are $400 in profit

Therefore:

Equity =$300+400 = $700(Equity is your account balance plus the floating profit/loss of your open positions)

Free margin =700-552.42 =147.58

3.Margin level is the ratio of equity to margin:

Margin Level = (Equity / Margin) x 100

So: 700/552.42 * 100

- www.mql5.com

Posting final comment here for myself and others to save time, this link provides a nice summary

- 2017.02.24

- www.icmarkets.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Greetings,

Trying to understand the meaning behind the number in the backtest results for Margin Level %.

At what level would it be considered a 'bad thing", ie, being margin called in possible future live trading?

For example, some of my backtests show this level at 419%, other times it is 1765%. I have no clue what this value means.

I'd appreciate any comments.

Thanks