EURUSD Technical Analysis 2015, 26.04 - 03.05: This is key week - Brearish or Bullish? Reversal breakout continuing or bearish breakdown to be started

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.24 05:52

EUR/USD, USD/JPY - Goldman Sachs (based on fxnews article)

Goldman Sachs updates its outlook on EUR/USD and USD/JPY noticing that the latest messages form the ECB and BoJ seem to be 'lost in translation'. The following are the key points in GS' note along with its latest forecasts for EUR/USD and USD/JPY.

1- "When central banks are implementing QE – as the ECB and Bank of Japan clearly are – they deliver two basic messages. First, they comment on whether the current pace of asset purchases is still appropriate and, when it isn’t, they provide more accommodation, as the BoJ did in October. Second, because QE is controversial, they sing the praises of asset purchases, pointing to rising inflation expectations and an improving growth picture," GS argues.

2- "We think this is what happened towards the end of the ECB press conference on Apr. 15, when President Draghi made favorable comments on the inflation and growth picture. The market heard exit, but in our view this is a clear case of “lost in translation." GS adds.

3- "After all, President Draghi earlier in the press conference argued forcefully that focus on early exit is premature and that having this debate now is like “quitting a marathon after 1k.” Our European economists continue to expect “full implementation” of ECB QE, meaning an unchanged pace of asset purchases through at least Sep. 2016. This is key to our view that a cyclical recovery in the Euro zone is not a force for EUR/USD higher," GS clarifies.

4- "There was more “lost in translation” in Governor Kuroda’s speech on Apr. 19. The market picked up headlines that “the underlying trend of inflation has improved markedly,” but the more important message in the speech, in our opinion, is that low inflation momentum is threatening to pull inflation expectations lower (Exhibit 4), which will then set the stage for additional monetary easing," GS notes.

5 "Our Japan Chief Economist forecasts additional stimulus for July by way of duration extension of JGB purchases (akin to "Operation Twist" in the US). Given how small speculative long $/JPY positioning now is, we think there is room for the market to catch up with real story in Japan, which is that another round of monetary easing is coming," GS adds.

GS targets EUR/USD at 1.00 in 6-months and USD/JPY at 125 over the same end of period.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.25 09:17

The Biggest EURUSD Resistance Test of the Year ( based on dailyfx article)

“EURUSD rolled over at slope resistance but several longer term technical observations are worthy of note; the rate found low at an important long term level (line off of 2008 and 2010 lows) and the ownership profile (as per COT) is at a record. The speculative crowd has never been more bearish…ever. Such conditions typically precede important reversals…although not necessarily right away. A break above the resistance lines (old support) would indicate that behavior has significantly changed and open up a run on 1.13.” It is decision time traders.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.27 14:26

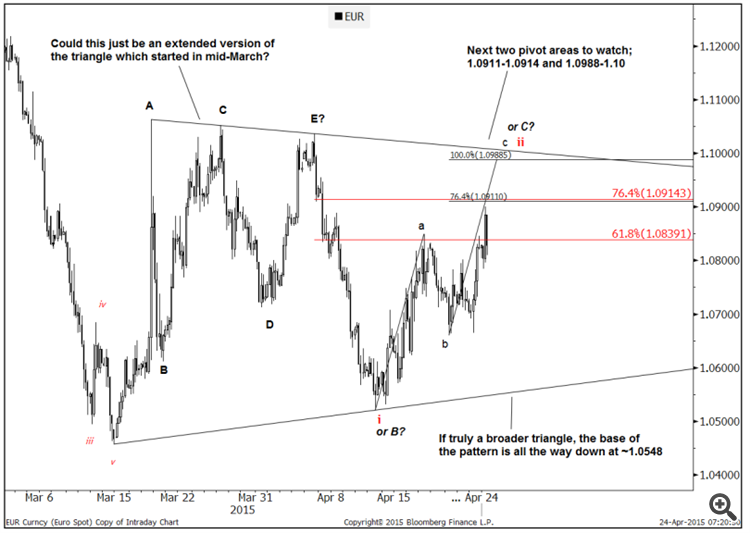

A Goldman Sachs EUR/USD Elliot Wave view (based on forexlive article)

"The market came close to testing 1.0911-1.0914 - 76.4% retrace of the Apr. 6th/13th drop and 76.4% of the swing target from Apr. 13th:

- The break opens topside risks to 1.0988-1.10 which includes the full extension from Apr. 13th and the trend across the highs since Mar. 18th.

- While it's still possible that this is wave ii of a v wave from the Apr. 6th high, it's also worth considering whether this is a broader, extended version of a triangle that started in mid-March (perhaps we were pre-mature in chasing the break-out?).

- If this is true, would really need a break below the Mar. 15th/Apr. 13th trendline (triangle support) to confirm that the next leg lower is taking place. This comes in all the way down at 1.0548."

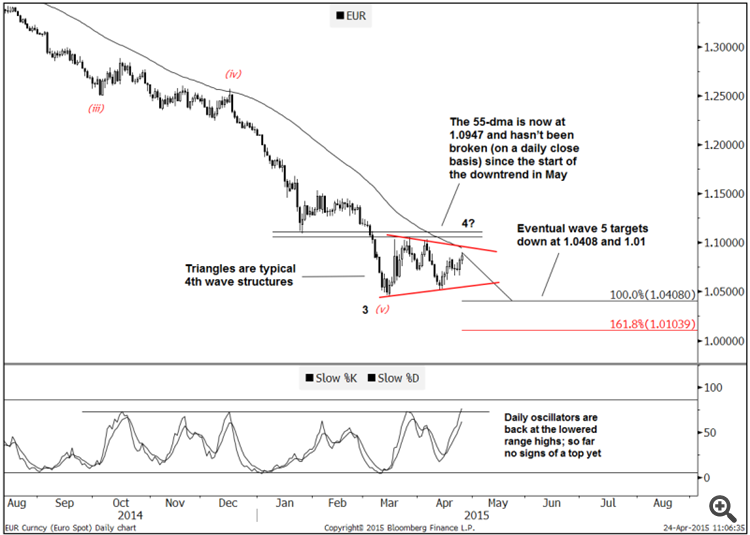

"If this is truly a wider/extended triangle,

then it suits the underlying view that there is still one last leg lower

to complete the 5-wave decline

- Taking

a 1.618 extension target from the May '14 high and projecting it off of

current levels implies that wave 5 could go roughly to ~1.01.

- At the same time, this might also mean that there is room to see further sideways/choppy price action.

- It

is however worth highlighting that the 55-dma is now at 1.0947 and

hasn't been broken (on a daily close basis) since May '14 (at the start

of the downtrend).

- The other

thing to note is that daily oscillators are near to the top of their

recent range (implying potential for an imminent turn)."

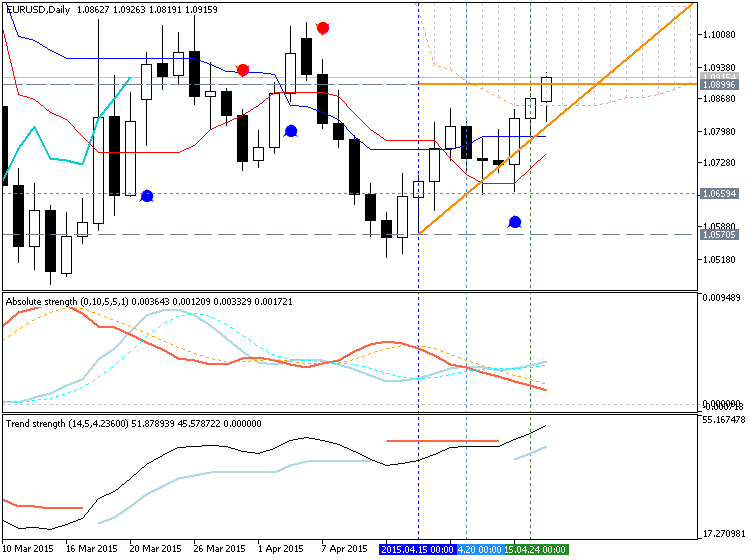

- New daily bar was open above 1.0848 resistance and Sinkou Span A line was crossed by close bar.

- D1 price is inside Ichimoku cloud

- New resistance is 1.0899

This is reversal from the primary bearish to the bullish market condition with the secondary ranging.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.26 13:01

EURUSD forecast for the week of April 27, 2015, Technical Analysis (based on fxempire article)

The EURUSD pair

initially fell during the course of the week but found enough support

to turn things back around and form a hammer. However, we recognize that

the 1.10 level above is still resistive, so therefore it’s difficult to

take a longer-term trade. In fact, we are comfortable with longer-term

trades until we are well above the 1.15 level, which is something that

we are obviously not going to see anytime soon. With that, we remain on

the sidelines as far as long-term trades are concerned, but will pay

attention to the shorter-term daily chart.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.28 14:12

EUR/USD Testing Resistance (based on investing.com article)

EURUSD: Seeking the high 1.09s before down. The near-term grind higher is still on; now testing resistance at the low end of the descending 55 day exponentially weighted moving average band (1.09151.1035). While short-term dynamic support at the flat "Kijun-Sen" (1.0775) remains intact additional gains into the high-1.09s is the best fit. but once there look for near-term bearish signals to take advantage of. Current intraday stretches are located at 1.0790 and 1.0955.

Spot gold: On the lookout for a +$1,211 break. The biggest single-day gainer since late Jan must count for something.It now looks quite clear that the decline from the early Apr high of 1,224 is, or rather was,a correctional descent. All that is needed now is a +1.211 break to confirm this and to allow extension to and through resistance at 1,22426. A short-term "Equality point" hints that 1.257 is the next attraction/resistance to align aim at. Current intraday stretches are located at 1,185 and 1,209.

Brent Crude: Could recheck the $62-level before. The short-term bullish wave structure remains incomplete though it is still valid. If the recent sellers' response leads to near-term bearish initiative below mid-body support at 63.90; pencil in decline closer to dynamic support, now starting at 62.00. A sub-60.70 overlap is however not ideally wished for since it would complicate the wave count more.

S&P500: Bearish print on top. The short-term "equality point" at 2,121 held buyers at bay with sellers' response being strong there. The bearish print as a result points lower near-term (with short-term momentum indicators running at rich levels indicating an overstretch) and the ascending 8 day "Tenkan-Sen", now at 2,092, could be retested - but a buyers' response there (or no later than at 2,080) is likely. Current intraday stretches are located at 2,090 and 2,121.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.28 18:02

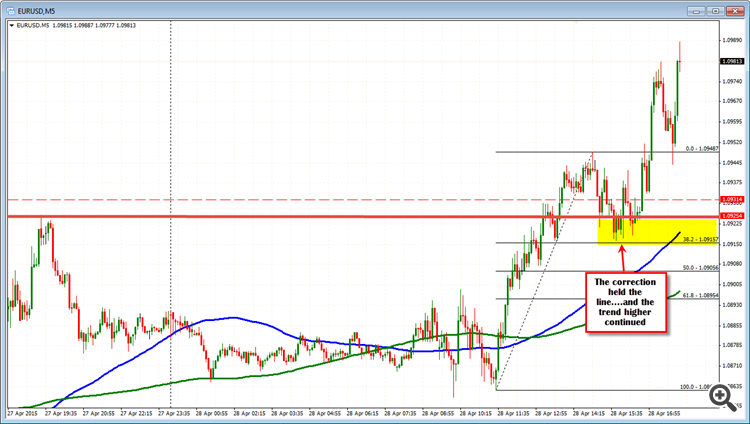

EURUSD extends above next hurdle. What next? (based on forexlive article)

The EURUSD had a bit of up and down time of it as the NY session got underway, but the support level held (see earlier post) against the 1.0915-25 area.

The range for the day (was 91 pips earlier) is now at 130 pips. The average trading range over the last 22 days is 131 pips. So we have reached the average. That does not stop the market from going higher but it can make additional moves more difficult. Traders who are long, can take partial profit against the 1.1000 level. If we do get a break, however, there will likely be stops as the squeeze continues. The next target would be at 1.1025-35 area where highs from April 3 and April 9th stalled (and March 24th as well - see chart below). The high on March 25 peaked at 1.1051.

sdsd

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.29 08:36

EUR/USD Forecast April 29, 2015, Technical Analysis (based on fxempire article)

The EUR/USD pair broke higher during the course of the session on Tuesday, heading towards the 1.10 level. This is an area that we should see quite a bit of resistance at, and with the Federal Reserve having its interest-rate announcement and more importantly, the interest rate statement during the session today, it’s very likely that we will have a catalyst for the next move in this pair. Because of this, we believe that it’s only a matter of time before the sellers step in, but we recognize that a move above the 1.12 level would change everything. It is very possible that we get some type of extraordinary move during the session. We believe this move will dictate where the market goes next.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.29 14:48

2015-04-29 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]- past data is 2.2%

- forecast data is 1.1%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

"Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 0.2 percent in the first quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.

The Bureau emphasized that the first-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see the box on page 3 and "Comparisons of Revisions to GDP" on page 5). The "second" estimate for the first quarter, based on more complete data, will be released on May 29, 2015.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE) and private inventory investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 65 pips price movement by USD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.29 21:00

Federal Reserve policymakers see weakness in US economy (based on afr.com article)

The Federal Reserve pointed to weakness in the US labour market and economy, in a sign that the central bank is struggling to proceed with its plans to raise interest rates this year.

"The committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labour market and is reasonably confident that inflation will move back to its 2 per cent objective over the medium term," the Fed said in its statement, following a two-day meeting of its policy-setting committee.

ECONOMY:

April: The Fed has taken a gloomier view of the economy: "Economic growth slowed during the winter months, in part reflecting transitory factors. The pace of job gains moderated ... Growth in household spending declined."

March: "Information received since the (Fed) met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 72 pips price movemment by USD - Federal Funds Rate news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

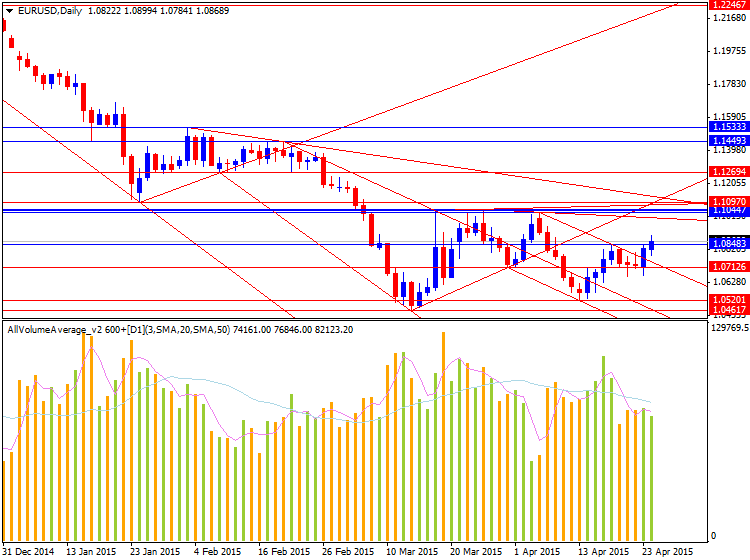

The price was on bearish ranging market condition with the secondary market rally which was started in the end of last week. Daily EURUSD price is breaking 1.0848 resistance level and Sinkou Span A line for the reversal of the price movement from the primary bearish to the bullish market condition.

D1 price is on primary bearish with secondary bear market rally with good possibility to reversal:

W1 price is on bearish market condition with secondary ranging between 1.0461 (W1) support level and 1.1051 & 1.1395 (W1) resistance levels

MN price is on bearish breakdown with 1.0461 support level

If D1 price will break 1.0531 support level on close D1 bar so the primary bearish will be continuing

If D1 price will break 1.0848 resistance level so we may see the reversal to the primary bullish condition with secondary ranging (the price will be inside Ichimoku cloud/kumo in this case)

If not so the price will be ranging between 1.0848 and 1.0531 levels with primary bearish

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-04-27 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German Import Prices]

2015-04-28 15:00 GMT (or 17:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2015-04-29 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]

2015-04-29 19:30 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]

2015-04-30 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German Retail Sales]

2015-04-30 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Spanish CPI]

2015-04-30 08:55 GMT (or 10:55 MQ MT5 time) | [EUR - German Unemployment Change]

2015-04-30 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2015-04-30 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-05-01 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2015-05-01 15:00 GMT (or 17:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : ranging

TREND : bear market rally