You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.02 05:48

EURUSD Continues to Carve Lower-Highs; 1.0710 Near-Term Support (based on dailyfx article)

EURUSD Under Pressure Amid Greek Headlines; Downward Trending Channel in Focus.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.02 12:03

NFP Expectations for April (based on dailyfx article)

- NFP is historically a volatile event

- Last month’s miss caused the EURUSD to decline over 118 pips

- Expectations for this Friday sit at 248k

NFP (Non-Farm Payrolls) figures are released monthly and is one of the markets most highly anticipated events. This event tracks monthly changes in employment in the United States, and gives traders a glimpse into the health of the economy. Also, it should not be overlooked that the FED (Federal Reserve) looks to these employment numbers to influence their decisions regarding monetary policy.Below we can see a series of the 12 previous NFP totals graphically displayed. While these numbers have been mixed, it is important to see what effects they can have on the Forex market. So how can NFP affect the market, and what are the expectations for Friday’s event?

The previous NFP event transpired last month on March 6th. To review, expectations were set at 235k, but on release the figures surprised the market. As seen in the graph above, the total amount of new jobs outside of the agricultural sector came in at 293k. This beat of expectations quickly drove traders to accumulate the US Dollar against the majority of major currencies.

Below we can see the price action for the EURUSD during the March NFP event using a 30 minute chart. Immediately after the announcement, prices formed a new lower high for the week at 1.0988. This rise in price only lasted seconds, as traders began to accumulate US Dollars on the news. This caused prices to drop as much as 118 pips over the next 30 minutes. Not only did the EURUSD decline for the day, this event caused the EURUSD to continue its trend and form a new monthly low in the following trading week.

So what can we expect for Fridays trading?

The next NFP event is set for this Friday April, 3rd at 8:30 am New York time. After reviewing last month’s release, it makes sense for traders to be on their guard for unexpected volatility at this time. Currently expectations are set for 248k. Traders should primarily focus on whether or not NFP beats or misses expectations. By using last month as a model, a beat above expectations could cause another major US Dollar rally. Conversely, if prices miss expectations, it could signal a sell off for the US Dollar against other Major G8 currencies.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.04.03

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 143 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.02 18:45

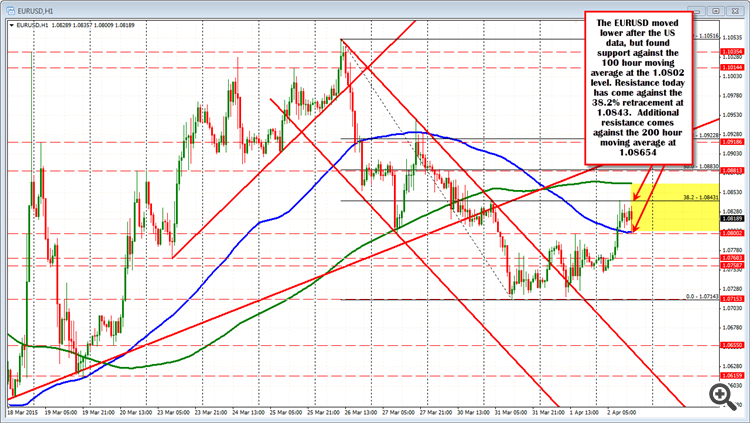

EURUSD falls on better US data but finds support (based on forexlive article)

The EURUSD is down testing the 100 hour moving average (at 1.0802) after the better-than-expected US trade data and weekly initial jobless claims.

The pair is nevertheless finding support buyers against the 100 hour moving average (blue line in the chart above at 1.0802).In the earlier rally today, the pair held resistance against the 38.2% retracement of the move down from the January 25 high to the low reached on Tuesday. That level comes in at 1.0843 and that was the high price for trading today.

With the pair trading between support and resistance from a technical perspective, I would expect that the market will simply lean against the level with stops on breaks. On a move higher the next target will look toward the 200 hour MA ( green line in the chart above). That level comes in at 1.08654 currently.

On a move lower, the 1.0759 – 68 area will be eyed. The 1.0768 level was the spring low going back to March 23. The 1.0759 level was the low going way back to September 2003 (a blast from the past).

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.04 07:58

EURUSD Technical Analysis (based on dailyfx article)