In general: the right signal is a signal whose guidance brings profits of any size.

Then combining the "profitability" area of several indicators can lead to "unprofitability" of the TS as a whole. This is not the same as "3. Incorrect combining of several good indicators will not improve system performance". imho.

This means that one good indicator works against another in the same system. Its signal must be inverted to improve the system, although it is not certain that this will improve it.

А теперь серьёзно, пока - простая математика:

-

Пример №1:

Есть 2 индикатора, каждый даёт 60% правильных сигналов. Результат применения

их обоих по системе "И" - это 36% правильных сигналов и 64% неправильных.

Соотношение (правильных\неправильных) = 36\64=0.562 (56,2%)

Your maths is wrong)

The result of applying both of them to the AND system is

36% of correct signals and 0.4*0.4 - 16% of incorrect signals.In other cases there will be no signal/transaction.

Ratio (right / wrong) = 36 / 16 = 2.25 (69.2% of profitable trades)

etc.

The conclusion: 1. You cannot use an indicator with less than 50% of correct signals in an Expert Advisor.

But that's the theory; in practice, it's much worse.)

неправильная у Вас математика)

Результат применения их обоих по системе "И" - это

36% правильных сигналов и 0,4*0,4 - 16% неправильных.в остальных случаях сигнала/сделки не будет.

Соотношение (правильных\неправильных) = 36\16=2,25 (69,2% прибыльных сделок)

и т.д.

вывод: 1. Нельзя использовать в советнике индикатор с менее 50% правильных сигналов.

Но это таки теория, на практике всё значительно хуже))

This is the correct mathematics.

Richie, your error in the calculation is that in calculating the probability you use as a priori knowledge of the signal (i.e. whether it is correct or not), which may in fact only be available post hoc, or, scientifically speaking, a posteriori. Hence the wrong conclusion.

Swan, you make a good point. That's exactly what most traders think. Only when each of the 2

Inductors give the right signal, the signal is considered to be correct. And that means the correct signal will be 36%.

Incorrect ones are all the rest, i.e. 100-36%=64%, not 16%. 16% is the "wrong" ones and it's definitely not

to be guided by. And in practice, of course, everything is much worse.

Of course, you cannot use an indicator with <50% in an EA, unless you invert it.

alsu,that's what I'm saying, it's just simple maths for now.

If we translate "correctness" into probability - then multiplying their "signals", what does that tell us?

;)

One lies with a 50% probability, the other 40%.

Together they lie at 20%.

:)))))

But - correctly predict 0.5x0.6 = 0.30.

Total correctly predicted by 30%.

---

Isn't that right?

only 50% is missing... :(

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Teddy Bear: I'm guessing on a honey jar lid;

Bunny: I'm guessing on a carrot;

Wolf: You're all fools, I've been guessing on a fox's tail for six months;

Woodpecker: Only idiots don't guess on termites;

Penguin: You can only guess on leeches, but most importantly, you must not guess on Fridays;

Owl: Citizens, let's put it all in one black box, stir it up and guess on it all together.

Wolf: You're an idiot, Philip, how can you put my favourite fox-tail in one box with leeches?

Bear: No, I won't give my jar lid to anyone.

Bunny: One carrot is good for guessing, but you'd better use two carrots of different sizes,

When they overlap, you have to buy them, when they are apart, you have to sell them.

-

-

Now seriously, for now - simple maths:

-

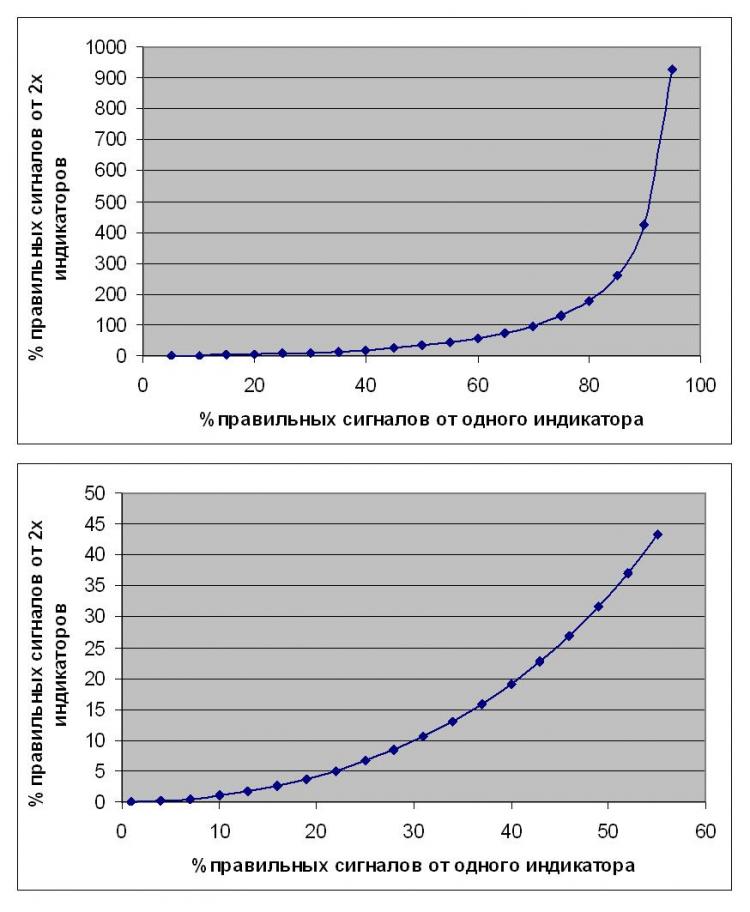

Example #1:

There are 2 indicators, each giving 60% correct signals. The result of applying

to both of them using the "AND" system is 36% correct signals and 64% incorrect signals.

Ratio (correct/incorrect) = 36\64=0.562 (56.2%)

-

Example #2:

There are 2 indicators, each giving 50% of correct signals. The result of applying

to both of them using the "AND" system is 25% correct signals and 75% incorrect signals.

Ratio (correct/incorrect) = 25\75=0.333 (33.3%)

-

Example #3:

There are 2 indicators, each giving 40% of correct signals. The result of applying

to both of them using the "AND" system is 16% correct signals and 84% incorrect signals.

Ratio (correct/incorrect) = 16\84=0.190 (19.0%)

-

And hence the conclusions:

-

1. Do not combine a good indicator with a bad one, adding a bad one will not bring better results;

2. You should not combine several bad indicators in an EA, it will be even worse;

3. Incorrect combination of several good indicators will not improve system operation;