You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Vitalya_1983 thanks, poked a blind man. =) I'll give it a try.

Although the option with percentage is not ideal: the more profit will be achieved, the less will be fixed on the rollback.

And want the solution the topicstarter was talking about:

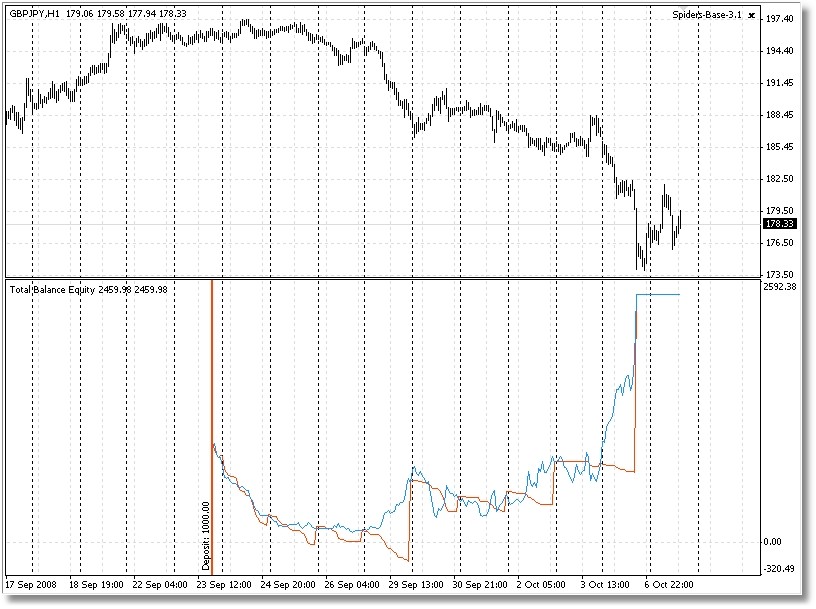

ЗЫ: вот собственно то, о чем говорил, про "на издохе движения", и как раз в такие моменты хорошо иметь тралл под рукой..

xrust - I have a suggestion to you - can you bring the code of your version of the equity trawl as a standalone EA.

It would be a very useful tool for hand traders.

I have been looking for such a tool for a long time but have not found anything suitable.

That would be great...

I will...

Сделаю...

Thanks in advance =)

>> I will...

Waiting ...

xrust - please give me a hint about the timeline.

Maybe someone has a ready solution and is willing, out of the goodness of his heart, to share it?

xrust - please give me a hint about the timeline.

Maybe someone has a solution and is kind enough to share it?

Thank you, we'll be testing...

Just a few suggestions:

1. Add indication: max. profit/losing profit;

2. If you want to add an option of trawl with a specified level in $, you can set not %, but distance from max profit to stop in money.

Let me try to explain the disadvantages of percentage approach: you have 20 positions with small lot - total profit for 24 hours brings $300. If we set, for example, 30% (in fact - any) level, then in case of pullback we will get $200 - $100 in passing. If we had a fix level, even 50, we would have 50$ more.

Someone may say: we would not get to 300 with a fixed level, but it is true with a small number of equally directed instruments. In the case of the packaged strategy the profit grows uniformly, without big drawdowns, and a serious change of the set character indicates a reversal. So, we should jump out of it, without waiting until the reversal (which is usually fast) eats a % of the passed.

Pardon the many gibberish, with the hope of "got it" ; )