The standard MetaTrader optimizer allows to select not only the backtesting period but also the forward testing -https://www.metatrader5.com/ru/terminal/help/algotrading/testing, its indicators are used by traders to select settings and make conclusions about the appropriateness of strategies.

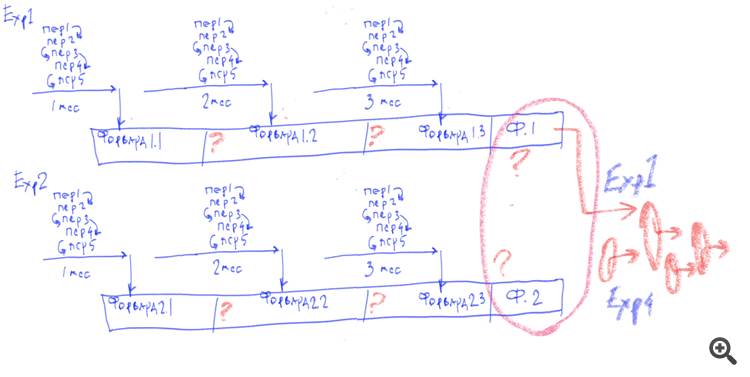

Well, how to automatically compare different forwards for different strategies in a situation when there are 12 consecutive forwards based on one strategy optimization results and 12 for another one?

And how are 12 consecutive forwards different from one common forward on the combined period of all 12 forwards?

If the strategies are in one EA, then they can be compared by the breakdown of the parameter that switches the strategy.

And in principle, if you want something more complex, write to service-desk with your proposals on what should be done and how it should be done. There may realize something, and leave something to be handled by your own improvised means.

And how are 12 consecutive forwards different from one common forward on the combined period of all 12 forwards?

Well, how do you automatically compare different forwards for different strategies against each other, moreover, in a situation where there are 12 consecutive forwards based on the results of one optimization and 12 based on the other?

I don't quite understand the problem. I've always done it in a simple way, for example: optimization for 2 months, test one month after optimization. I've accumulated data for a year and made a conclusion about algorithm efficiency. Basically all the functionality is there, I wrote down the basic data on the test in a notebook. If the system shows a stable plus on the forward, it is viable.

I automatically do exactly the same thing, but I get the result in the form of screenshots. So my task is -1. to learn to record data on forwards in a file, where they will be analyzed and processed as a whole for the year. 2. compare data for one year of two or more Expert Advisors 3. automatically select the most successful Expert Advisor in terms of forwards.

I.e. I can write a report, but each next report will overwrite the previous one. And I won't be able to get a general table. So far I have only thought of such an algorithm - at the end of each run forward report should be rewritten into a regular tester table and somehow pull out this data and form a separate table for processing all forwards.

In MT5 you can use OnTesterPass to process and record all results in your own files. MT4 has the TesterStatistics function available from OnTester.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I almost never see any analysis of the effectiveness of strategies and systems based on forwards.

What is it? Absence of tradition or avoiding unpleasant emotions?

If the absence of honest forwards in selling EAs can be somehow explained by the desire to sell the product, the emphasis on nice fitted charts in the working discussion cannot be explained by anything else but the desire to deceive. Moreover, there are even statements that the history of brokers cannot be trusted, it contains some "extra volatility" and other myths.

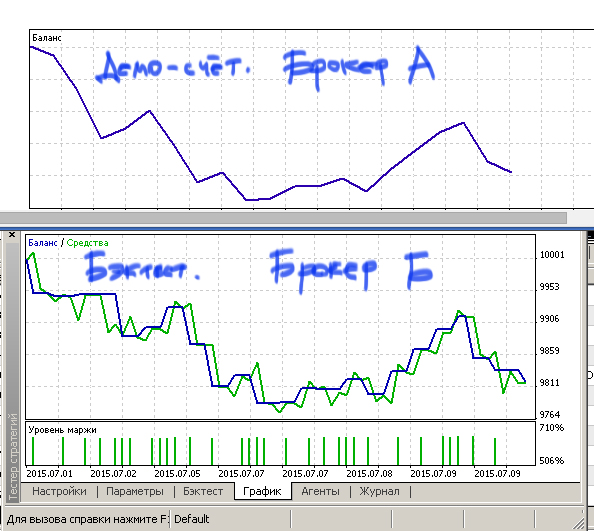

But the question is still valid - can forwards be trusted? The answer is clear - only to the extent that the trading simulation can be trusted, i.e. backtests in general. Everyone can do the simplest experiment - get the trading result on a demo account and run the same system with the same settings in the Strategy Tester within the same period. I.e. obtain a real and a test virtual forward and compare it. I have done it many times with different brokers and the result is always the same. Yes, there are differences, but they are not fundamental.

In fact, modeling of system behavior by running it on a non-optimized interval of history is the most efficient method of analysis for a trader. Reality check is of course the most reliable way, but unfortunately one has to live forever to go through all variants in real life. I.e. modelling like forward to the past is the most effective way of research. But then why are forwards completely absent from the discussions? Maybe it's because there is no handy software for processing and analyzing results of multiple tests, both back and forwards?

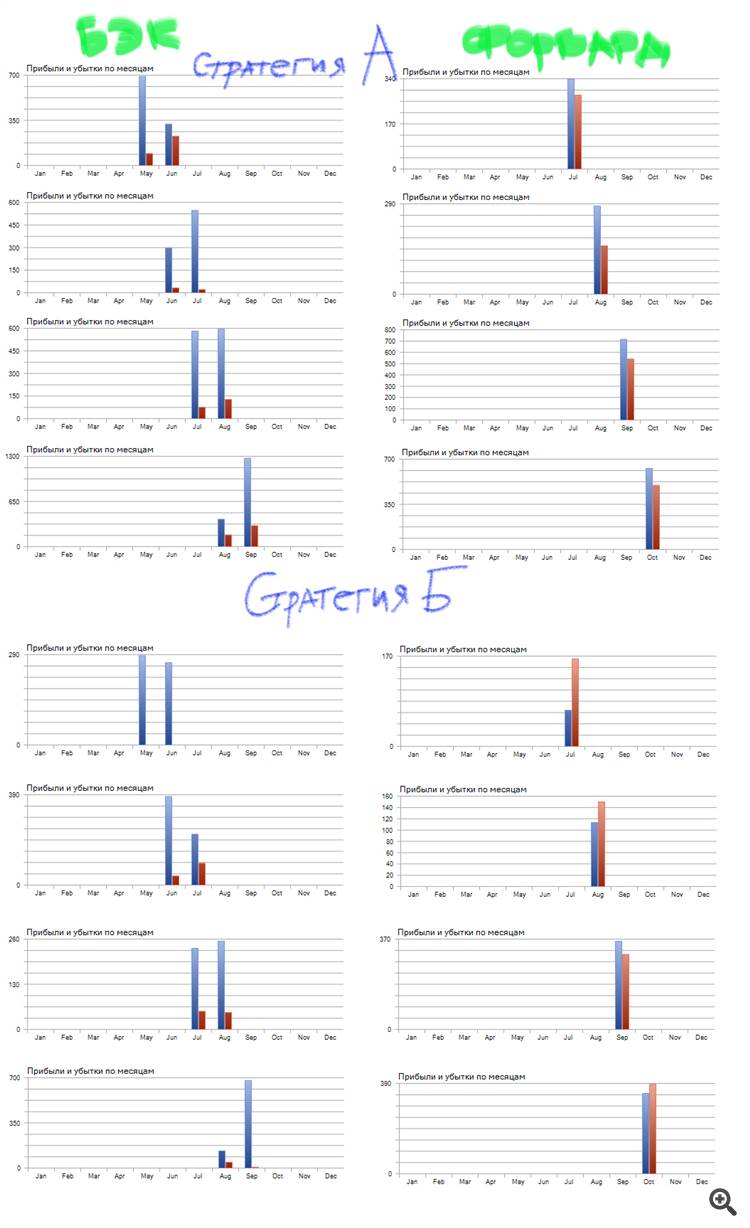

For example - I took two similar strategies that are different by only one parameter, ran them through the autotester and manually gathered pictures.

It is immediately obvious that strategy B's backtest is even better, but it loses on the forward side. In other words, strategy A has better profitability inertia than strategy B. Which strategy is more suitable for trading? Clearly, the first one.

Besides, we can use forwards to find out the optimal testing periodicity and much more. But they are not trendy.

Does anybody know such programs? For example, can someone automatically and consistently put the test results for both back and forwards, at least in a table in Excel, for starters, ie create a history of a number of optimizations? Since this analysis of forwards and subsequent selection of strategies should already be automated, rather than by eye. I.e. automatic evolution of strategies can already be done now by very simple means.