Machine learning in trading: theory, models, practice and algo-trading - page 3032

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

who cares how to maximise balance, there are 100 ways to do it....

It's important to realise that this criterion is not enough, or it doesn't fit at all.

I don't want to maximise balance, but sustainability. I wonder how Mikhail does it.

One of the past variants - minimising the spread in the series of lots on the plots, the strategy was trained "in its entirety", with all possible actions (stop, trailing stop, exit, reversal), netting.

It did not go to the real because of "bugs" on forts.

Minimisation while maximising the number of trades, paradox.

One of the past variants - minimising the spread in the series of lots on the plots, the strategy was trained "in its entirety", with all possible actions (stop, trailing stop, exit, reversal), netting.

It did not go to the real because of "bugs" on Forts.

Minimisation while maximising the number of trades, paradox.

And what about the current variants?

Can you be more specific? Spread from what? From a straight line, as I suggested?

What about the current variants?

Let there be five plots (weeks, months)

1. variant of maximal consecutive loses 1/2/7/2/1 - only 13 min 1 max 7 spread 6

2. variant 3/4/3/4/3 - only 17 min 3 max 4 spread 1

the second is steeper and was trained to reduce the max, but even if this variant 7/8/7/8/7, it was preferred to the first and training pulled it out.

Current in coding, I will try it out maybe I will publish something.

Well, and accordingly the check on the out of the box that the max series does not go beyond the max series did not go out.

Let there be five plots (weeks, months)

1. variant of maximal consecutive loses 1/2/7/2/1 - only 13 min 1 max 7 spread 6

2. variant 3/4/3/4/3 - only 17 min 3 max 4 spread 1

the second is steeper and was trained to reduce the max, but even if this variant 7/8/7/8/7, it was preferable to the first and training pulled it out.

Current in coding, I will try it out maybe something will be published.

Well, and accordingly the check on the out of the box that the max series does not go beyond the max series did not go out.

Interesting approach.

In my opinion 7/8/7/8/7 (5 strong drawdowns) is worse than 1/2/7/2/1 (1 strong drawdown). But one should experiment too.

It seems to me that deviation from a straight line will automatically take everything into account. I read somewhere about such a method. Maybe in a book, maybe here on the forum.

It seems to me that the deviation from a straight line will automatically take everything into account. I read somewhere about such a method. Maybe in a book, maybe here on the forum.

Try this method - I have invented it now, it is a little different from mine (it is more difficult to justify :) ).

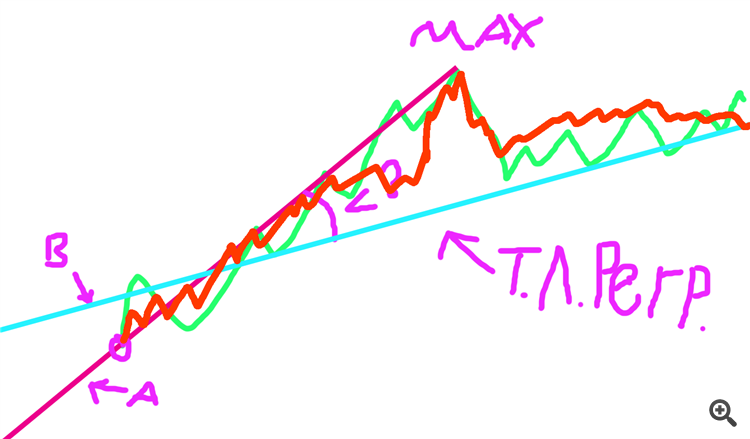

Line A is drawn from the beginning of the balance to the balance maximum.

Line B is the Linear Regression Trend line.

The task is to find the angle between the two lines. Or express the difference of the slope coefficient in the linear equation of two vectors through the coefficient.

If you solve it and put it in code, please share the function :)

Yes, note that the intersection can be left of the origin - even in negative coordinates :)

Here's a method you might try - I've just thought of it now, slightly different from mine (it's harder to justify :) )

Line A is drawn from the beginning of the balance to the balance maximum.

Line B is the Linear Regression Trend line.

The task is to find the angle between the two lines. Or express the difference of the slope coefficient in the linear equation of two vectors through the coefficient.

If you solve it and put it into code, please share the function :)

Yes, note that the intersection can be left of the origin - in negative coordinates even :)

Are you sure that the angle will mean the stability of the curve? Here's a less stable one under your maximum.

Or this more stable one:

Are you sure the angle will mean the curve is stable? Here's a less stable one for your maximum.

Or this more stable one:

Yes. The smaller the angle, the more stable the balance growth.

Yes. The smaller the angle, the more stable the balance growth.

Deviation of each point from a straight line is the obvious option. I'll keep it as my main one for now.

The conclusion is not obvious. Is there a proof like in geometry problems?

The deviation of each point from a straight line is the obvious option. I'll keep it as my main one for now.

The A-max line will always be above the regression line. The stronger the fluctuations of the trend line, the stronger the movement to 180 degrees (if the balance has not gone to loss) and further to 270, if the balance has gone to loss.

The comparison of the two angles allows us to assess the stability of the balance dynamics. It tells how much the price fluctuated relative to the conditionally linear growth of the balance. It is also possible to plan the expectation matrix, and build an ideal linear balance relative to it (what is not the target), and count the deviations in the same way.

The blue line is a new regression trend line.