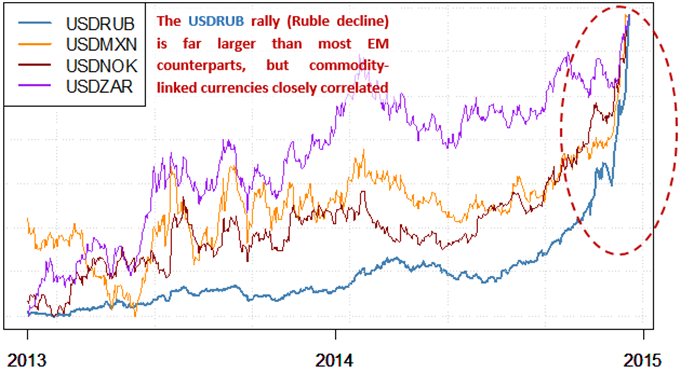

Ruble have had the biggest price % drop ( more than 55% ) the last 3 months.

The drop was due:

1. Collapse of oil and commodities prices. Russian budget assumed an average $100 per barrel price for 2014.

2. Sanctions from western countries to Russia due to the Crimea.

3. Inability of Russian Central Bank to control the Ruble effectively though interventions.

4. Russia Ecomony is entering a recession and expected to stay for at least 2 years.

In this topic we will update with news that are relevant to Russia Economy, Politics, and Energy price.

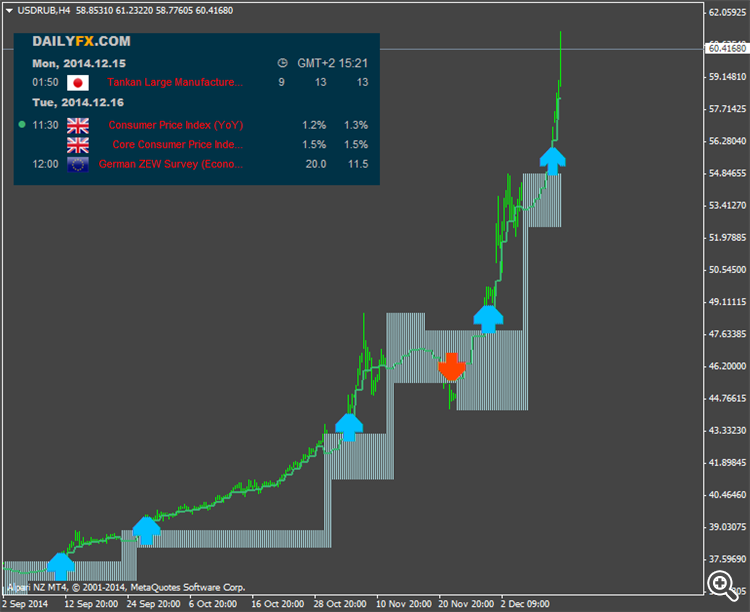

The situation with USD/RUB

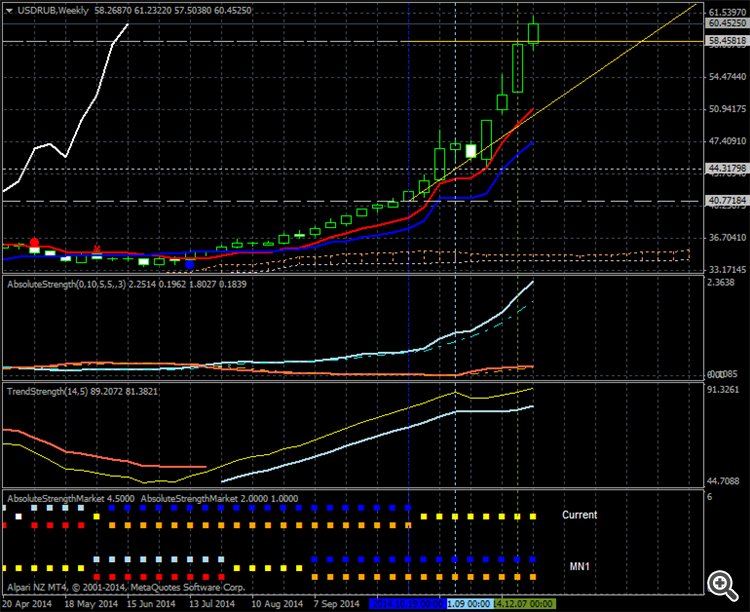

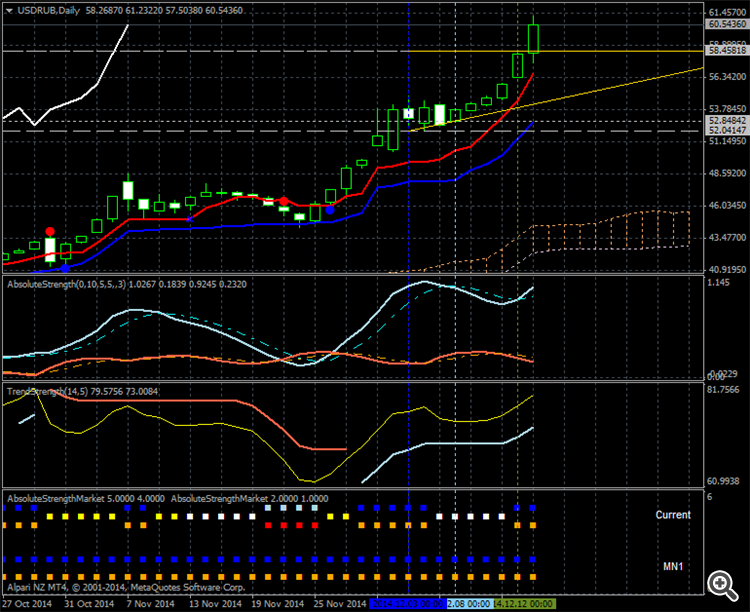

As we see on H4 timeframe - it is uptrend:

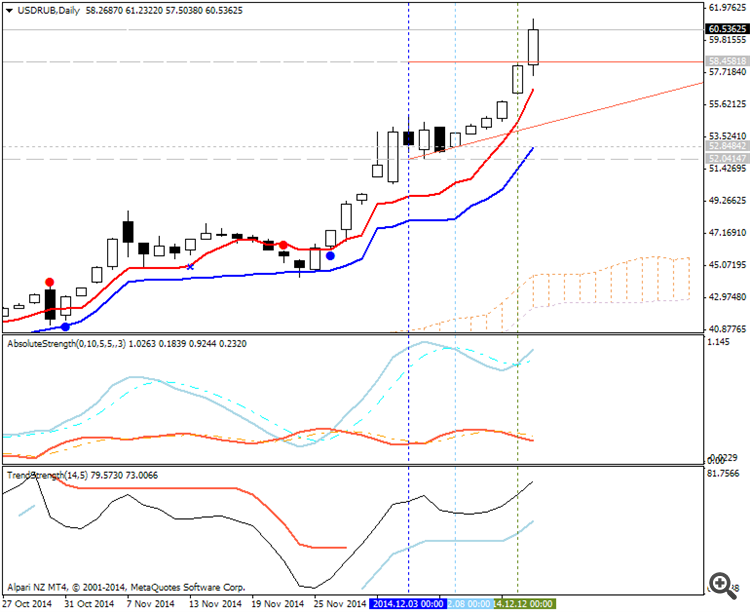

D1 timeframe

Price crossed 58.45 resistance level on open D1 bar. If the price will break this level on close bar (tomorrow) so we can expect the bullish trend to be continuing. Otherwise it will be correction within the primary bullish.

It was short term situation. Long term: W1 and MN1.

W1 - same resistance level and the price is breaking it on open bar. We should wait for this bar to be closed to be sure for this uptrend to be continuing:

Conclusion.

Just fundamental factors only can move this pair to be down for downtrend. It means - it should be something happened in the world for Russian Runle to be stronger compare with US Dollar for example.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.16 04:21

Russian Ruble Plummets and Here’s How We Might Trade the Clear Trend (based on dailyfx article)

- Russian Ruble plummets a remarkable 9+ percent versus US Dollar

- Central Bank of Russia Policy insufficient to stem Ruble sell-off, direction clear

- Further losses seem likely, but selling Ruble too risky as capital controls seem imminent

If the Central Bank of Russia is unable to stop

further USDRUB rallies via interest rate hikes and interventions, we

believe that the Russian government will effectively halt speculation on the domestic currency. This may admittedly seem hyperbolic and sensationalist, but already we’ve seen the CBR hike interest rates by 100bps at a time to a massive 10.5 percent

and most recently to 17 percent. Near-zero short-term interest rates in

the US Dollar and other major currencies should make investors more

than happy to receive 10 percent yields. And yet the Ruble rout

continues; it will be critical to see how markets react to the massive,

unexpected interest rate hike.

We believe the Euro seems especially at risk on further turmoil given economic links and geographical proximity to Russia—particularly as Western Europe and its allies leave Russia politically isolated. The Russian Crisis of 1998 was at the time the world’s largest sovereign credit default and its effects across broader markets were substantial.

Russia Defends Ruble With Biggest Rate Rise Since 1998

Russia took its biggest step yet to shore up the ruble and defuse the currency crisis threatening its stricken economy.

In a surprise announcement just before 1 a.m. in Moscow, the Russian central bank said it would raise its key interest rate to 17 percent from 10.5 percent, effective today. The move was the largest single increase since 1998, when Russian rates soared past 100 percent and the government defaulted on debt.

The news prompted an immediate gain in the ruble, with one-month ruble forwards up 1.6 percent in Asian trading.

Yet the announcement, as well as its timing, underscored the financial straits in which Russia now finds itself. If sustained, the new higher rates would squeeze an economy that is already being hurt by sanctions led by the U.S. and European Union, and by a collapse in oil prices. Some analysts said they doubted the economy could withstand such high rates for long.

“This move symbolizes the surrender of economic growth for the sake of preserving the financial system,” said Ian Hague, founding partner at New York-based Firebird Management LLC, which oversees about $1.1 billion, including Russian stocks. “It’s the right move to make, and it wasn’t easy to make it.”

So far this year, Russia has spent $80 billion of its foreign-exchange reserves in an unsuccessful attempt to prop up the ruble, which tumbled past 64 against the dollar for the first time yesterday. The currency’s collapse has evoked the turmoil of the 1998 Russian crisis, an event that reverberated through financial markets around the world.

Emergency Gathering

The Russian central bank announced the increase -- the sixth this year -- after policy makers gathered for an unscheduled meeting.

“This decision is aimed at limiting substantially increased ruble depreciation risks and inflation risks,” the central bank said in the statement. President Vladimir Putin, whose incursion into Ukraine’s Crimean peninsula in March prompted the U.S. and its allies to strike back with sanctions, this month called for “harsh” measures to deter currency speculators.

“While such drastic tightening measures will inflict more pain on the economy, we have been arguing for a while that it is not about preventing recession, but full-scale financial turmoil caused by the precipitous ruble fall,” said Piotr Matys, a currency strategist at Rabobank International in London.

Losing Value

The ruble lost 9.7 percent to 64.4455 per dollar yesterday, extending its plunge this year to 49 percent. Brent, the grade of oil traders look at for pricing Russia’s main export blend, slipped 79 cents, or 1.3 percent, to end the session at $61.06 a barrel on the London-based ICE Futures Europe exchange.

Russia derives about 50 percent of its budget revenue from oil and natural gas taxes. As much as a quarter of gross domestic product is linked to the energy industry, Moody’s Investors Service estimated in a Dec. 9 report.

The economy may shrink 4.5 percent to 4.7 percent next year, the most since 2009, if oil averages $60 a barrel under a “stress scenario,” the central bank said yesterday. Net capital outflow may reach $134 billion this year, more than double last year’s total.

“There is a feeling that this rate hike is unfortunately not going to be enough,” Nicholas Spiro, managing director of Spiro Sovereign Strategy in London. “Russia’s central bank has tried every trick in the book with exception of full-blown capital controls.”

Others were more optimistic, saying the action was big enough to arrest the ruble’s record decline. “The central bank is trying to stop the avalanche, and such a massive hike may be sufficient,” said Slava Breusov, an analyst at Alliance Bernstein in New York. “No one seems to be thinking what it will do to the economy, as the priority is to stop the ruble plunge.”

Even Russians Are Running From the Ruble

PARIS -- In recent weeks, the fall in the Russian ruble and Russian stock markets closely tracked the declines in global oil prices. But everything changed on Dec. 15. The oil price remained stable, but the ruble and the stock price indexes lost 30 percent from Monday morning to Tuesday afternoon. An unprecedented effort by Russia's Central Bank in the wee hours of Dec. 16 to stabilize the ruble, by hiking the interest rate from 10.5 percent to 17 percent, proved useless.

The cause of Russia's "Black Monday" was readily apparent: the government bailout of state-owned Rosneft, the country's largest oil company. Usually, bailouts calm markets, but this one recalled early post-Soviet experiments, when the Central Bank issued direct loans to enterprises -- invariably fueling higher inflation. The Central Bank's governor at the time, Viktor Gerashchenko, was once dubbed the world's worst central banker.

In 2014, the Central Bank is more constrained than it was in Gerashchenko's era: It cannot lend directly to firms. Yet it has also become more sophisticated at achieving the same ends that Gerashchenko sought.

Alpari uk email to clients regarding the ruble:

"USDRUB trades close-only

Please note that it’s not currently possible to open USDRUB trades across any of our platforms.

The lack of liquidity from our providers, due to extreme levels of volatility in the market, means that USDRUB traders are currently close-only.

We're always here to help, so if you have any questions please contact our Client Services team at"

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Ruble have had the biggest price % drop ( more than 55% ) the last 3 months.

The drop was due:

1. Collapse of oil and commodities prices. Russian budget assumed an average $100 per barrel price for 2014.

2. Sanctions from western countries to Russia due to the Crimea.

3. Inability of Russian Central Bank to control the Ruble effectively though interventions.

4. Russia Ecomony is entering a recession and expected to stay for at least 2 years.

In this topic we will update with news that are relevant to Russia Economy, Politics, and Energy price.