Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.10.31 17:02

Forex Weekly Outlook November 3-7US ISM Manufacturing PMI, rate decision in Australia, the UK and the Eurozone, Employment figures from New Zealand, Australia, Canada as well as important jobs data from the US with the all-important NFP report. These are the major market movers planned for this week. Check out these events on our weekly outlook.

Last week, The Federal Reserve ended its QE3 program with a vote of confidence in the US economic recovery. The ongoing improvement in the labor market, the economic expansion and the satisfactory inflation rate has made the decision to end the bond-buying program as almost foregone. Furthermore the advance GDP data released a day later showed the economy grew 3.5% in Q3 slightly better than forecasted, suggesting the US economy is marching forward. Will this trend continue in Q4?

- US ISM Manufacturing PMI: Monday, 14:00. The Manufacturing PMI declined to 56.6 in September after posting 59 points in August. The reading reached the lowest level since June and analysts expected a higher figure of 58.6.The New Orders Index fell short by 6.7 from the 66.7 release in August, still indicating growth in new orders. The Production Index reached 64.6, rising 0.1 above the August reading. The Employment Index expanded for the 15th consecutive month, registering 54.6, declining 3.5 points below the August reading. Overall the general trend remained positive. Another mild drop to 56.5 is expected this time.

- Australian rate decision: Tuesday, 2:30. The Reserve Bank of Australia kept the cash rate unchanged at 2.5%, in line with market forecast, but warned against weakening in the housing sector driven by the overpriced housing market. Global growth continued in a moderate pace, despite a recent slowdown in China’s growth. The Bank also cautioned against the strength of the Australian dollar, offering less assistance than would normally be expected in achieving balanced growth in the economy. However the general trend pointed to moderate growth in the coming quarters. No change in rates is anticipated.

- US Trade Balance: Tuesday, 12:30. The U.S. trade balance narrowed unexpectedly in August to $40.1 billion, reaching its smallest level in seven months. Economists expected a higher deficit of $41 billion. Exports rose by 0.2% to $198.5 billion in August, and imports gained 0.1% to $238.6 billion. Petroleum imports were weak but imports of capital goods soared to their highest on record. The U.S. trade balance is expected to reach $40.1 billion this time.

- NZ employment data: Tuesday, 20:45. Unemployment in New Zealand declined to its lowest level in more than five years, reaching 5.6% in the second quarter from 5.9% in the first three months of 2014. The reading was better than the 5.8% forecasted by analysts, however the participation rate declined to 68.9% from 69.3% in the first quarter. Nevertheless, the job market continues to grow rising 0.4% in the second quarter after expanding 0.9% in the previous quarter. The figures suggest that New Zealand’s job market is no longer a key concern for the country. New Zealand job market is expected to increase by 0.6% while the unemployment rate is expected to narrow again to 5.5%

- BOJ Governor Haruhiko Kuroda: Wednesday, 1:30. BOJ Governor Haruhiko Kuroda will speak in Tokyo. Japan’s inflation reached to its lowest pace in half a year, drifting further away from the Central Bank’s 2% target. Kuroda may give further explanations on the reasons behind the new stimulus measures issued at the end of October, earlier than expected.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. U.S. Private-sector employers increased hiring in September, adding 213,000 jobs, according to ADP payrolls processor. The 11,000 climb was better than the 207,000 rise predicted by economists. 88,000 jobs were created from small businesses, 48,000 jobs were created from medium sized businesses and 77,000 jobs were created from large businesses. The slowdown in August proved to be temporary after the NFP release posted strong gains. Us private sector is expected to add 214,000 jobs in October.

- US ISM Non-Manufacturing PMI: Wednesday. 14:00. Non-manufacturing Purchasing Managers Index declined to 58.6 in September, following 59.6 registered in August. The reading was broadly in line with market forecast, indicating that he service sector is advancing more rapidly than the manufacturing sector. Respondents commented that business activity cooled mildly in the past few months after posting strong growth, but they remain positive about the general trend of the economy. Non-Manufacturing PMI is predicted to reach 58.2 this time.

- Australian employment data: Thursday, 23:30. Australia’s Unemployment rate increased mildly in September amid an unexpected decline in. Australian job market contracted 29,700 jobs mainly in part-time work, lifting unemployment to 6.1% from 6.0% in August. The slowdown in employment coincides with the sharp drop in mining investment. The Reserve Bank of Australia faces a tough challenge whether to raise interest rates from a record low of 2.5% to help reduce rising house prices. However, such a move may increase interest rates could undermine growth and cause unemployment to rise. Australian job market is expected to gain 10,300 positions while the unemployment rate is expected to remain unchanged at 6.1%.

- UK rate decision: Thursday, 11:00. The Bank of England nine-member Monetary Policy Committee voted to maintain rates at 0.5%, despite rising calls for a rate hike. The BOE’s next move will be strongly dependent on the Eurozone central bank call. The current slowdown in Europe postposes all rate hike plans. Economists expect soft demand from Europe will keep the central bank on hold until 2015. Rates are expected to remain at 0.5% this time.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank kept its benchmark interest rate at 0.05% at its October meeting, following a 10 bps cut in the previous month. Furthermore, the Bank Policymakers decided to reveal their plan to buy asset-backed securities and covered bonds. These new moves are intended to stimulate financing bodies to expand loans to all sectors of the economy. The ECB also decided to increase its monetary policy accommodation to spur growth.

- US Unemployment claims: Thursday, 12:30. The number of new claims for unemployment benefits declined again last week, reaffirming the growth trend in the US job market. The 1,000 decline from the previous week was better than forecasted and the four-week moving average, fell again to 287,750, the lowest level since February 2006. Analysts have noted that claims have rarely remained low for such a long period. If the pace of firings will remain low, and hiring will continue, wage is expected to grow in the fourth quarter. The number of new jobless claims is expected to reach 285,000 this week.

- Canadian employment data: Friday, 12:30. Canadian private sector surged in September amid a job gain of 74,000 positions, the majority in full-time employment. The unexpected increase pushed the unemployment rate down two 6.8% from 7.0%, the lowest level in nearly six years. Economists expected a job addition of 18,700 with an unchanged unemployment rate. The rebound in full time positions indicates a positive trend in the Canadian job market. Canadian private labor market is expected to increase by 400 positions while the unemployment rate is predicted to remain at 6.8%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. U.S. employers increased hiring in September with a job gain of 248,000, pushing the jobless rate to a six-year low of 5.9%. The strong figures suggest the US economy is advancing with a steady job growth and fewer layoffs. Economists expected a smaller gain of 216,000 and no changes in the unemployment rate. The employment was broad based but the participation rate dropped to 62.7, the lowest level since 1978 and weak wage growth is another concern the Fed has to address. US job market is expected to gain 229,000 in October with no change in the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.02 08:19

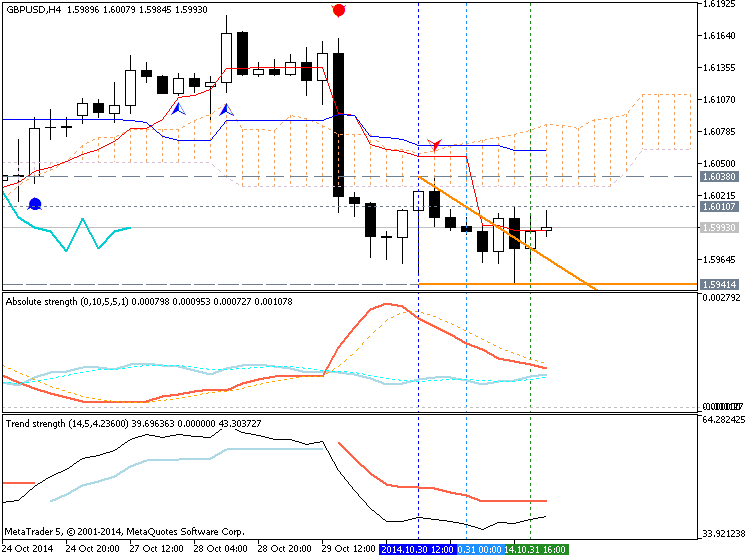

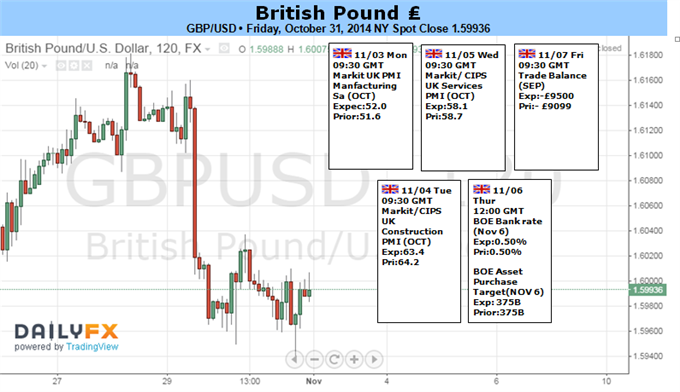

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: Neutral- Sterling finishes sharply lower versus US Dollar and targets fresh lows

- Bank of England Rate Decision threatens volatility on surprises, but watch US Dollar on NFPs

The British pound finished the week notably lower versus the resurgent

US Dollar, but a busy week of economic event risk ahead suggests the GBP/USD may see big moves and could very well stage a reversal.

Watch for any surprises out of an upcoming Bank of England Rate Decision

and/or the highly-anticipated US Nonfarm Payrolls report to drive the

lion’s share of Sterling/Dollar moves in the week ahead. Traders are

clearly preparing for big volatility across the major FX pairs as 1-week

volatility prices have hit their highest since the Scottish Referendum

vote in September.

We do not expect the Sterling will see the same level of turmoil on a

simple BoE rate announcement. Yet we need only look to the past week’s

Bank of Japan interest rate decision to see the effects of a truly

surprising central bank meeting. Analysts widely expect that the

Monetary Policy Committee will leave interest rates unchanged and

therefore produce no post-decision statement. To that end we’ll watch

earlier-week PMI figures to gauge sentiment ahead of next week’s Bank of

England Quarterly Inflation Report.

Beyond UK event risk it remains important to watch how the US Dollar and

British Pound start the new month. Through September it seemed as

though the US Currency was unstoppable as it hit fresh peaks against

almost all major counterparts. Yet the month of October brought

considerable consolidation. Late volatility suggests that November could

produce a material change in market conditions. And indeed historical

seasonality studies have shown that major currencies are more likely to

see important reversals at the beginning and end of a given calendar

period. Let’s watch and see how the Sterling starts to gauge whether a

more significant breakdown is likely.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.02 12:09

GBP/USD forecast for the week of November 3, 2014, Technical AnalysisThe GBP/USD pair initially tried to rally during the course of the week, but then turned back around to slam into the 1.60 handle. With that being said though, it looks as if we have plenty of support in this area, so we believe that the market will continue to bounce around in this general vicinity. If we get a break above the 1.62 level, we feel that this market should continue to go much higher, perhaps heading as high as 1.72 given enough time. We have no interest in selling until we get below the 1.5850 handle.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.05 05:04

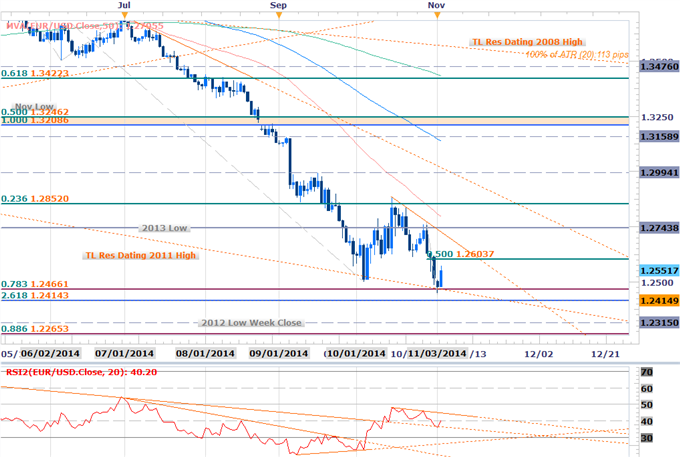

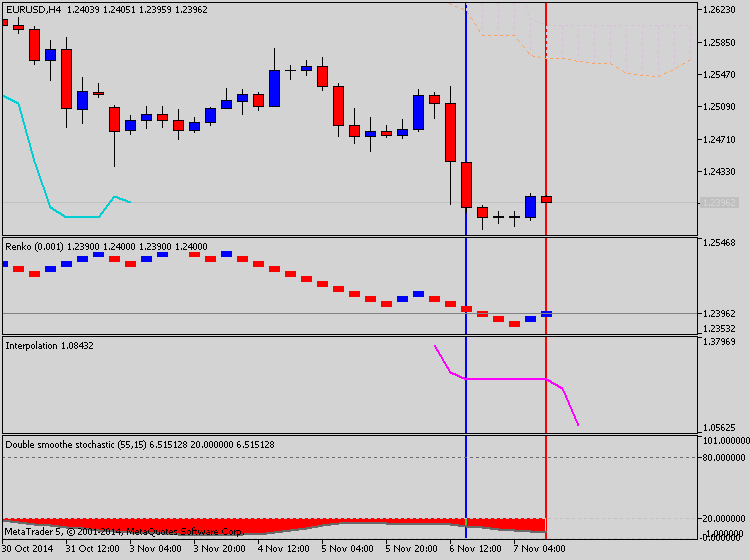

EURUSD Scalps Target 1.26 Ahead of ECB / NFPs (based on dailyfx article)

- EURUSD responds to long-dated trendline- immediate focus is higher

- Scalps target topside correction / short entries higher up

- EURUSD responds to 2011 trendline- Recovery shifts immediate focus is higher

- Broader downtrend remains intact sub-October trendline resistance

- Resistance (possible short entries) at 1.26, 1.2640 & 1.27

- Support objectives at 1.2466, 1.2414 & 1.2315

- Daily RSI divergence / former resistance-trigger now support- constructive

- Numerous resistance/support triggers pending

- Event Risk Ahead: Eurozone Retail Sales and US ADP Employment & ISM on Wednesday, ECB on Thursday, NFP on Friday

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.05 13:39

2014-11-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]- past data is 58.7

- forecast data is 58.5

- actual data is 56.2 according to the latest press release

if actual > forecast (or actual data) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

Nonetheless, companies recruited additional staff to the greatest degree in three months as capacity remained under some pressure, which was highlighted by a further increase in work outstanding.

The seasonally adjusted Business Activity Index posted 56.2 in October, down from 58.7 in September. Latest data marked the second successive monthly fall in the headline index, and October’s reading was the lowest recorded for 17 months, although the implied rate of growth remained above the average for over 18 years of data collection."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 56 pips price movement by GBP - Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.07 12:21

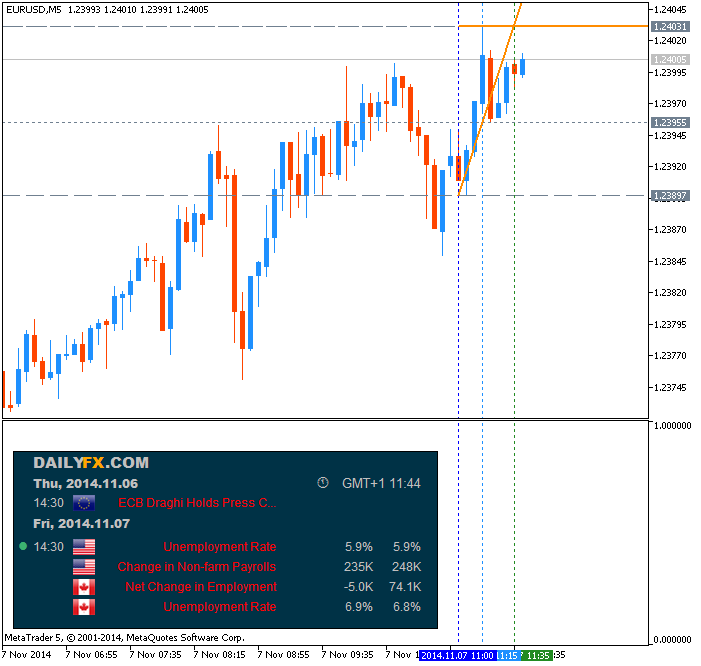

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

- U.S. Non-Farm Payrolls (NFP) to Expand 200+K for Eighth Time in 2014.

- Jobless Rate to Hold at 5.9% for Second Consecutive Month.

The U.S. Non-Farm Payrolls (NFP) report may generate a further decline

in the EUR/USD as market participants anticipate a pickup in job growth.

What’s Expected:

Why Is This Event Important:

At the same time, Average Hourly Earnings are also expected to uptick to

an annualized 2.1% from 2.0% in September, and stronger employment

paired with growing wage pressures should heighten the bullish sentiment

surrounding the greenback especially as the Federal Open Market

Committee (FOMC) moves away from its easing cycle.

How To Trade This Event Risk

Bullish USD Trade: NFPs Exceed Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

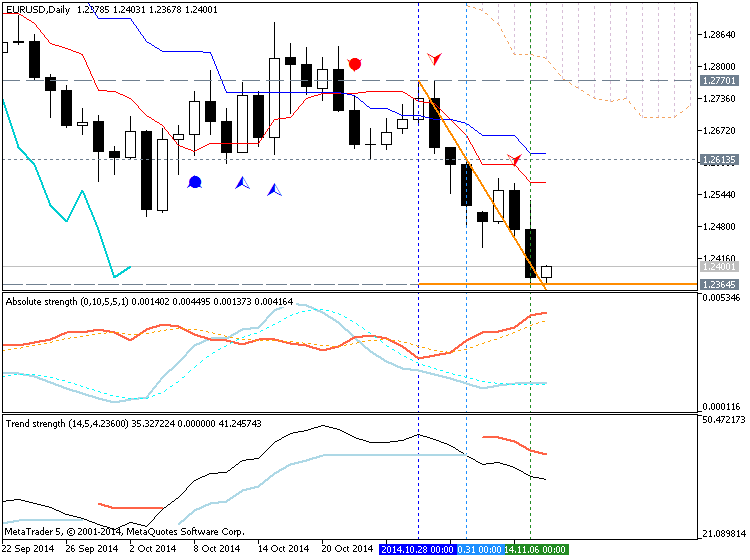

EUR/USD Daily Chart

- Will continue to look for lower highs/lows as the RSI retains the bearish momentum carried over from the end of 2013.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2625 (61.8% expansion)

- Interim Support: 1.2290 (100% expansion) to 1.2320 (38.2% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

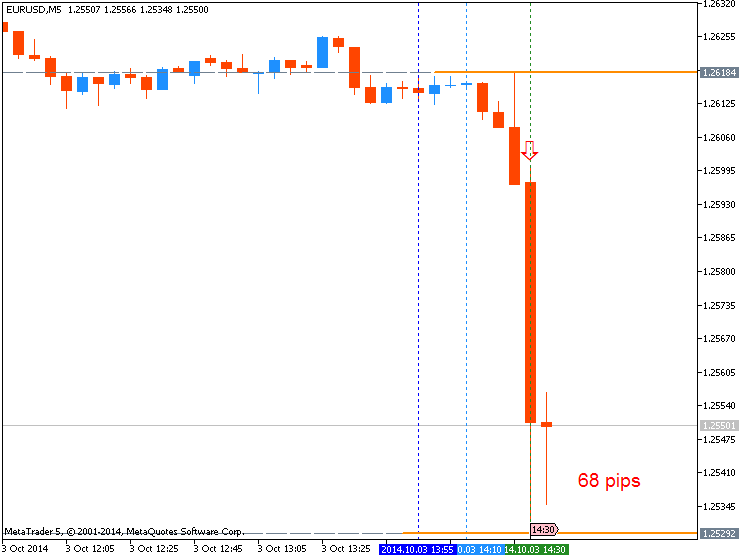

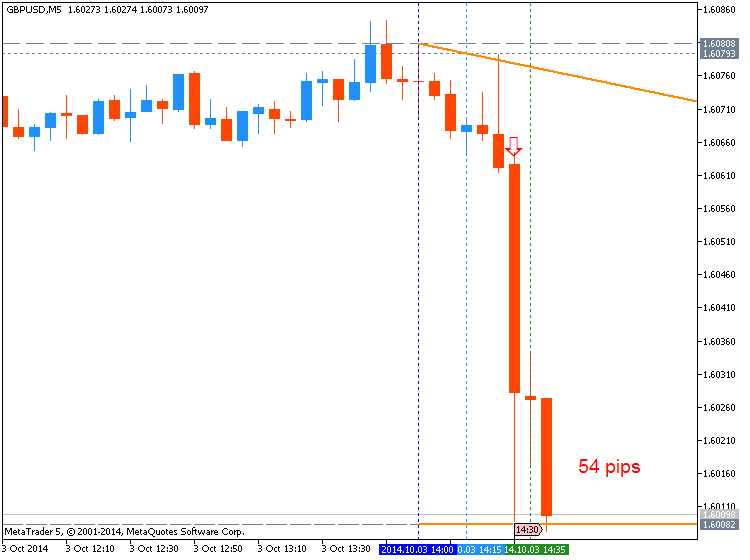

| SEP 2014 | 10/03/2014 12:30 GMT | 215K | 248K | -76 | -83 |

September 2014 U.S. Non-Farm Payrolls

EURUSD M5 : 68 pips price movement by USD - Non-Farm Employment Change news event :

GBPUSD M5 : 54 pips price movement by USD - Non-Farm Employment Change news event :

USDCAD M5 : 50 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) increased 248K in September after expanding a revised 142K the month prior, while the jobless rate unexpectedly slipped to a six-year low of 5.9% from 6.1% in August. The uptick in hiring certainly highlights an improved outlook for the world’s largest economy, and the bullish sentiment surrounding the U.S. dollar may gather pace over the remainder of the year as the Fed is widely expected to halt its asset-purchase program at the October 29 meeting. Indeed, the better-than-expected prints spurred a bullish dollar reaction, with the EUR/USD slipping below the 1.2550 handle to hit a fresh yearly low of 1.2501.

MetaTrader Trading Platform Screenshots

GBPUSD M5: 70 pips range price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.08 09:35

Trading Video: Next EURUSD, USDJPY and SPX Moves Require Greater Conviction (based on dailyfx article)

- The divergence in monetary policy presents the greatest potential for EURUSD, GBPUSD and USDJPY trends

- GBPUSD and the Pound face the most concentrated event risk next week on the BoE's Quarterly report

- Risk trends may not be active now, but be wary of their influence over the FX and capital markets

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with ranging between 1.6183 resistance and 1.5950 support levels.

H4 price is on secondary flat within primary bearish.

W1 price is located inside Ichimoku cloud/kumo with ranging market condition. The upper border of kumo is Sinkou Span A line which is the virtual border between primary bullish and the primary bearish for high timeframes on the chart. Thus, W1 price is on ranging market condition within primary bearish.

MN price is inside Ichimoku cloud/kumo and above Sinkou Apan A line with 1.6052 support level crossed by price on open MN bar: this is indicating the secondary ranging within primary bullish. Besides, Chinkou Span line is ready to cross the price from above to below for good breakdown. If the price will break 1.6052 support together with Chinkou Span line crossing the price so we may see good breakdown with the reversal of the price movement from primary bullish to the primary bearish market condition.

If D1 price will break 1.5950 support level so the primary bearish will be continuing (good to open sell trade for example)If D1 price will break 1.6183 resistance - we may see the secondary market rally inside primary bearish with the good possibility to market reversal to primary bullish on D1 timeframe (good to counter-trend trading systems)

If not so we may see the ranging market condition within bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2014-11-03 01:00 GMT (or 02:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-11-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-11-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

2014-11-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-11-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

2014-11-04 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-11-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2014-11-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-11-05 14:15 GMT (or 15:15 MQ MT5 time) | [USD - FOMC Member Kocherlakota Speech]

2014-11-05 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-11-06 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

2014-11-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

2014-11-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-11-07 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2014-11-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart