Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.31 16:29

Forex Weekly Fundamentals Outlook June 2-6Currency movements were mixed in the last week of May, and now a very busy week awaits traders: rate decision in Australia, Canada, the UK and the Eurozone are due alongside top-tier US events culminating in the all-important NFP report on Friday are the market movers on FX calendar. Here is an outlook on the highlights of this week.

The ECB kept the pressure on the euro with comments pointing to action. Also the data weighed on the common currency. In the US, the theory of a terrible first quarter and an improvement afterwards was reinforced by the news of contraction in Q1, while fresh jobless claims were encouraging. Apart from that, the pound was pounded and the Aussie recovered. And now, we have the top tier indicators in the first week of the month. Let’s start,

- US ISM Manufacturing PMI: Monday, 14:00.US manufacturing sector activity edged up in April to 54.9 from 53.7 in March, beating forecast of a 54.3 reading. According to the report, new orders remained unchanged at 55.1, while employment climbed to 54.7 from 51.1 in the previous month. Most responders were positive mainly due to strong demand out of China. US manufacturing activity is expected to advance to 55.7 this time.

- Australian rate decision: Tuesday, 14:00. The Reserve Bank of Australia signaled it would maintain low interest rates in the coming months as inflation is contained and the economy adjusts to fewer resource projects. Growth is expected to slow down after mining investment sharply plunged. Therefore, the 2.5% rate and the accommodative monetary policy are expected to stay for the rest of the year. No change in rates s expected now.

- Australian GDP: Wednesday, 1:30. The Australian economy expanded faster than expected last quarter, despite a decline in business investment. GDP edged up 0.8% in the last quarter of 2013, beating expectations for a 0.7% rise. Consumer spending picked-up as well as exports and housing transactions. Low interest rates and a recent decline in the exchange rate had a significant positive impact on growth. GDP growth in the first quarter of 2014 is expected to advance by 0.9%.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. Private sector employment in the US expanded by 220,000 jobs in April following 209,000 in the prior month. The majority of new positions were created in the construction industry gaining 19,000 jobs over the month, compared to 21,000 in March. Manufacturing remained slow adding 1,000 jobs in April, down from 4,000 in March. Analysts expected a lower job addition of 203,000. The impressive gain was well above the twelve-month average, indicating the US job market is improving. Private sector employment is expected to show a 217,000 jobs addition in May.

- US Trade Balance: Wednesday, 12:30. The U.S. trade deficit contracted in March to $40.4 billion from $49.8 billion in February thanks to a rise in exports but the small improvement did not help GDP in the first quarter, plunging into negative territory posting the first contraction in three years. U.S. trade deficit is expected to widen to $40.8 billion.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained its overnight interest rate at 1%, keeping it unchanged for the last 29 policy meetings. However, the bank left the door open for a rate cut. Bank of Canada governor Stephen Poloz was less concerned with low inflation, high house prices and household debt, claiming recovery is consistent and will improve amid stronger US demand. Rates are expected to remain unchanged at 1%. Canadian GDP slightly disappointed.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. The U.S. service sector continued to advance in April, expanding to 55.2 from 53.1 in March. Analysts expected a lower reading of 54.3% in March. Responders were positive about business conditions and the current state of the US economy. The strong release indicates that the US economy is advancing and strengthening in Q2. Manufacturing activity in the US private sector is expected to gain further momentum and reach 55.6.

- UK rate decision: Thursday, 11:00. Stronger voices calling to raise rates were heard in the last BoE meeting in May. BoE Governor Mark Carney, who has supported the low rate policy, said that the Bank is getting close to raise borrowing costs. However the estimates suggest a hike may come in a year’s time while other analysts believe a higher rate will executed in the first three months of 2015. Rates are expected to remain unchanged at 0.50%.

- Eurozone rate decision: Thursday, 11:45, press conference at 12:30. The

ECB is likely to act as promised and to keep the pressure on the euro.

While the euro dropped throughout May due to Draghi’s comment last

time, the exchange rate is probably still too high. This keeps

inflation low. In addition, money supply is squeezing. A cut of 10 to

15 basis points is likely in both the main lending rate and the deposit

rate. In addition, the ECB could accompany this move with some new

kind of LTRO. While the governing council is likely to keep the QE

powder dry, Draghi could certainly provide some more details about such

a potential program, making it clear that the option is on the table. A

negative rate by such a major central bank is uncharted territory. In

addition and despite all the preparations, Draghi’s action and words

are not fully priced in. Draghi could drag the euro down once again.

- US Unemployment Claims: Thursday, 12:30. The number of initial jobless claims dropped drastically last week to nearly the lowest level in seven years reaching 300,000 claims. The 27,000 drop was far better than the 321,000 forecasted by analysts, indicating hiring is picking up despite the GDP contraction posted in the first quarter. Employers are confident enough to keep staff reducing the number of layoffs. Unemployment claims is expected to reach 314,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s unemployment rate remained unchanged in April at 6.9%, despite a loss of 29,000 jobs compared to March. Employment worsened in the provinces of Quebec, New Brunswick, Newfoundland and Labrador and in Prince Edward Island, while it increased in Saskatchewan. The unemployment rate remained the same because labor force participation fell 0.2% to just over 66%.Canada’s labor market is expected to increase by 12,300 jobs with no change in the unemployment rate.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US labor market created 288,000 jobs in April, well above the consensus forecast of 215,000 new positions, posting the best reading since January of 2012. The surprising addition pushes the unemployment rate down to 6.3% from 6.7% in March, much better than the 6.6% estimated by analysts. Private sector job creation strengthened and the government started hiring again after many months of layoffs. Overall, the US job market is stronger and consumer spending also improves boosting economic activity. US economy is expected to show a 219,000 jobs addition in May, while the unemployment rate is predicted to rise to 6.4%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.02 09:26

2014-06-02 07:00 GMT (or 09:00 MQ MT5 time) | [USD - Fed's Evans Speech]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD - Fed's Evans Speech = Charles L. Evans is the ninth president and chief executive officer of the Federal Reserve Bank of Chicago. In that capacity, he serves on the Federal Open Market Committee (FOMC), the Federal Reserve System's monetary policy-making body.

==========

Federal Reserve Bank of Chicago President Charles Evans provided his perspective on monetary policy at a macroeconomics workshop in Turkey.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 20 pips price movement by USD - Fed's Evans Speech news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.02 16:32

2014-06-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

- past data is 54.9

- forecast data is 55.4

- actual data is 53.2 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

USD - ISM Manufacturing PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 13 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.03 10:27

2014-06-03 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]- past data is -111.6K

- forecast data is -112.3K

- actual data is -111.9K according to the latest press release

if actual < forecast = good for currency (for EUR in our case)

EUR - Spanish Unemployment Change = Change in the number of unemployed people during the previous month. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 5 pips price movement by EUR - Spanish Unemployment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.03 12:49

2014-06-03 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]- past data is 0.7%

- forecast data is 0.7%

- actual data is 0.5% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate

==========

Eurozone Inflation Slows More Than Forecast

Eurozone inflation slowed more than expected in May, raising concerns about deflationary pressures.

Inflation fell to 0.5 percent in May from 0.7 percent in April, flash estimates published by Eurostat showed Tuesday. The rate was forecast to ease marginally to 0.6 percent.

Inflation held below the European Central Bank's target of 'below, but close to 2 percent' for the sixteenth consecutive month.

Excluding food, alcohol and tobacco, core inflation slowed to 0.7 percent from 1 percent a month ago.

Energy prices remained flat after declining 1.2 percent in April. Cost of services advanced 1.1 percent, slower than the 1.6 percent increase seen in the previous month. Food, alcohol and tobacco prices gained only 0.1 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 21 pips price movement by EUR - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.03 17:57

EURUSD: "Sell the Rumor, Buy the News" Reaction to ECB? (adapted from fxstreet article)

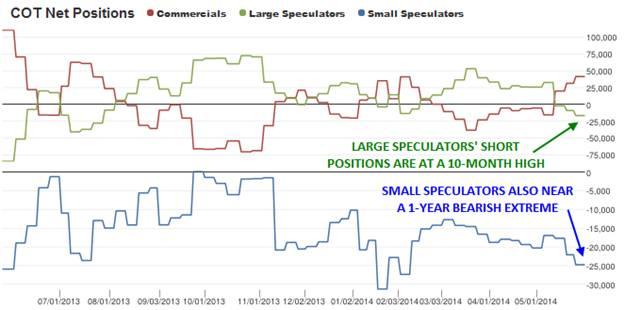

It seems like the only topic on forex traders’ minds this week is Thursday’s European Central Bank announcement. Since last month’s hint of future action from ECB President Mario Draghi, the market has grown more and more convinced that the ECB will not only cut its main interest rate on Thursday, but also take nonconventional actions to try to stave off deflation. We’ll have a full ECB preview up tomorrow, but for now we’d like to set the scene from a sentiment and positioning perspective.

Beyond the

traditional dichotomy between technical and fundamental analysis, one

oft-overlooked aspect of a currency’s value is traders’ sentiment and

positioning. When traders are overly optimistic on a certain currency

pair, it often falls despite typically bullish fundamental and technical

events. Likewise, when traders become excessively pessimistic on an

instrument, it may rally regardless of the fundamental or technical

developments because there’s “no one left to sell.” The most reliable

way to see how the market is positioned is through the CFTC’s Commitment

of Traders report, which shows whether various types of traders have

bought or sold different currency pairs. A chart of the most recent COT

data (from last Tuesday) is shown below:

“Commercial traders,” shown in red below, are typically large companies trying to hedge their currency risk, and as a result, they are not interested in making money trading. For this reason, the large (green) and small (blue) speculators give the most reliable indication of how active, profit-driven traders are positioned. Looking at the current data shows that these traders are nearing bearish extremes on the EUR/USD heading into Thursday’s ECB meeting: large speculators are currently net short the EUR/USD to the tune of 17,000 futures contracts, the most bearish reading since August 2013, while small speculators are net short almost 25,000 contracts, also near 1-year lows.

This extreme bearish positioning suggests that many traders have already sold the EUR/USD in anticipation of bold action by the ECB on Thursday. Paradoxically, this suggests that even if the ECB fulfills expectations by cutting its main interest rate by a token amount and reducing its deposit rate to negative levels, the EUR/USD could actually bounce in a classic “sell the rumor, buy the news” dynamic. At this point, the ECB may have to reach for its “Big Bazooka” – Quantitative Easing – to truly elicit more weakness in the EUR/USD.

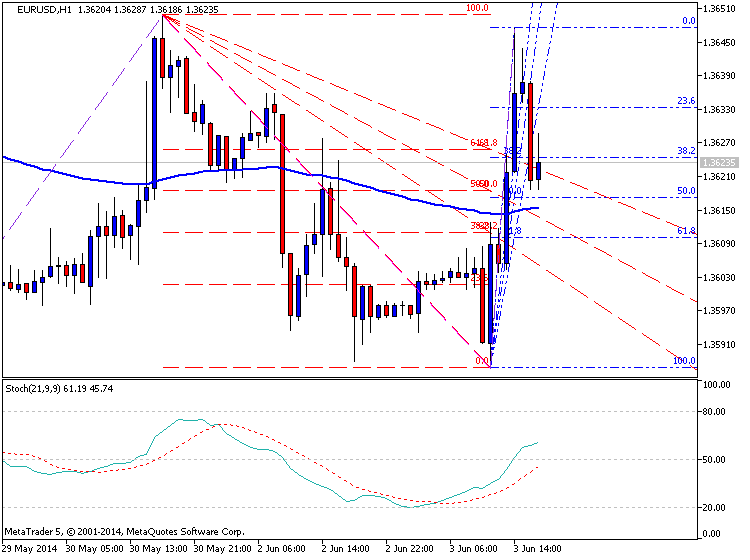

We saw an instructive example of this phenomenon earlier today with the release of the eurozone CPI, which printed at just 0.5% vs. expectations of a 0.7% rise. With the ECB’s laser-like focus on inflation of late, this weak report increases the likelihood of bold action by the central bank. However, the EUR/USD has actually spiked 50 pips higher since the report (see chart below), suggesting that euro shorts may be simply overextended and exhausted.

In the short

term, the pair may remain trapped within its recent range between 78.6%

daily Fibonacci retracement support at 1.3587 and

previous-support-turned-resistance at 1.3650 ahead of the ECB’s

decision. However, the EUR/USD may be primed for a bounce later this

week unless the traditionally-conservative ECB can break its mold with

truly bold action on Thursday.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 11:09

2014-06-04 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]- past data is 56.5

- forecast data is 56.1

- actual data is 55.7 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - Spanish Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry. It's positively correlated with interest rates - early in the economic cycle an increasing supply of money leads to additional spending and investment, and later in the cycle expanding money supply leads to inflation.

==========

Spanish Service Sector Activity Rises At A Slower Rate In May

Spanish service sector activity continued to rise in May, though at a slower rate, the results of a survey by Markit Economics showed Wednesday.

The service sector business activity index fell to 55.7 in May from 56.5 in April. The index was also below the consensus estimate that called for a reading of 56.1. Nevertheless, this marked the seventh consecutive month of expansion.

Among the sub-sectors, the biggest expansion was seen at post and telecommunications and financial intermediation companies

Staffing levels rose for the second consecutive month, marking the first instance of back-to-back rises in employment since early 2008, though at a moderate rate. Due to weak job creation and strong growth of new orders, backlogs of work rose for the fourth consecutive month.

New orders rose sharply in May and a general improvement in market conditions was reported.

Input cost inflation remained weaker than the series average. However, among the sub-sectors, input costs at hotels and restaurants rose sharply, diverging from the general trend.

Output prices continued to remain low owing to competitive pressures. However, the pace of decrease slowed for the fifth straight month and was at its weakest since August 2008 when the current sequence of decline began.

Business sentiment remained positive in May, changing little from the previous month. The optimism is attributed to predictions of an ongoing economic recovery in Spain.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 7 pips price movement by EUR - Spanish Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 13:21

2014-06-04 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]- past data is 0.5%

- forecast data is 0.9%

- actual data is 0.9% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. There are 3 versions of GDP released about 20 days apart - Flash, Revised, and Final. The Flash release is the earliest and thus tends to have the most impact

==========

Eurozone Q1 GDP Growth Confirmed At 0.2%

The euro area economy grew as initially estimated in the first quarter, second estimate from Eurostat showed Wednesday.

Gross domestic product in the 18-nation currency bloc grew 0.2 percent sequentially, slower than the revised 0.3 percent expansion posted in the fourth quarter of 2013.

On a yearly basis, growth accelerated to 0.9 percent from 0.5 percent. Eurostat confirmed the preliminary estimates for the first quarter released on May 15.

On the expenditure side, household spending gained only 0.1 percent, while government expenditure grew 0.3 percent.

Investment advanced 0.3 percent versus a 0.9 percent rise in the previous quarter. The increase in exports eased sharply to 0.3 percent from 1.4 percent. On the other hand, imports growth rose marginally to 0.8 percent from 0.7 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 20 pips price movement by EUR - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 10:43

2014-06-05 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Factory Orders]- past data is -2.8%

- forecast data is 1.3%

- actual data is 3.1% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Factory Orders] = Change in the total value of new purchase orders placed with manufacturers. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders

==========

German Factory Orders Recover In April

Germany factory orders recovered at a faster than expected pace in April, official figures revealed Thursday.

Factory orders increased 3.1 percent in April from March, Destatis reported. Economists were expecting a 1.4 percent rise in orders after falling 2.8 percent in March.

Foreign orders increased 5.5 percent, while domestic orders remained at the level of the previous month.

Orders from the euro area advanced 9.9 percent on the previous month. At the same time, orders from other countries were up 3.1 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 11 pips price movement by EUR - German Factory Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 11:51

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

- European Central Bank Seen Implementing Rate Cut & Negative Deposit Rates.

- Will Governing Council Also Introduce Non-Standard Measures?

Trading the News: European Central Bank (ECB) Interest Rate Decision

The EUR/USD may face a sharp selloff over the next 24-hours of trade as

market participants see the European Central Bank (ECB) pushing monetary

policy into uncharted territory.

What’s Expected:

Why Is This Event Important:

Beyond expectations for a rate cut & negative deposit rates, the ECB may also look to implement more non-standard measures in an effort to increase lending to small-and-medium sized enterprises (SME), but the bearish sentiment surrounding the single-currency may end up being short-lived should central bank President Mario Draghi scale back his willingness to further embark on the easing cycle.

The growing threat for deflation paired with the ongoing contraction in private sector credit may prompt the ECB to implement a range of tools to address the weakening outlook for the monetary union, and the EUR/USD may test fresh yearly lows over the near-term should central bank leave the door open for more easing.

Nevertheless, the downtick in unemployment paired with improvement in confidence may encourage the ECB to further delay its easing cycle, and a rate cut alone may present a buying opportunity for the EUR/USD as market participants have already priced-in a reduction in the benchmark interest rate.

How To Trade This Event Risk

Bearish EUR Trade: ECB Cuts Rates & Keeps Door Open for More Monetary Easing

- Need red, five-minute candle following the statement to consider a short Euro position

- If market reaction favors a short trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bullish euro trade, just in the opposite direction

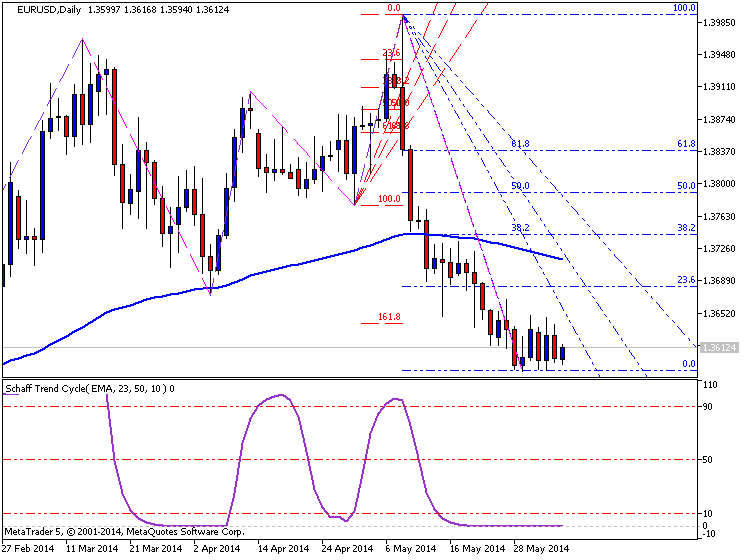

EUR/USD Daily

- Broke Ascending Channel & Bullish RSI Momentum From 2013 Following Last ECB Meeting

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3780 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

May 2014 European Central Bank Interest Rate Decision

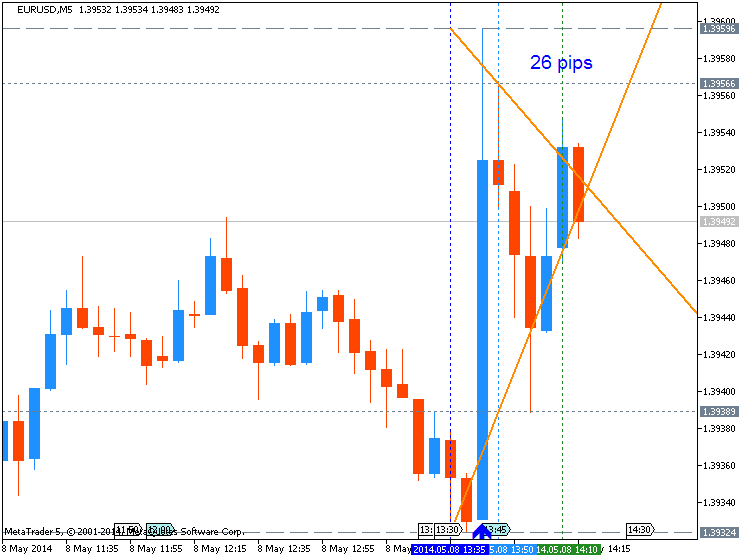

EURUSD M5 : 26 pips price movement by EUR - Interest Rate news event :

The European Central Bank kept the benchmark interest rate on hold in May as the central bank continues to see a gradual recovery in the monetary union, but it seems as though the Governing Council is showing a greater willingness to implement additional monetary support in the coming months as President Mario Draghi highlights a greater risk for deflation. Despite the initial market reaction to the ECB rate decision, speculation for more easing dragged on the EUR/USD, with the pair closing the day at 1.3838.

2014-06-05 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

EURUSD M5 : 82 pips range price movement by EUR - Interest Rate news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

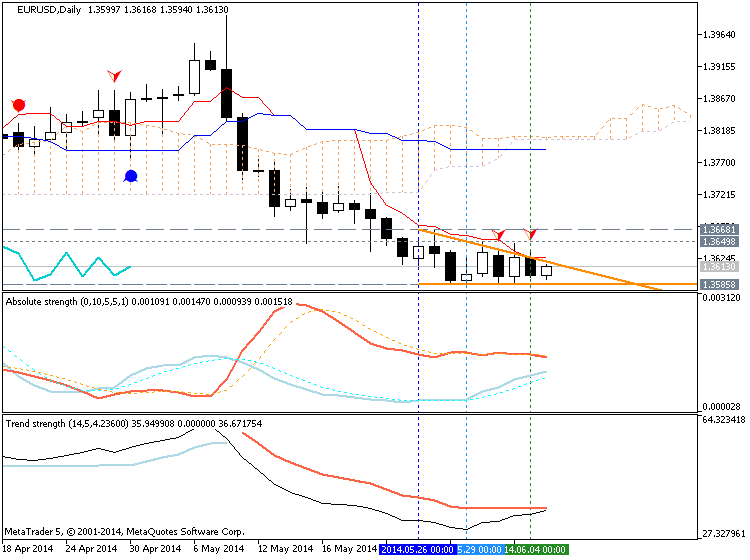

D1 price is on bearish market condition located below Ichimoku cloud/kumo trying to break 1.3585 support on close bar for the bearish to be continuing.

H4 price is on market rally within primary bearish stopped by 1.3649 resistance level.

W1 price is on bullish correction trying to break 1.3615 support for good breakdown together with Chinkou Span line crossing the price on close W1 bar.If D1 price will break 1.3585 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-06-02 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

2014-06-02 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-06-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-06-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-06-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-06-03 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2014-06-03 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2014-06-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]

2014-06-04 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

2014-06-04 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Final Services PMI]

2014-06-04 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]

2014-06-04 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-06-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-06-04 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-06-05 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Factory Orders]

2014-06-05 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Retail Sales]

2014-06-05 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

2014-06-05 12:30 GMT (or 14:30 MQ MT5 time) | [EUR - ECB Press Conference]

2014-06-06 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Trade Balance]

2014-06-06 06:45 GMT (or 08:45 MQ MT5 time) | [EUR - French Trade Balance]

2014-06-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart