Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.05 19:46

Forex Weekly Outlook September 8-12Mark Carney and Haruhiko Kuroda speeches, New Zealand rate decision, Australian employment data, US Unemployment Claims, Retail sales and Consumer sentiment are the major events on our calendar for this week. Here is an outlook on the main market-movers coming our way.

Last week Non-Farm Payrolls declined below the 200,000 level with only a 142,000 job gain in August, considerably lower than the 230,000 gain expected by analysts. The unemployment rate fell by 0.1%, but was attributed to a 0.1 drop in the participation rate. Despite a rebound in economic growth during the second quarter, the recent employment data suggests the economy shifts to lower gear. Will this trend continue?

- Mark Carney speaks: Tuesday, 8:30. BOE Governor Mark Carney will speak in Liverpool and may speak about his intentions to raise rates before wages increase. The International Monetary Fund expects U.K. growth to soar this year. However wage growth is not expanding according to projections. Carney stated that the banks have made “substantial progress” in returning to normal and the expansion trend is gathering momentum.

- New Zealand Rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised its official Cash Rate to 3.5% in July from 3.25% in the previous month. This was the fourth hike in five months amid a growth trend in the economy. The rise was in line with market forecast but economists believe this was the last rise in this hike series, after which the Bank will assess the tightening measures impact on the economy. The Reserve Bank has previously announced another rate hike of 1.25% by the end of 2014 and 2015 reaching a ‘neutral’ level of 4.5%. The bank said the economy was expected to expand at an annual pace of 3.7% in 2014. No changes are forecasted this time.

- Australian employment data: Thursday, 1:30. Australia’s unemployment rate soared to a 12-year high of 6.4% in July from 6.0% in the previous month while economists expected the rate to remain at 6.0%. The economy contracted 300 jobs following a 15,900 job addition in June. Full-time positions increased by 14,500 while part-time roles declined 14,800. The participation rate, increased by 0.1% to 64.8%. Economists believe this decline is only a temporary glitch reflecting the volatility of month-to-month data. Australia’s job market is expected to gain 15,200 jobs while the Unemployment rate is expected to decline to 6.3%.

- US Unemployment Claims: Thursday, 12:30. The number of jobless claims increased by 4,000 last week to 302,000, a bit higher than the 300,000 expected by analysts. The four-week moving average of initial claims edged up 3,000 last week to 302,750. The level of continuing claims declined by 64,000 from the previous week and the level of unadjusted continuing claims fell by 95,339 to 2,306,286. Overall, the level of claims last week was well below the 4,388,758 posted a year ago. Jobless claims are expected to increase by 306,000.

- Haruhiko Kuroda speaks: Friday, 6:05. BOJ Governor Haruhiko Kuroda will speak at the National Graduate Institute for Policy Studies in Tokyo. He may talk about the central bank’s intentions to raise the sales tax again in order to narrow government deficit. Kuroda remained optimistic about pulling out of deflation and reaching the 2% inflation target. BOJ Governor is also positive that Japan’s economy will continue to expand in the months ahead.

- US Retail sales: Friday, 12:30. U.S. retail sales unexpectedly halted in July, remained unchanged from June, suggesting some loss of momentum in the economy at the beginning of the third quarter. However gob growth continued to be positive, indicating sales activity is bound to strengthen in the coming months. The main fall occurred in the automobile sector declining 0.2% after a 0.3% fall. Meanwhile, core retail sales, excluding automobiles, gasoline, building materials and food services inched up 0.1% in July. Retail sales are predicted to increase 0.3% while core sales are expected to gain 0.2%.

- US Prelim UoM Consumer Sentiment: Friday, 13:55. American consumer confidence unexpectedly dropped in August to a nine-month low of 79.2 points from 81.8 points in July, missing predictions for a reading of 82.7. The unexpected fall was led by concerns over economic outlook as households projected an inflation rate of 3.4% over the next year, distinctly higher than the 0.4% wage growth forecasted. This pessimistic projection may impact consumer spending in the coming months. American consumer confidence is expected to pick-up to 83.2 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.06 14:30

NZDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for New Zealand Dollar: Neutral- NZDUSD .8240/60 of Interest for a Low

- US Dollar Profit Taking Ensues on Surprise August NFPs Miss

The Reserve Bank of New Zealand (RBNZ) policy meeting on September 10

may heighten the bearish sentiment surrounding NZD/USD should the fresh

batch of central bank rhetoric drag on interest rate expectations.

According to a Bloomberg News survey, all of the 12 economists polled

forecast the RBNZ to keep the benchmark interest rate steady at 3.50%

as Governor Graeme Wheeler adopts a neutral tone for monetary policy,

and the New Zealand dollar may face a further decline in the days ahead

if the central bank head sees a period of interest rate stability

throughout the remainder of 2014. At the same time, Governor Wheeler may

continue to highlight weaker commodity prices to favor a weakened

outlook for the New Zealand dollar, but the recent slide in the

higher-yielding currency may raise the outlook for price growth as it

draws imported inflation.

With that said and given the near-term decline in NZD/USD, the biggest

risk surrounding the RBNZ interest rate decision will be a removal of

the verbal intervention on the kiwi as the central bank sees a more

sustainable recovery in New Zealand. As a result, Credit Suisse

Overnight Index Swaps continue to show expectations for at least one

25bp rate hike over the next 12-months, but dovish remarks from the

RBNZ may push NZD/USD to give back the rally from the February low

(0.8050) as market participants scale back bets for higher borrowing

costs.

Nevertheless, the 0.8250-60 region remains the next key level of

interest as NZD/USD retains the descending channel along with the

downward trend in the Relative Strength Index (RSI), but a lack of

jawboning from the RBNZ may foster a more meaningful recovery in the

New Zealand dollar as the oscillator comes off of oversold territory.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.08 18:05

NZDUSD Doji Ensemble Indicates Caution Near Critical Support (based on dailyfx article)

- NZD/USD Technical Strategy: Pending Short

- Remains At A Critical Juncture Near 0.8260

- Awaiting Downside Break to Open 0.8060

NZD/USD continues to skip across the critical 0.8260 barrier with a medley of short body candles suggesting caution from traders. A daily close below the nearby floor would be preferred for entering new short positions, given the context of a downtrend on the daily.

The Harami noted in the most recent candlesticks report delivered a

short-lived bounce for NZD/USD. The emergence of a Gravestone Doji now

hints at a pullback for the pair over the session ahead. Buying interest

is likely be renewed near the 0.8267 lows.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.09 06:37

NZDUSD Technical Analysis (based on dailyfx article)

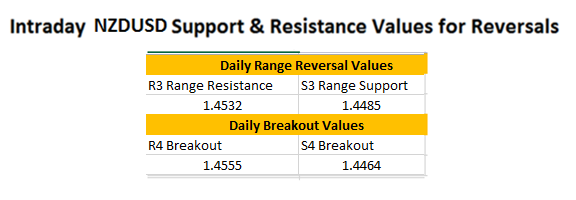

- NZDUSD is Current Range Bound

- R3 Support Sits at .8295

- Market Breakouts Signaled Under .8274

The NZDUSD starts the week supported going into the US session open. Currently price resides at range support, near the S3 camarilla pivot found at .8295. In the event price remains supported for the session, traders can look for a potential price bounce back towards range resistance. Currently resistance sits near the R3 pivot point at .8338, completing the days 43 pip trading range.

A breakout below the S4 pivot would signal a strong reversal back in the direction of the NZDUSD’s current daily trend. It should be noted that price has declined as much as 566 pip over the last two months of trading. Conversely a price break above R4 resistance at .8360, would indicate momentum shifting towards a higher high. In either of the above breakout scenarios, the range should be considered invalidated for the day with traders then positioning themselves with the markets new direction.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.10 07:24

Trading Video: FX Volatility Surge Puts Dollar and S&P 500 on Alert

- FX volatility levels swell - is it a precursor to a deeper shift in sentiment market-wide?

- EURUSD, GBPUSD and USDJPY maintain trend but curb progress

- Top event risk rests with an active Pound in BoE testimony and Kiwi on an RBNZ rate decision

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.10 18:12

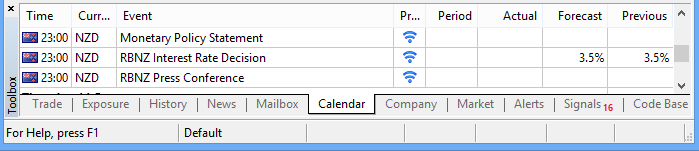

Trading the News: Reserve Bank of New Zealand (RBNZ) Rate Decision (based on dailyfx article)

- RBNZ Expected to Retain Current Policy Amid Period of ‘Interest Rate Stability’.

- Will RBNZ Governor Graeme Wheeler Remove the Verbal Intervention on Kiwi?

According to a Bloomberg News survey, all of the 13 economist polled see

the Reserve Bank of New Zealand (RBNZ) keeping the interest rate on

hold at 3.50%, but the fresh batch of central bank rhetoric may produce

increased volatility in the NZD/USD as market participants weigh the

outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

In light of the marked depreciation in the NZD/USD, the biggest risk for

surprise will be a removal of the verbal intervention on the kiwi, and a

further decline in the exchange rate may prompt Governor Graeme Wheeler

to adopt a more hawkish tone for monetary policy as it fuels imported

inflation.

Below-target inflation along with the slowdown in employment may

encourage the RBNZ to retain a period of ‘interest rate stability’ in

New Zealand, and the fresh batch of central bank rhetoric may spur a

further decline in the NZD/USD should it drag on interest rate

expectations.

Nevertheless, the RBNZ may no longer jawbone the kiwi as the lower

exchange rate raises the risk for imported inflation, and the NZD/USD

may face a more meaningful rebound ahead of the next Fed meeting on

September 17 should Governor Wheeler unexpectedly adopt a more hawkish

tone for monetary policy.

How To Trade This Event Risk

Bearish NZD Trade: RBNZ Continues Talk Down Interest Rate Expectations

- Need red, five-minute candle following the statement to consider a short New Zealand dollar trade

- If market reaction favors selling kiwi, short NZD/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long NZD/USD trade

- Implement same setup as the bullish New Zealand dollar trade, just in the opposite direction

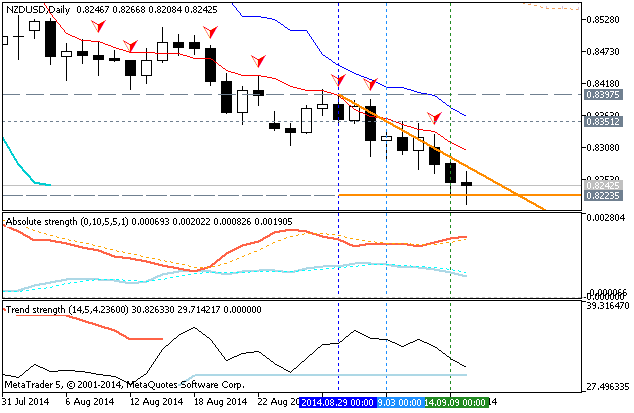

NZDUSD Daily

- Will look for fresh highs should the NZD/USD carve a higher-low in July

- Interim Resistance: 0.8430 (23.6% retracement) to 0.8450 (23.6% expansion)

- Interim Support: 0.8160 (100% expansion) to 0.8180 (38.2% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JUL 2014 | 07/23/2014 21:00 GMT | 3.50% | 3.50% | -79 | -114 |

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 35 pips price movement by NZD - Official Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.12 08:04

Technical Analysis: AUDUSD & NZDUSD trade similarly for different reasons

The NZDUSD made new lows on the back of comments from RBNZ’s Wheeler who said that the currency was overvalued and that rates would stay on hold until 1Q of 2015. Meanwhile in Australia, the AUDUSD made it’s new move lows despite much stronger employment statistics that had the market questioning the seasonals.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

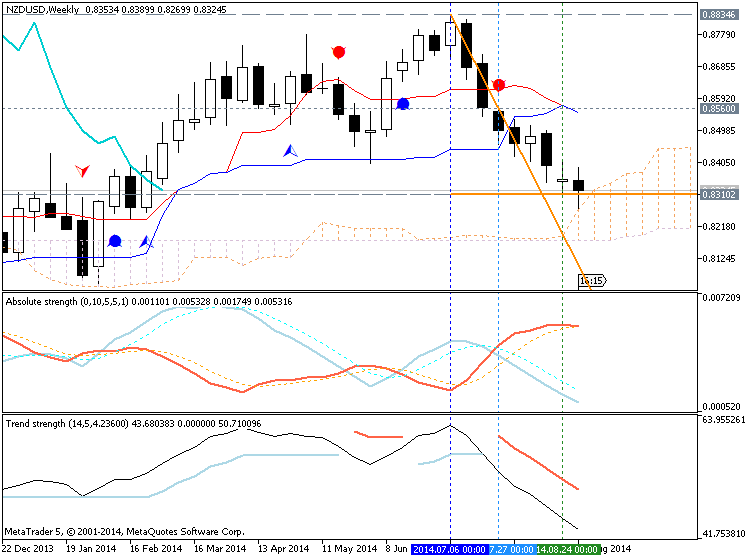

D1 price is on bearish market condition with 0.0206 as the nearest support level.

W1 price is on secondary correction within primary bullish with good possibility to be reversed to primary bearish:

H4 price is on ranging within secondary bearish.

If D1 price will break 0.8286 support level on close bar - the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2014-09-10 21:00 GMT (or 23:00 MQ MT5 time) | [NZD - Official Cash Rate]

2014-09-11 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-09-11 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-09-11 22:30 GMT (or 00:30 MQ MT5 time) | [NZD - Business NZ Manufacturing Index]

2014-09-12 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

2014-09-12 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart