buy stop = price is on uptrend/buy now and we think that the uptrend will be continuing "continuing buy" ("buy and continue buy").

buy limit = "sell and continue buy"

https://www.metatrader4.com/en/trading-platform/help/positions/orders

and

https://www.metatrader5.com/en/terminal/help/trading/performing_deals

- www.metatrader4.com

Yes I've read those descriptions but they don't make sense to me as a newbie trader.

Example:

Buy Limit – buy provided the future "ASK" price is equal to the pre-defined value.

How does anyone know what the future price will be? I don't see a future price property to specify in the MqlTradeRequest structure.

What does the "pre-defined value" represent?

I'm trying to write an example in plain English of what this type of buy would look like:

To the broker: "I want to buy 100 shares (one Lot) of company xyz stock for $200.00 (Ask price) but I'm adding a Buy Limit to my order in the amount of $210.00. Therefore, execute this buy order only if the future stock price hits $210.00" ???

How far off the mark am I in understanding this Buy Limit term?

Thank you...

- www.mql5.com

I've read about Buy Limits and Buy Stops but I'm having trouble putting that information into an example in my mind.

Can someone give me an example of a Buy Limit order vs a Buy Stop order?

Thank you...

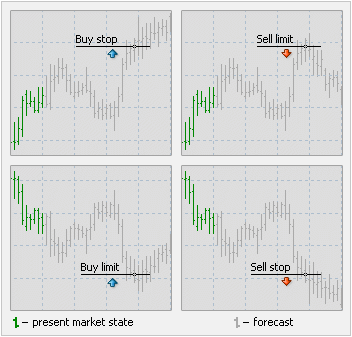

Buy Stop = You want to buy at a price which is above the current market price

Buy Limit = You want to buy at a price which is below the current market price

Sell Stop = You want to sell at a price which is below the current market price

Sell Limit = You want to sell at a price which is above the current market price

Buy Stop Limit = A Buy Limit Will be Placed when a level which is currently above market price is reached

Sell Stop Limit = A Sell Limit Will be Placed when a level which is currently below market price is reached

Think of the price like a ping pong ball.

When you hear limit think "paddle" (bounces off)

When you hear stop think "net" (goes beyond)

This might Help .

OK, so here is my plain English example:

Buy Order using Buy Stop and Buy Stop Limit

Xyz company stock currently trading at $18.00 per share.

"Buy 100 shares of xyz company for $16.00 a share (this is the Buy Stop) and limit the buy to no more than $17.00 (this is the Buy Stop Limit)".

The order is triggered when/if the stock hits $16.00 and then becomes a limit order.

Sell Order using Sell Stop and Sell Stop Limit

Xyz company stock currently trading at $18.00 per share.

"Sell 100 shares of xyz company for $20.00 a share (this is the Sell Stop) and limit the sell to no less than $19.00 (this is the Sell Stop Limit)".

The order is triggered when/if the stock hits $20.00 and then becomes a limit order.

OK, so here is my plain English example:

Buy Order using Buy Stop and Buy Stop Limit

Xyz company stock currently trading at $18.00 per share.

"Buy 100 shares of xyz company for $16.00 a share (this is the Buy Stop) and limit the buy to no more than $17.00 (this is the Buy Stop Limit)".

The order is triggered when/if the stock hits $16.00 and then becomes a limit order.

Sell Order using Sell Stop and Sell Stop Limit

Xyz company stock currently trading at $18.00 per share.

"Sell 100 shares of xyz company for $20.00 a share (this is the Sell Stop) and limit the sell to no less than $19.00 (this is the Sell Stop Limit)".

The order is triggered when/if the stock hits $20.00 and then becomes a limit order.

Nice : i see

Xyz is at $18.00 ,each example is independent :

- if you want to buy 100 shares when the price falls to $16.00 you place a Buy Limit [because you expect it to bounce up after reaching $16].

So the market goes from $18.00 to $19.00 and then to $16.00 ,the broker buys 100 shares for you. - if you want to buy 100 shares when the price rises to $20.00 you place a Buy Stop [because you expect it to keep going over $20 if it reaches there]

So the market goes from $18.00 to $20.00 ,the broker buys 100 shares for you. - if you want to buy 100 shares when the price falls to $16.00 ,but you have a condition ,you want it to have hit at least $20 from the moment we are now (not anytime) [for reasons resulting from your analysis] you will place a buy stop limit with price $20.00 <-the condition price ,and stoplimit price of $16.00 .

What happens in this case is when the market goes at $20.00 ,then a buy limit order will be placed at $16.00

(case a : ) the market goes from $18.00 to $19.00 and then down to $16.00 ,nothing happens.

(case b : ) the market goes from $18.00 to $21.00 and then down to $16.00 ,your broker buys 100 shares for you.

Nice : i see

Xyz is at $18.00 ,each example is independent :

- if you want to buy 100 shares when the price falls to $16.00 you place a Buy Limit [because you expect it to bounce up after reaching $16].

So the market goes from $18.00 to $19.00 and then to $16.00 ,the broker buys 100 shares for you. - if you want to buy 100 shares when the price rises to $20.00 you place a Buy Stop [because you expect it to keep going over $20 if it reaches there]

So the market goes from $18.00 to $20.00 ,the broker buys 100 shares for you. - if you want to buy 100 shares when the price falls to $16.00 ,but you have a condition ,you want it to have hit at least $20 from the moment we are now (not anytime) [for reasons resulting from your analysis] you will place a buy stop limit with price $20.00 <-the condition price ,and stoplimit price of $16.00 .

What happens in this case is when the market goes at $20.00 ,then a buy limit order will be placed at $16.00

(case a : ) the market goes from $18.00 to $19.00 and then down to $16.00 ,nothing happens.

(case b : ) the market goes from $18.00 to $21.00 and then down to $16.00 ,your broker buys 100 shares for you.

Super old thread that i came across looking for something else.. Lorentzos as you've helped me so much i feel i should correct a mistake you've made here (although chances are you may now know the correct usage anyway - still, helpful for others..).

A buy stop limit is not as you say it is.. The limit part is used to 'limit' the purchase price of the buy-stop trade. That is, say you're expecting positive news on a stock but are unsure, you may enter a buy-stop to purchase it above a certain price. A buy stop limit however puts a limit on the maximum price you are willing to pay for it. For example, company XYZ is trading at $10 and has earnings out after hours. Its ultra positive, so your buy-stop triggers at $11, with your limit of $12. What this means is at $11 your order doesn't turn into a market order, it instead turns into a buy order with a limit price of $12, therefore purchasing all available stock from $11 up to that price but not above. Its used in this example to prevent you paying up some crazy price if it spikes without you being filled near your buy-stop price.

Super old thread that i came across looking for something else.. Lorentzos as you've helped me so much i feel i should correct a mistake you've made here (although chances are you may now know the correct usage anyway - still, helpful for others..).

A buy stop limit is not as you say it is.. The limit part is used to 'limit' the purchase price of the buy-stop trade. That is, say you're expecting positive news on a stock but are unsure, you may enter a buy-stop to purchase it above a certain price. A buy stop limit however puts a limit on the maximum price you are willing to pay for it. For example, company XYZ is trading at $10 and has earnings out after hours. Its ultra positive, so your buy-stop triggers at $11, with your limit of $12. What this means is at $11 your order doesn't turn into a market order, it instead turns into a buy order with a limit price of $12, therefore purchasing all available stock from $11 up to that price but not above. Its used in this example to prevent you paying up some crazy price if it spikes without you being filled near your buy-stop price.

Hmm that sounds reasonable . So it essentially will buy only in that range until your volume is filled (in this example) . Thank you for the clarification 🙂

The documentation offers this explanation though :

ORDER_TYPE_BUY_STOP_LIMIT Upon reaching the order price, a pending Buy Limit order is placed at the StopLimit price

Hmm that sounds reasonable . So it essentially will buy only in that range until your volume is filled (in this example) . Thank you for the clarification 🙂

The documentation offers this explanation though :

Technically not just in that range as it could buy lower than the trigger price (after it's been triggered, of course) - in the example $11, so theoretically you could get some fills sub $11, but in practice that's very unlikely to happen as it requires a large simultaneous sell order to push against your buy order (and the positive news flow).

The documentation is correct, it's just the wording that makes it seem complicated - to clarify using my example;

ORDER_TYPE_BUY_STOP_LIMIT Upon reaching the order price ($11), a pending Buy Limit order is placed at the StopLimit price ($12)

Having used them 100's of times in my professional career this is 100% how they work, and yes - it does feel good to finally impart some of my own wisdom on this forum :)

Technically not just in that range as it could buy lower than the trigger price (after it's been triggered, of course) - in the example $11, so theoretically you could get some fills sub $11, but in practice that's very unlikely to happen as it requires a large simultaneous sell order to push against your buy order (and the positive news flow).

The documentation is correct, it's just the wording that makes it seem complicated - to clarify using my example;

Having used them 100's of times in my professional career this is 100% how they work, and yes - it does feel good to finally impart some of my own wisdom on this forum :)

Thank you 👍

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I've read about Buy Limits and Buy Stops but I'm having trouble putting that information into an example in my mind.

Can someone give me an example of a Buy Limit order vs a Buy Stop order?

Thank you...