SirFency: Basically if I put a ST or TP on my order then I cannot send another order of the same size unless the previous order has been closed.

Apparently I cannot place both a sell order and a buy order on the same symbol. I cannot hedge a symbol.

I would need to somehow store the order value in a variable,

Rather than having two separate accounts to hedge is there some other way to get around this stupid rule?

- You mean "SL or TP." Stop loss; not Strategy Tester.

-

Wrong, you certainly can on Oanda. You just can't have the second SL/TP above the first buy's SL/TP, etc. The first opened order must close first. US broker. Since 2009, hedging is not permitted for US traders.

NFA Enforces FIFO Rule, Bans Forex Hedging in US Forex Accounts - Trading Heroes

FAQ: FIFO in the Forex Market - BabyPips.com May 31, 2011 - On some US brokers, they force the SL of all orders to be the same.

- You mean "SL or TP." Stop loss; not Strategy Tester.

- Hedging is not permitted.

- Order Value is meaningless. Select your order and get it's profit.

- Move to another country. Or don't hedge; reduce your position size or close the order instead.

- You mean "SL or TP." Stop loss; not Strategy Testers.

-

Wrong, you certainly can on Oanda. You just can't have the second SL/TP above the first buy's SL/TP, etc. The first opened order must close first. US broker. Since 2009, hedging is not permitted for US traders.

NFA Enforces FIFO Rule, Bans Forex Hedging in US Forex Accounts - Trading Heroes

FAQ: FIFO in the Forex Market - BabyPips.com May 31, 2011 - On some US brokers, they force the SL of all orders to be the same.

- You mean "SL or TP." Stop loss; not Strategy Testers.

- Hedging is not permitted.

- Order Value is meaningless. Select your order and get it's profit.

- Move to another country. Or don't hedge; reduce your position size or close the order instead.

I try and follow your advice because you are very knowledgeable but in this case it was not helpful at all. Move to another country? really? c'mon man. If you are not going to put forth effort to answer a question why bother commenting at all?

Yes, really. The law says you can not hedge. 1) If you don't like the laws of a country, either work to get them changed or 2)

move to another country where the law does not apply or 3) get a broker outside your jurisdiction, or 4) do not hedge. c'man man; I

gave you alternatives. Don't bi*ch at me just because you don't like realty; stop the world and get off.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

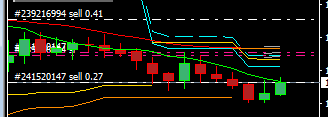

My first issue is this:

I use Oanda. I am in the US and we have the FIFO rule. Basically if I put a ST or TP on my order then I cannot send another order of the same size unless the previous order has been closed. The first order placed must be closed before another order can be bought. This only applies to orders that have a Stop Loss or Take Profit associated with them. I can place multiple orders without a stop loss or take profit but that means I need to sit and watch the chart and defeats the purpose of the EA. I could also place another order as long as the order was of a different lot size but this becomes messy and I do not want to do it this way.

The other issue is this:

Apparently I cannot place both a sell order and a buy order on the same symbol. I cannot hedge a symbol. One way I might be able to get around this issue is to have two accounts. One account only does buy orders and one account only does sell orders.

My first question is this.

I would need to somehow store the order value in a variable, after it reaches a certain greater than or less than, close the order. here can I get this value to store it in a variable?

My second question is this:

Rather than having two separate accounts to hedge is there some other way to get around this stupid rule?