You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.26 12:52

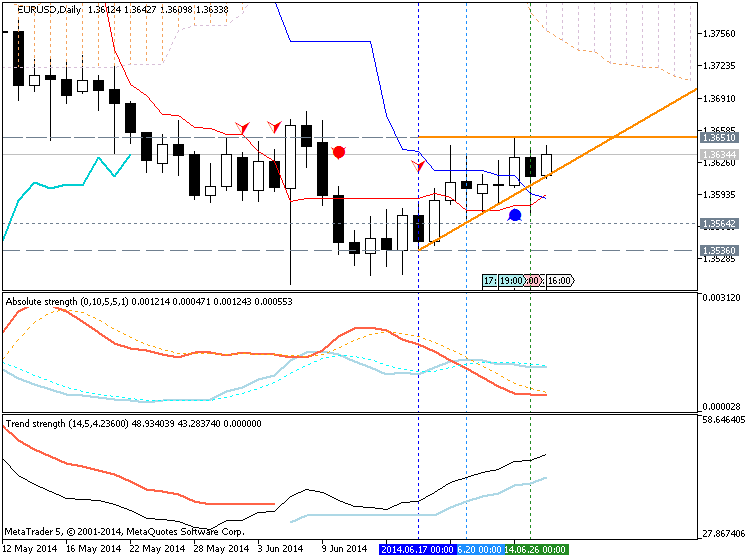

EUR/USD To Be Halted By 1.37

'It [GDP data] was very disappointing, and in the current situation we have very low vol, heading into month-end, and half-year end as well. So, the ducks are all lined up [for] U.S. dollar weakness.' - RBC Capital Markets (based on Reuters)

Pair's Outlook

The Euro is slowly but surely moving in the direction of the 55 and 200-day SMA on the back of a weaker greenback. This resistance at 1.37 is expected to prevent further appreciation of the single currency and thus a test of the monthly PP and 100-day SMA. Even if this is not the case, and the currency pair continues to advance, the long-term outlook will remain bearish as long as the major down-trend line at 1.39 stays intact.

Traders' Sentiment

While the sentiment of the market is lightly bearish towards EUR/USD (56% of open positions are short), the number of buy orders is increasing. Their share 50 pips from the spot price soared from 39% up to 60% compared to the most recent update.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.26 17:39

EURUSD: US and Germany Square Off in World Cup and FX Market

The US and Germany kick off a "massive" World Cup match in just a few hours, but the currencies of the two countries have also been locked in a tight competition this week. Yesterday, it appeared the Germans (and the rest of the Eurozone) were pulling ahead with an attempted breakout from the EURUSD's 3-week symmetrical triangle pattern (see 4hr chart below). However, the US stepped up its game at the last second and drove the pair back down to the bottom of its triangle near 1.3600. As we go to press, the pair is inching below the lower trend line, but given the failed upside breakout yesterday, it would be prudent to wait for a daily close below this level before confirming the breakdown.

For the uninitiated, a breakout from a symmetrical triangle pattern suggests a strong move in the same direction. Using the measured move method of projecting a target based on the "height" of the triangle points to a possible 150-pip move once the breakout is confirmed, which could drive the EURUSD either back up toward 1.3800 or down to new 2014 lows in the mid 1.3400s, so there could be plenty at stake here for traders.

Unfortunately, the secondary indicators are not giving any advance warning of which way the pair may trend next. The RSI is essentially neutral near the 50 level, while the MACD is rolling over, but still holding above the 0 level, showing receding bullish momentum.

Coincidentally, the resolution of the German-US battle in the FX market may take place at the same time as the countries' World Cup clash. Oddsmakers favor the Germans on the futbol pitch, but the Americans currently have the upper hand on traders' screens. No matter how these situations resolve, fans and traders are in for some serious excitement over the course of the day!

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.27 17:17

EUR/USD getting closer weekly high of 1.3650

FXStreet Chief Analyst Valeria Bednarik comments on the EUR/USD moves following the release of better than expected German CPI numbers on Friday, saying that the pair is approaching its weekly high of 1.3650.

Key quotes

"Stocks up in the US and some relaxed confidence ahead of next week events with the EUR/USD hourly chart showing indicators bouncing higher from their midlines and price advancing above a mild bullish 20 SMA."

"In the 4 hours chart however, the neutral stance prevails with 200 EMA flat around 1.3645 acting as immediate short term resistance."