Discussion of article "Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average"

I hope you can reply me: why can't I insert pictures when I edit documents, user links, youtube videos, tables, code, the only thing missing in the middle is a function to insert pictures ,,, why?

Good/Nice.

romulocta:

Hello. Does this indicator generate good buy and sell signals in isolation or do you need another indicator to confirm entries? Have you ever calculated its assertiveness rate in any market?

Hello. Does this indicator generate good buy and sell signals in isolation or do you need another indicator to confirm entries? Have you ever calculated its assertiveness rate in any market?

Hi romulocta. This indicator can also be used alone. I have no statistics regarding assertiveness rate. However, there is a free product that uses PMO at this link https://www.mql5.com/en/market/product/43378

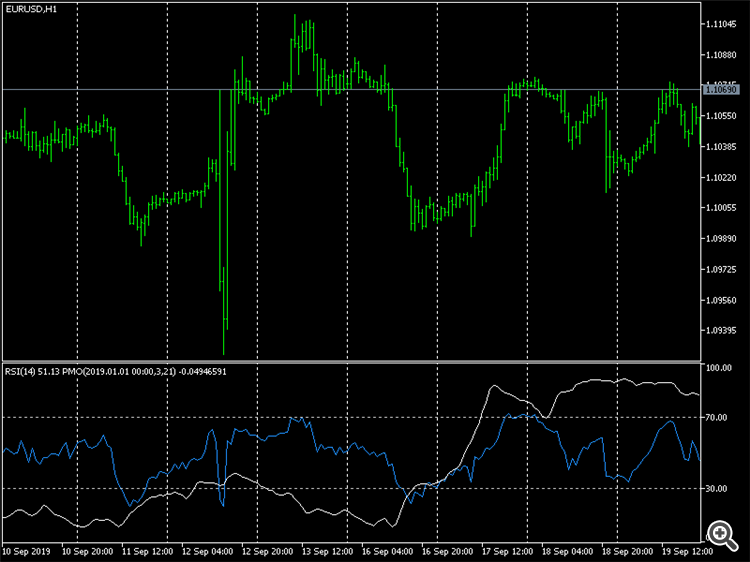

Technical Indicator Pivot Mean Oscillator

- www.mql5.com

Pivot Mean Oscillator (PMO) is a unbounded zero-centered oscillator that provides a quick and normalized measure of divergence between two spreads. Detailed description of the mathematical formulation along with some comments and experiments can be found in this article. Trading aspects This version of PMO is tuned on spreads relative to...

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

New article Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average has been published:

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.

Figure below shows the results obtained from running PMO(3,21) on the EURUSD chart with H1 timeframe spanning through the first 8 months of 2019. PMO values are centered around zero in accordance with a bell-shaped distribution. The slight left skew is probably due to the excess of short conditions accumulated by EURUSD in last months. Nevertheless, the predominance of symmetries around zero let us infer that there is a general balance between short and long movements.

Fig. 2: Distribution of PMO(3,21) values resembling a bell-shaped curve. This let us suppose a quasi-gaussian statistical model which can be useful for prediction purposes.

Author: Marco Calabrese