Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.02 06:19

2014-06-02 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

- past data is -4.8%

- forecast data is 1.8%

- actual data is -5.6% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

AUD - Building Approvals = Change in the number of new building approvals issued. It's an excellent gauge of future construction activity because obtaining government approval is among the first steps in constructing a new building. Construction is important because it produces a wide-reaching ripple effect - for example, jobs are created for the construction workers, subcontractors and inspectors are hired, and various services are purchased by the builder.

==========

Australia Building Approvals Tumble 5.6% In April

The total number of building approvals issued in Australia in April was down a seasonally adjusted 5.6 percent on month, the Australian Bureau of Statistics said on Monday, standing at 14,931.

That was well shy of forecasts for an increase of 2.0 percent following the 3.5 percent contraction in March.

On a yearly basis, building approvals were up 1.1 percent - far short of expectations for 12.3 percent and down from 20.0 percent in the previous month.

The number of approvals for private sector houses eased 0.3 percent on month but gained 16.5 percent on year to 9.254. Approvals for private sector dwellings excluding houses plunged 14.0 percent on month and 16.6 percent on year to 5,435.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 41 pips price movement by AUD - Building Approvals news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.02 09:26

2014-06-02 07:00 GMT (or 09:00 MQ MT5 time) | [USD - Fed's Evans Speech]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD - Fed's Evans Speech = Charles L. Evans is the ninth president and chief executive officer of the Federal Reserve Bank of Chicago. In that capacity, he serves on the Federal Open Market Committee (FOMC), the Federal Reserve System's monetary policy-making body.

==========

Federal Reserve Bank of Chicago President Charles Evans provided his perspective on monetary policy at a macroeconomics workshop in Turkey.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 13 pips price movement by USD - Fed's Evans Speech news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.02 16:32

2014-06-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

- past data is 54.9

- forecast data is 55.4

- actual data is 53.2 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

USD - ISM Manufacturing PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 10 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.03 07:44

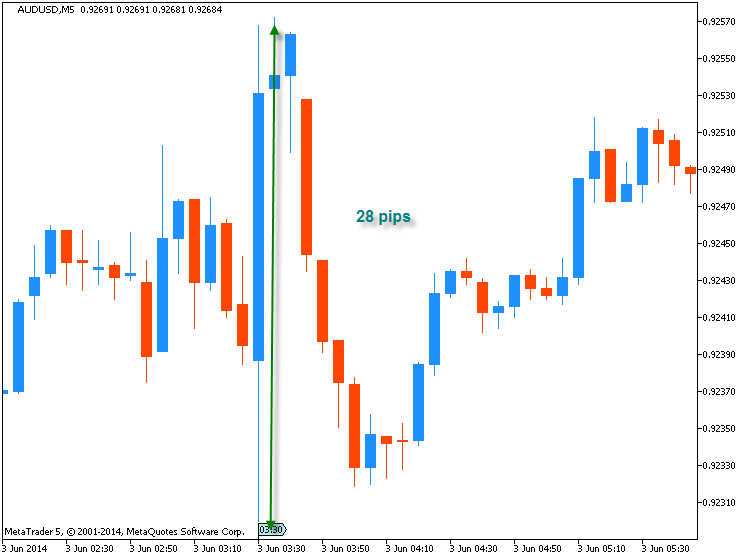

2014-06-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]- past data is 0.1%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

AUD - Retail Sales = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

Australia Retail Sales Gain 0.2% In April

Retail sales in Australia added a seasonally adjusted 0.2 percent on month in April, the Australian Bureau of Statistics said on Tuesday - coming in at A$23.168 billion.

That missed forecasts for an increase of 0.3 percent following the 0.1 percent gain in March.

Among the individual components of the survey, food retailing was up 0.3 percent, along with household goods retailing (0.6 percent), cafes, restaurants and takeaway food services (0.7 percent) and other retailing (0.2 percent).

Department store retail was relatively unchanged (0.0 percent), while clothing, footwear and personal accessory retailing fell 0.1 percent.

By region, retail sales in New South Wales added 0.7 percent, followed by Victoria (0.5 percent), Queensland (0.2 percent), Tasmania (0.3 percent) and the Northern Territory (0.4 percent).

Sales in Western Australia (-0.2 percent), the Australian Capital Territory (-0.7 percent) and South Australia (-0.1 percent) were down.

Also on Tuesday, the ABS said that Australia saw a current account deficit of A$5.67 billion in the first quarter of 2014 - up 52 percent on quarter.

That beat forecasts for a shortfall of A$7.0 billion following the downwardly revised deficit of A$11.7 billion in Q4 (originally a deficit of A$10.1 billion).

Exports of goods and services gained A$4.959 billion (6 percent) and imports of goods and services added A$759 million (1 percent). The primary income deficit fell A$1.811 billion (17 percent).

In seasonally adjusted, the net goods and services surplus surged A$5.315 billion (54 percent) to A$15.118 billion in Q1.

Net exports of GDP climbed 1.4 percent - beating forecasts for 0.80 and up from 0.60 in the previous three months.

Australia's net international investment liability position was A$850.4 billion, an increase of A$11.9 billion from Q4. Australia's net foreign debt liability fell A$3.2 billion to a net liability position of A$855.6 billion. Australia's net foreign equity shed A$15.1 billion to a net asset position of A$5.2 billion.

AUDUSD M5 : 28 pips range price movement by AUD - Retail Sales news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 08:58

2014-06-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - GDP]- past data is 0.8%

- forecast data is 1.0%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

Australia Q1 GDP Climbs 1.1% On Quarter

Australia's gross domestic product expanded a seasonally adjusted 1.1 percent on quarter in the first three months of 2014, the Australian Bureau of Statistics said on Wednesday.

That beat forecasts for an increase of 0.9 percent following the 0.8 percent gain in the fourth quarter of 2013.

On a yearly basis, GDP climbed 3.5 percent - also topping expectations for a rise of 3.2 percent and up from 2.8 percent in the three months prior.

The terms of trade decreased 1.2 percent on quarter and 3.8 percent on year.

Real gross domestic income increased 0.8 percent, while disposable income added 1.3 percent on quarter and 2.2 percent on year.

The contributors to the increase in expenditure on GDP were net exports (1.4 percentage points), final consumption expenditure (0.3 percentage points) and private gross fixed capital formation (0.2 percentage points). The main detractor was changes in inventories (-0.6 percentage points).

The main contributors to GDP were mining (up 8.6 percent), financial and insurance services (up 2.8 percent) and construction (up 3.0 percent).

Mining contributed 0.9 percentage points to the increase in GDP while financial and insurance services and construction each contributed 0.2 percentage points.

Upon the release of the data, the Australian dollar strengthened against major currencies, trading near 0.9296 against the U.S. dollar, 95.40 against the yen, 1.0155 against the Canadian dollar, 1.4637 against the euro and 1.1023 against the kiwi.

Also on Wednesday, Australia's service sectors improved in May to be just barely in contraction, the latest survey from the Australian Industry Group revealed on Wednesday.

AiG's performance of service index came in with a score of 49.9 - up sharply from 48.6 in April but still just barely below the reading of 50 that separates expansion from contraction in a sector.

Among the individual components of the survey, growth in the sector was confined to health and community services, finance and insurance, and personal and recreational services during May.

But wholesale trade, employment and retail trade were lower.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 36 pips price movement by AUD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 08:19

2014-06-05 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]- past data is 0.90B

- forecast data is 0.30B

- actual data is -0.12B according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers

==========

Australia Sees A$122 Million Deficit In April

Australia posted a seasonally adjusted merchandise trade deficit of A$122 million in April, the Australian Bureau of Statistics said on Thursday.

That was well shy of forecasts for a trade surplus of A$510 million following the upwardly revised surplus of A$902 million in March (originally A$731 million).

Exports dipped A$421 million or 1 percent on month to A$28.497 billion

Rural goods fell A$208 million (6 percent), while non-monetary gold lost A$131 million (11 percent), non-rural goods dropped A$96 million and net exports of goods under merchanting tumbled A$3 million (19 percent).

Services credits gained A$17 million.

Imports climbed A$604 million or 2 percent on month to A$28.619 billion.

Capital goods climbed A$399 million (8 percent) and consumption goods gained A$192 million (3 percent).

Intermediate and other merchandise goods lost A$76 million (1 percent) and non-monetary gold shed A$6 million (2 percent). Services debits gained A$96 million (2 percent).

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 16 pips price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.05 08:28

2014-06-05 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]- past data is 51.4

- forecast data is n/a

- actual data is 50.7 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

[CNY - HSBC Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

China Services PMI Slides To 50.7 In May- HSBC

Activity in China's services sectors continued to expand in May, albeit at a slower pace, the latest survey from HSBC and Markit Economics revealed on Thursday.

The services PMI saw a score of 50.7 last month, the bank said - down from 51.4 in April.

The composite PMI climbed into expansion at 50.2 in May - up from the revised 49.5 in April (originally 49.4).

A reading above 50 signals expansion in a sector, while a score below means contraction.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 22 pips price movement by CNY - HSBC Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.06 12:37

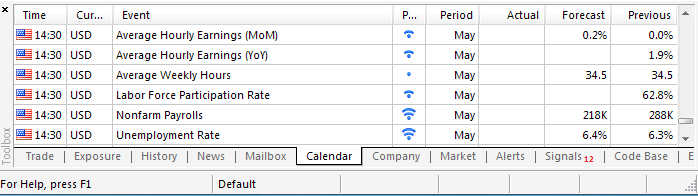

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

- U.S. Non-Farm Payrolls (NFP) to Increase 200+K for Fourth Consecutive Month.

- 288K Print in April Marked the Highest Print Since January 2012.

U.S. Non-Farm Payrolls (NFP) are projected to increase another 215K in

May, but the data print may spur a mixed reaction in the EUR/USD as the

jobless rate is expected to widen to an annualized 6.4% from 6.3% the

month prior.

What’s Expected:

Why Is This Event Important:

Despite the ongoing improvement in the labor market, it seems as though the Federal Open Market Committee (FOMC) will stick to its current approach at the June 18 meeting, and we would need to see a marked pickup in NFPs to see a material shift in the Fed’s policy outlook at Chair Janet Yellen remains in no rush to normalize monetary policy.

The ongoing improvement in business sentiment along with the resilience in private sector consumption may encourage U.S. firms to further expand their labor force, and a positive development may spur a bullish reaction in the greenback as it puts increased pressure on the Fed to move away from its highly accommodative policy stance.

Nevertheless, the rise in planned job-cuts paired with the persistent

slack in the real economy may ultimately generate a disappointing labor

report, and a dismal print may heighten the bearish sentiment

surrounding the reserve currency as it drags on interest rate

expectations.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 215K+; Unemployment Holds Steady

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

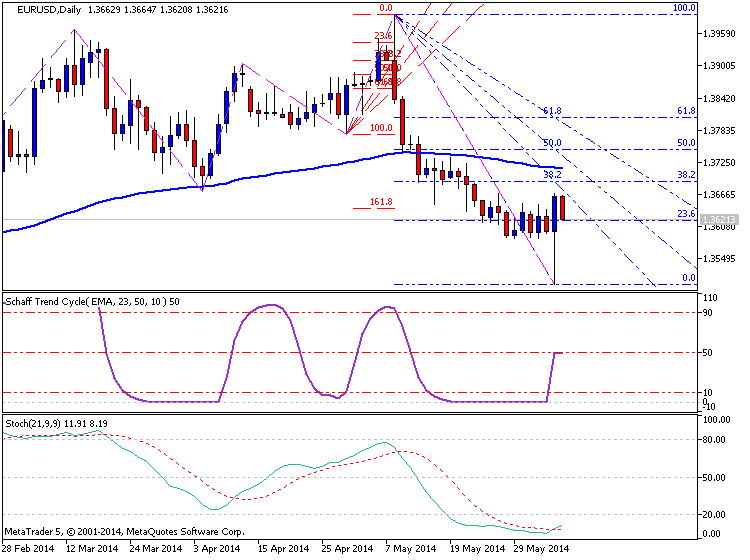

EUR/USD Daily

- Failure to Close Above Former Support Favors Bearish Forecast

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3780 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

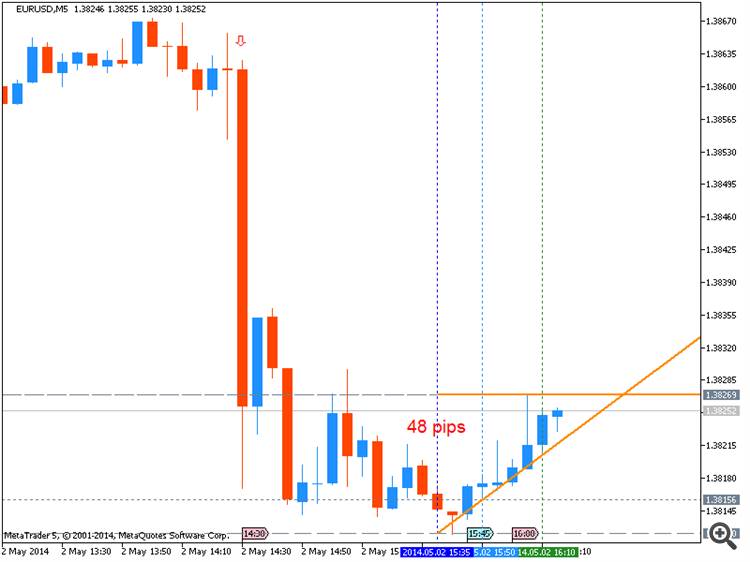

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| APR 2014 | 5/2/2013 12:30 GMT | 218K | 288K | -47 | +12 |

EURUSD M5 : 48 pips by USD - NFP news event

U.S. Non-Farm Payrolls increased 288K in April following a revised 203K

rise the month prior, while the jobless rate unexpectedly slipped to an

annualized 6.3% from 6.7% as discouraged workers continued to leave the

labor force. The better-than-expected NFP print pushed the EUR/USD back

down towards the 1.3800 handle, but the market reaction was certainly

short-lived as the pair ended the day at 1.3871.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 26 pips price movement by USD - Non-Farm Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

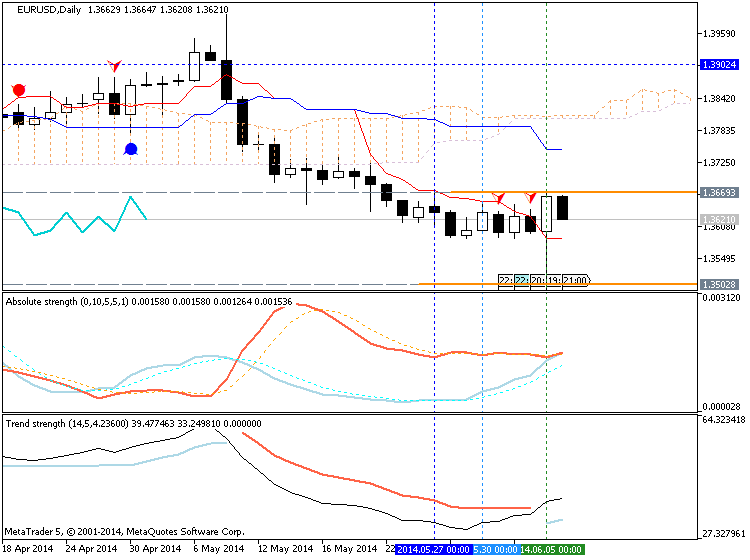

D1 price broke Ichimoku cloud border (Sinkou Span A line) to be reversed from bearish to primary bullish market condition on D1 timeframe and stopped by 0.9312 and 0.9335 resistance levels. Besides, Chinkou Spam line crossed the price for possible breakout and for primary bullish to be continuing.

H4 price is on ranging market condition located inside Ichimoku kumo trying to break one of the border of the cloud for the reversal from bearish to bullish.

W1 price is located below Ichimoku cloud with flat condition for possible breakout of Sinkou Span A line for possible reversal to ranging bullish.

If D1 price will break 0.9335 resistance level so the primary bullish will be continuing.

If not so we may see the ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-06-01 23:30 GMT (or 01:30 MQ MT5 time) | [AUD - AIG Manufacturing Index]

2014-06-02 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-06-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-06-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-06-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]

2014-06-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-06-03 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-06-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]

2014-06-03 23:30 GMT (or 01:30 MQ MT5 time) | [AUD - AIG Services Index]

2014-06-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - GDP]

2014-06-04 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-06-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-06-04 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-06-05 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

2014-06-05 22:30 GMT (or 00:30 MQ MT5 time) | [AUD - AIG Construction Index]

2014-06-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bullish reversal

TREND : ranging

Intraday Chart