Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.04.25 06:49

Why Traders Lose Money (based on dailyfx article)

- There is a large chasm between trading and analysis.

- Analysis can assist with winning percentages, but this doesn’t always equate to profitability.

- Traders need to learn to manage risk if they ever hope to be consistently profitable.

When a trader first gets started, it might be hard to imagine how getting control of losses can seem an impossible task. It may even feel like the cards are stacked against you… situations in which you’re right in your analysis, yet you still lose on the trade and watch capital disappear from your trading account.

So, a natural question is why some traders consistently make money while others lose, even when they’re right. That is what we will be investigating in this article.

The Difference between Trading and Analysis

Many new traders come to the market with a bias or point-of-view.

Perhaps this is built from a background in economics, or finance, or

maybe just a keen interest in politics. But one of the biggest mistakes a

trader can make is harboring the expectation that ‘the market is wrong

and prices have to come back.’

But let’s face it: Markets are unpredictable, and it doesn’t matter what

type of analysis you use. As new information comes into the market,

traders and market makers price it accordingly; because these folks

don’t want to lose money just as much as you don’t want to lose money.

Is this to say that analysis is worthless? Absolutely not: It merely

means that analysis is only a part of the equation of being a successful

trader. Analysis is a way to potentially get the probabilities on the

trader’s side, even if just a by a little bit; a way to maybe get a 51%

or 52% chance of success as opposed to a straight-up coin flip.

Good analysis, whether it be fundamentally-driven or technically-driven,

can be right a majority of the time. But no form of analysis will ever

be right all of the time. And this is the reason that there is such a

large chasm between analysis and trading.

In analysis, it doesn’t matter how wrong you are when you aren’t right.

In trading, this matters quite a bit. Because even if you’re winning on

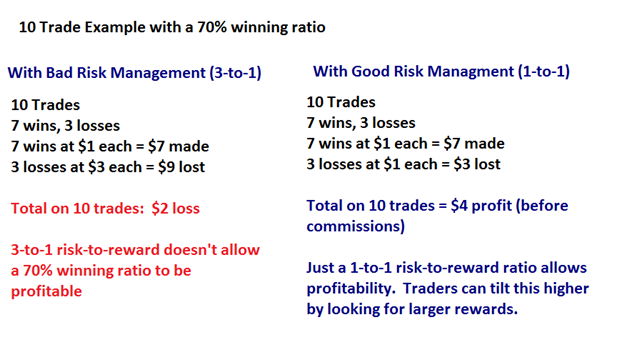

70% of your trades, if you’re losing $3 for every trade in which you’re

wrong but only making $1 every time that you’re right, you’re still

losing. It might feel good, because 70% of the time you’re walking away

from your positions with the feeling of success; and as human beings

this is something we generally strive for (to feel good).

The example below shows how bad risk management can destroy even a strong winning percentage of 70% success.

But logically, it doesn’t make sense to embark on this type of endeavor

because the goal of trading is to make money; not necessarily to just

‘be right’ more than 50% of the time.

How to actually trade analysis

First thing first, traders need to crystallize what their actual goal is

in trading in markets; and point-blank, that goal should be to make

money.

After that, traders need to expect that they will, at times, be wrong.

So given these two facts, the next logical assumption is that without

being able to control the damage from those instances in which we’re

wrong, the prospect of profitability is a distant one.

So risk management isn’t just a preference or a style of trading: It’s a

necessity for long-term profitability. Because even if you’re winning

90% of the time, the losses on the other 10% can far outstrip the gains

that are made on the 90%.

I fully realize this isn’t necessarily exciting information. When I

teach risk management, rarely do a see a student-trader ready to burst

out of their seats to go and manage some risk. Most people want to hear

about entry strategies, and analytical methods to try to get those odds

of success tilted even higher in their favors.

But until a trader learns to manage their risk, much of this additional

work is a moot point. Because as long as the risk exists that one bad

position can and will wipe away the gain from many other ‘good’

positions; that trader is going to struggle to find profitability.

So, to properly trade analysis one needs to first observe proper risk

management. Because trading isn’t just ‘guessing’ and ‘hoping’ that we

get it right. Profitable trading is implementing analysis while properly

managing risk factors; implementing a defensive approach so that when

one is wrong, the losses can be mitigated and when one is right, profits

can be maximized.

How can one begin to use ‘proper’ risk management?

We’ve already encountered one of the biggest mistakes of risk

management, and that’s controlling the size of the losses relative to

the size of the gains.

The solution is simple; implementing it not as much. As human beings,

we often follow our gut instincts or our ‘feelings.’ But in trading, we

have to keep the bigger picture in mind. When we place a trade, we often

try to win on that one trade. This can keep traders holding on to

losers for far too long, and closing out winners way too quickly.

At the beginning of his I was so when new forex trading, I think that I can do victory in a way that is so easy.

But in fact the assumption was wrong. And I lost a lot of money

I think that forex trading is an analysis that uses the luck factor. But hopefully my assumption is wrong

At the beginning of his I was so when new forex trading, I think that I can do victory in a way that is so easy.

But in fact the assumption was wrong. And I lost a lot of money

I think that forex trading is an analysis that uses the luck factor. But hopefully my assumption is wrong

Sorry but i have to disagree with you. Forex is no luck. It is a combination of fundamental and technical-analysis (link was deleted by moderator) and of controlling empotions.

In my opinion, the best way to trade in this market is to create a strategy that are always based in the concept of good winning rate and better RR ratio, so considering that the trader is psychologically stable and discipline, operating below the mentioned parameters will always end up a loser, but most traders use strategy that is way below this standards that is why most of them at the losing end.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use