Forum on trading, automated trading systems and testing trading strategies

Indicators: Pivot Lines TimeZone

newdigital, 2014.01.30 11:06

How to Use Forex Yearly Pivot Points to Forecast Euro Targets (based on dailyfx article)

- Pivot points is a popular and easy way that traders can identify potential support and resistance

- Pivot points are based on a mathematical calculation that uses the previous high, low and close of a specified period; weekly, daily, monthly, yearly

- Yearly pivots can forecast maximum and minimum price extremes for the coming year as well as areas where price can change direction.

While most traders are familiar with daily, weekly, and even monthly pivots which fit their type of trading, yearly pivots can also be used to forecast future potential support and resistance areas. Buying at or near a significant area of support and selling at a key area of resistance is the main focus of any trader no matter what the market or the duration traded. Yearly pivots can be monitored for those key trading opportunities.

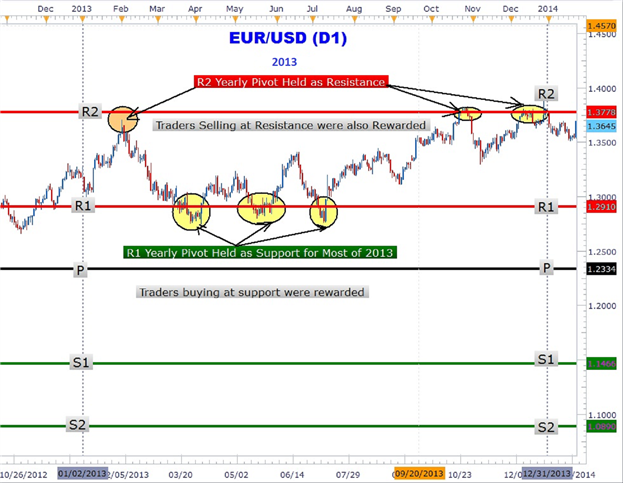

As you can clearly see in the Euro chart above, forex yearly pivots have been plotted. Notice how the Euro rallied up to the R2 pivot and turned around sharply falling over 600 pips in February. Another significant area that can be easily seen showing the power of yearly pivots is the triple touch of the R1 yearly pivot at 1.2910. The third and final touch led to over a 600-pip rally back to the R2 yearly pivot to close out 2013 up over 4%.

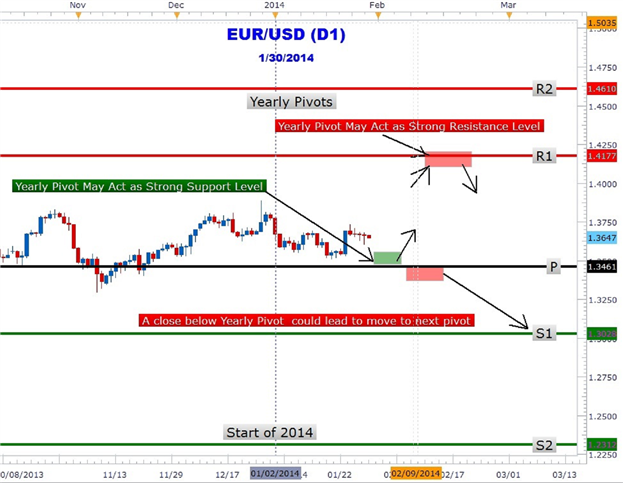

Could forex yearly pivots show traders the next move in the Euro? In the chart above the 2014 yearly pivots are plotted on the EURUSD chart. The year is just getting started and the great thing about yearly pivots is only having to draw them once a year! EURUSD is trapped between the central pivot at 1.3461 and R1 at 1.4177. As at the time of this writing, the Euro has not tested either pivot. However, forex traders may be waiting for a move down to the central pivot (1.3461) for a move back toward the R1 (1.4177) yearly pivot resistance.

Alternative scenario is for the Euro to make an immediate run for it up to the R1 level. At R1 pivot resistance, traders may look to take profit on their longs and/or short the Euro at this level. However, a close above R1 could lead to a move higher to the R2 pivot (1.4610). Traders should also consider the possibility of a close below the central pivot that could lead to a prolonged down push to the S1 (1.3028) level.

Forex traders who scalpers, position or swing traders can make use of yearly pivots to locate key areas of support and resistance. Look for future articles on other currency pairs that lay out the yearly pivot ‘landscape’ to help you navigate the forex market.

Scalp Forex Breakouts with Pivot Points (based on dailyfx article)

- Pivots can help easily identify support & resistance levels

- Traders should monitor R4 and S4 values for breakouts

- As with any strategy, identify areas to exit your position

Scalping with Pivots

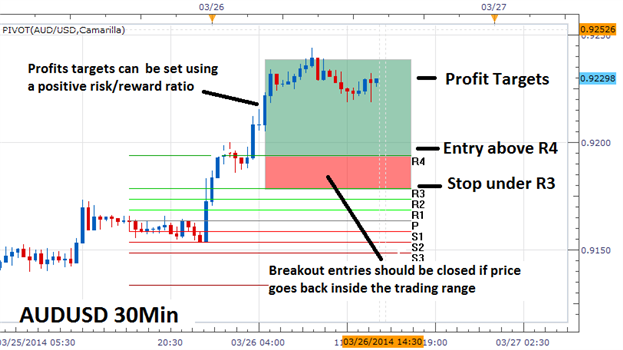

Pivot points can be great ways to identify key levels of support and resistance for the day trader. There are many types of pivots we can use and in today’s example, we will use camarilla pivots added to today’s AUDUSD graph seen below. Key levels of resistance are denoted with a green line (R1-4) while key levels of support (S1-4) are denoted by a red line.

In an uptrend, such as the AUDUSD chart below, traders will want to watch for a breakout above resistance. As R4 is the last line of resistance this line is an opportune place to look for potential market entries. Let’s look at a sample setup.

Breakout Entries

Once you have identified support and resistance, it is time to plan your entry. The most common methodology of trading breakouts is to set entries to buy a currency pair, in an uptrend, when resistance is broken. As well, traders can look to sell levels of support in a downtrend as price breaks to lower lows. This can be done using entry orders to enter the market as soon as price moves beyond one of these values.

Market orders can also be used to trade breakouts. This method is normally preferred by traders who have time to remain in front of their trading console and monitor their positions. Traders using market orders may often wait for one candle close to confirm a breakout prior to entering into their trade. Regardless of the entry method preferred, the objective is still the same.

Managing Risk

The last portion of any active trading strategy is to manage risk. When using pivot points, these pricing levels become fairly intuitive. When buying a breakout over R4, trades can be managed by placing stops under the R3 value. In the event that prices begin mobbing back through earlier levels of resistance, traders will want to exit the market at the first available convenience.

Once a stop has been placed, traders can then extrapolate their profit target. A simple methodology is to extrapolate a positive risk reward ratio of a traders choosing. This ensures in the event that the trade moves favorably profits are maximized, while cutting losing positions as quickly as possible.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Pivot-2:

Author: Nikolay Kositsin