You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Head And Shoulders Chart Pattern

More video :

In this video we will show traders how to day trade using one of our favorite day trading tools, Bollinger Bands.

Created by John Bolliger in the 1980's, Bollinger Bands help traders recognize market volatility, and when used correctly, one of the few indicators that can be used to identify trending AND trend fading opportunities in the market.

Forum on trading, automated trading systems and testing trading strategies

Indicators: Bollinger Bands ®

newdigital, 2013.08.06 13:54

Bollinger Bands and Volatility

When volatility is high; prices close far away from the moving average, the Bands width increases to accommodate more possible price action movement that can fall within 95% of the mean.

Bollinger bands will widen as volatility widens. This will show as bulges around the price. When bollinger bands widen like this it is a continuation pattern and price will continue moving in this direction. This is normally a continuation signal.

The example below illustrates the Bollinger bulge.

High Volatility and Low Volatility

When volatility is low; prices close closer towards the moving average, the width decreases to reduce the possible price action movement that can fall within 95% of the mean.

When volatility is low price will start to consolidate waiting for price to breakout. When the bollinger bands is moving sideways it is best to stay on the sidelines and not to place any trades.

The example is shown below when the bands narrowed.

Forum on trading, automated trading systems and testing trading strategies

Indicators: Bollinger Bands ®

newdigital, 2013.08.06 14:04

Bollinger Bands Trend Reversals- Double Tops and Double Bottoms

A Forex trader should wait for the price to turn in the opposite direction after touching one of the bands before considering that a reversal is happening.

Even better one should see the price cross over the moving average.

Double Bottoms Trend Reversals

A double bottom is a buy setup/signal. It occurs when price action penetrates the lower bollinger band then rebounds forming the first low. then after a while another low is formed, and this time it is above the lower band.

The second low must not be lower than the first one and it important is that the second low does not touch or penetrate the lower band. This bullish Forex trading setup is confirmed when the price action moves and closes above the middle band (simple moving average).

Double Tops Trend Reversals

A double top is a sell setup/signal. It occurs when price action penetrates the upper bollinger band then rebounds down forming the first high. then after a while another high is formed, and this time it is below the upper band.

The second high must not be higher than the first one and it important is that the second high does not touch or penetrate the upper band. This bearish Forex trading setup is confirmed when the price action moves and closes below the middle band (simple moving average).

I recently got asked the question, how much should one risk per trade in forex? This is a good question, my recommended answer is to keep your risk under 2%, that way even if you get a losing streak of three trades in a row you only draw down your account by 6%. For even safer trading or for learners of the Forex Market I recommend even keeping the risk level under 1%.

Forum on trading, automated trading systems and testing trading strategies

Traders Joking

newdigital, 2014.02.27 06:34

"The 1% Rule

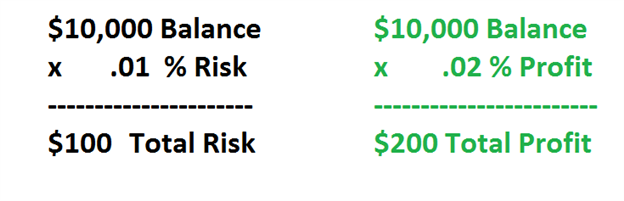

While no one wants to experience a loss on their account, it is an inevitable part of scalping. Because of this, it is always important to have a plan of action to manage risk before entering into a trade. While placing a stop is important, traders should also consider the 1% rule. This means that traders should never risk more than 1% of their account balance on any one trading idea. That means using the math above, if you are trading a $10,000 account you should never risk more than $100 on any one positions.

The 1% rule can also be coupled with a favorable risk reward ratio. Using a 1:2 setting, this means if we risk 1% in the event of a loss, at minimum we should look to close our trades out for a 2% profit. This would translate into a $200 profit on a $10,000 account balance. Now that you are familiar with the 1% rule, let’s look at our next risk management tip."

Walker England, Trading Instructor, The Definitive Guide to Scalping, Part8: Risk Management

===============