You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overview of the main economical events of the current day - 21/05/2013

The dollar is corrected before the key events of Wednesday

The dollar decreased on Monday against all currencies in anticipation of the publication of the minutes of the last FED meeting and Ben Bernanke's speech in Congress, both events will take place on Wednesday. The dollar's corrective decline started after 7-days growth and due to technical factors – after the dollar reached 3-years maximum last week amid rumors and expectations of a more rapid closing up of QE-3 program.

On Monday there were no any significant statistics data but Chicago FED report on manufacturing activity in its region was also negative for the dollar. Chicago Federal National Activity Index – CFNAI dropped to -0.53 in April from -0.23 in March while three of four components of the index showed a decline.

The yen rose on Monday from the minimum of 2008 after Japan's Economy Minister Akira Amari said that a further decline of the national currency could have negative consequences for the economy and could worsen the quality of life of people.

"Correction of excessively strong yen basically has come to an end", Amari said. According to the Reuters poll, 48% of firms in Japan want USD/JPY pair maintain near the level of 100 yen to the dollar particularly due to the fear of import costs growth while the yen is weak.

On Tuesday a 2-days meeting of the Bank of Japan starts, its results will be announced on Wednesday.

The euro demonstrated growth amid stronger industrial orders in Italy. They rose in March for the first time during five months by 1.6% while only 0.6% growth was expected. The increase was mainly due to foreign demand. Italy's economy has been reducing since the summer of 2011, and industrial production volume now is more than 20% lower its peak in 2007.

The pound also has risen, which was supported by the real estate market data. The report from the Rightmove showed that housing prices in Great Britain rose by 2.1% in May. It is the fifth monthly growth in a row which is connected with the limited supply. The annual increase was 2.5%, much higher than 0.4% growth in the previous month. Rising housing prices prove that the assets-buying program of the Bank of England and the loan financing scheme start to bring favorable results.

New Zealand dollar also finished Monday with a growth after having lost almost 6% of its value at the beginning of May. The reason for the corrective bounce up was the speech of the Minister of Finance who reported the rapid growth of real estate prices. If this price increase continues, it may make the Reserve Bank of New Zealand to raise interest rates.

JPMorgan Bank lowered the target level for the pair AUDUSD for the second quarter to 0.99 from 1.05. Meanwhile, according to Wall Street Journal poll, 15 economists on average expect that at the end of 2013 the Australian dollar will be traded at parity against the U.S. dollar.

The FED's representative Charles Evans announced on Monday that soft monetary policy would last till the inflation rate becomes lower than 2%. A bond buying program will be prolonged till a significant improvement in the labor market with 5.25%-6% unemployment rate. Another FED representative Richard Fisher said that the completion of the purchase of all the securities at the same time would have too negative influence. And there is no stable growth of jobs which is favorable to be seen.

By MasterForex Company

Overview of the main economical events of the current day - 22/05/2013

The pound slumped at the inflation data

The dollar almost didn't change on Tuesday to the dollar index – it rose against the franc, yen, Canadian dollar and pound but fell against the euro. The pound fell sharply after the release of manufacturing and consumer inflation data. Inflation rate slowed in April due to energy prices decline and oil prices fall by 6.8%

UK producer prices (PPI Output) increased in April by 1.1%, with expectations of 1.4% growth, which was the lowest annual rate since September, 2009.

The consumer price index (CPI) rose by 2.4% (vs. +2.6% forecast) and by 0.2% (vs. +0.4% forecast). Annual consumer inflation was the lowest since September, 2012.

Core CPI also did not meet the forecast of +2.3% and rose by just 2.0%, which was the lowest figure since November, 2009.

UK CPI Percentage change over 10 years:

Inflation figures reduction will give the future head of the Bank of England, Mark Carney more space to ease monetary policy after he takes up the post at the end of June. The pound recovered from the middle of March expecting that the Bank of England wouldn't provide further stimulation due to the fears that the inflation could get out of control. HSBC Bank believes that in the nearest 2-3 weeks the pound can sink again to 2013 low of about 1.48.

The euro rose on Tuesday after the speech of FOMC Member James Bullard and FOMC Member William Dudley. Bullard announced that the Fed should continue to buy bonds "correcting purchase rates according to the incoming data on the real economic growth and inflation". It can be a purchase upward correction as the inflation is relatively lower than the central bank's target level of 2% and it can fall even more. Bullard didn't make any comments whether the Fed should stop buying bonds.

The Swiss franc sank on Tuesday after the International Monetary Fund's report that supported the policy held by the Swiss National Bank. According to the IMF the Swiss National Bank should continue protecting the minimum limit for the euro/franc at 1.20. It also marked that Switzerland should not go back to a free floating exchange rate until deflationary pressure weakened and the economic recovery got stronger.

The Canadian dollar fell on Tuesday amid falling prices for commodities. Besides the CAD is under pressure of consumer inflation weak data which were released last week. The last speech of the governor of the Bank of Canada, Mark Carney had almost no influence on the CAD. He said about the success of Canada in the financial crisis and about the economic recovery.

Markets are waiting for Fed Chairman Bernanke to testify on outlook for the U.S. economy before the Joint Economic Committee of Congress on Wednesday. This speech can be more important than the publication of the minutes of the last Fed meeting which will take place a few hours after Bernanke's speech.

By MasterForex Company

Overview of the main economical events of the current day - 23/05/2013

Fed can start to curtail asset-buying program at one of its nearest meetings.

The dollar rose on Wednesday against all major currencies amid the Fed Chairman Ben Bernanke's speech in the Congress and the publication of the minutes of the last Fed meeting. At the beginning of Bernanke's speech the dollar slumped after he had said that premature tightening of Fed monetary policy could hurt economic recovery.

Market participants decided that the Fed was sure to continue its asset-buying program. Existing home sales data which turned out worse than expected also influenced the dollar's fall. Existing home sales volume reached the level of 4.97 mln houses while the growth of 4.99 mln was expected.

However, then the dollar rose sharply after Bernanke had said that "the Fed will gradually reduce the amount of bond purchases" and that "the Fed can reduce the amount of bond purchases at the next meetings if the data will allow to do it". All this increases the importance of the U.S. macroeconomic data.

The published minutes of the last Fed meeting showed that the question of an earlier curtail of incentive programs is seriously discussed among the FOMC members. However, there are significant disagreements concerning the timing of QE curtail start, which was shown at their last meetings.

"A number of leaders expressed their willingness to slow the pace of bond purchases at the meeting in June if the economic data published by that time will show a fairly strong and steady growth of the economy. However, the leaders had different opinions about the required evidences and the probability of such outcome", - according to the minutes.

USD/JPY pair grew up to the maximum of October, 2008 after the Bank of Japan made a decision not to change its monetary policy at the meeting on Wednesday. The Bank of Japan confirmed its plans to double the monetary base for two years. Also in April the deficit of trade balance became worse in Japan, it is being maintained for 10 months in a row. The yen decline hasn't had an affect on foreign trade yet.

The euro fell on Tuesday but this decline didn't last long. The trade surplus reached its record height of 25.9 billion euro in March partly due to the growing export.

But a sharp fall was shown by the pound after the release of retail sales data which were much worse than expected. Retail sales volume fell by 1.3% against the forecast of 0.1%.

Source: ons.gov.uk

The Swiss franc sank to a two-year low against the euro after the president of the Swiss National Bank, Thomas Jordan announced that there was a possibility to adjust the lower limit of EUR/CHF pair and also to introduce negative interest rates in case of necessity.

Australian dollar fell on Wednesday after consumer sentiment data in Australia from the Westpac showed the sentiment worsening for the second month in a row. Earlier the Australian Bureau of Statistics has warned of the possibility of a sharp slowdown in mining investment and the energy sector for the next five years.

By MasterForex Company

Overview of the main economical events of the current day - 24/05/2013

Manufacturing PMI shows a decline in China

The dollar weakened on Thursday against all major currencies showing a corrective fall and recovering the previous day's growth despite rather good macrostatistics data. Most of all the dollar fell against the yen amid a sharp fall of Japanese share index Nikkei that slumped by 7.3%, which has become the strongest adjustment since March, 2011 when it fell because of the earthquake. Stock markets started to fall the day before when Bernanke announced about the possibility of an earlier curtail of incentive programs. Another reason of decline was the release of HSBC manufacturing PMI data of China.

HSBC Flash Manufacturing PMI

Source: markiteconomics.com

HSBC preliminary PMI slumped unexpectedly in May to 49.6 from 50.4 last month while no changes were forecasted. It fell for the first time during 7 months below 50, which separates activity growth from its fall. It made the situation worse and market participants started to reconsider their estimation of economic outlooks of China. In May there was a sharper decrease of new orders and employment sub-indices while export order rate slowed.

A sharp fall of the dollar against the yen stimulated its decrease against other currencies. The euro grew amid the release of better manufacturing PMI than expected. Meanwhile the service PMI turned out worse than forecasted. Besides, it is still below 50, which indicates activity decline. Preliminary composite index PMI for the whole eurozone rose up to 47.7 in May from 46.9 with the forecast of 47.2.

The pound rose on Thursday amid the release of the second estimate of GDP for the first quarter, which remained unchanged. At the same time household spending of Great Britain rose in the first quarter at the slowest pace for 18 months despite a slight increase in earnings in the period.

Released US data on Thursday turned out better than forecasted indicating a further USA economic recovery. The number of initial jobless claims last week decreased more significantly than expected – to 340 thousand with a forecast of 346 thousand. The USA primary housing market sales rose by 2.3% in April having reached the highest level since July, 2008 – 454 thousand houses in annual basis with the forecast of 425 houses.

FHFA housing price index rose by 1.3% m/m in March with expectations of growth by only 0.8%. In annual basis housing prices rose by 7.2 % in March. Kansas City Fed composite index for manufacturing sector rose up to 2 in May against -5 in April. Index above zero indicates activity growth. The index growth is recorded for the first time since September, 2012.

The Australian dollar sank to its 11-month low after the release of PMI data of China but at the end of the day it showed some growth. Consumers' inflation expectations from Melbourne Institute grew up to +2.3% in May in comparison with +2.2% last month.

By MasterForex Company

Overview of the main economical events of the current day - 27/05/2013

Consumer sentiment in Germany reached multi-year highs

The end of Friday showed a little change of EURUSD although at the beginning the euro was rising after GfK release of the consumer confidence index in Germany and a more important index of business sentiment in Germany from IFO which turned out better than expected. But then the euro started to fall after the release of the US durable goods orders data which almost twice exceeded the expectations.

GfK report showed that consumer sentiment in Germany reached 6-year high. The leading indicator of consumer confidence in Germany rose up to 6.5 points in June from 6.2 points in May although no changes were expected. The index has been growing for 5 months in a row and its value is the highest since September, 2007. Labor market is still sound and the growth of wage level improves household income and increases its readiness for large purchases.

Source: gfk.com

The survey of the IFO research institute which is considered a barometer of business sentiment showed a growth of business confidence in Germany after its 2-month fall. Business sentiment index of Germany grew up to 105.7 in May from 104.4 in April exceeding the forecasts of economists who expected the index to remain without changes. Only the subindex of the current conditions rose up to 110.0 while the subindex of expectations remained at the same level of 101.6. Business sentiment index is an average of current conditions index and expectations index.

Also on Friday, the National Statistical Office of Germany provided the final data of the economic development in the first quarter. Germany's GDP dropped by 0.2% in annual basis and rose by 0.1% in quarter basis, which coincided with the initial estimation. Consumer optimism growth and improvement of business confidence indicate a possible Germany's GDP acceleration of growth in the following six months which can rise by 0.5% by the end of the year.

Friday's release of the data of the US durable goods orders allowed the dollar to recover its positions. The orders rose by 3.3% in April with an expectation of growth by only 1.7%. Base orders for durable goods without the volatile components of orders for transportation equipment rose by 1.3% while a growth only by 0.5% was expected.

However by the end of the week the dollar had fallen against the euro and the yen and had risen a little against the pound and commodity currencies. According to the dollar index which reflects its relations towards the basket of six major currencies the dollar dropped by 0.88 during the week. Most of all, the dollar sank against the yen amid Japanese stock index Nikkei 225 dropped by almost 7% during the week. The decline in the Nikkei futures was even higher than 10% at the moment. USDJPY pair has shown lately a very high correlation with the Japanese stock market.

Also recently there has been strong correlation between the dollar and the U.S. stock market: the dollar rose with it as the money received by the US stock market also supported the dollar. Over the past week the broad market index S&P 500 dropped by 1.1% after Bernanke's speech in Congress where he said about the possible reduction of the incentive programs at future meetings, in case of economic conditions improvement. Stock market decline had a negative impact on the dollar.

By MasterForex Company

Overview of the main economical events of the current day - 28/05/2013

The main events of this week

The week started quietly, there were no any significant statistics data on Monday and due to the holidays the markets of the USA and Great Britain were closed. This week will not be oversaturated with macrostatistics data. On Thursday in eurozone the indexes of consumer confidence and different economic sectors will be released. Their slight growth is expected. On Friday there will be a release of preliminary consumer inflation and unemployment data. In Germany labor market data will be published on Wednesday.

As it is expected, the unemployment figures will indicate that the situation in the eurozone economy remains difficult amid the pressure from the economy measures. There is a forecast of employment decline in the eurozone except Germany where the situation is more favorable, which was shown by business and consumer confidence indexes last week.

Also retail sales data of Germany will be released on Friday; a slight growth is expected in comparison with the previous month. In France consumer spending data will be published on Friday which will probably show a decrease due to a small household confidence, which has a negative influence on consumption.

In Great Britain CBI Realized Sales will be published on Wednesday, Nationwide Housing Prices – on Thursday and consumer and mortgage lending data – on Friday. The number of approved mortgages is expected to increase slightly as well as consumer lending in April. GfK Consumer Confidence, also released on Friday, is likely to show a subdued consumer confidence amid an uncertain economic recovery.

In the USA CB Consumer Confidence index will be released on Tuesday. It is forecasted to rise considering a rather strong growth of Michigan University preliminary sentiment index which will be finally released this Friday. S&P/Case-Shiller Composite-20 HPI will be released on Tuesday.

The US Preliminary GDP and Pending Home Sales will be released on Thursday. The GDP growth estimate is not expected to be reconsidered. On Friday there will be a release of Chicago PMI and consumer spending and income data for April. It is expected that the household sector has begun the second quarter insecurely. Personal income grew by only 0.1%, while consumer spending remained unchanged.

On Wednesday Bank of Canada Rate Decision will be held and no changes in the monetary policy are expected. The Bank of Canada Rate Statement will be examined thoroughly for any signals of the central bank position change. The meeting will be headed by Mark Carney. At the end of the week he will leave for Great Britain to take over the reins at the Bank of England. On Friday Canada’s GDP will be released.

Building Approvals and Private Capital Expenditure data will be published on Thursday. The companies are expected to continue lowering their forecasts of capital expenditures during the year. On Friday ANZ Business Confidence will be released.

Besides, on Friday there will be a release of consumer inflation data of Japan for April which is expected to have some adjustment due to the introduction of a quantitative easing program. If the CPI shows some growth, it can support USDJPY.

At the debt market Italy will sell medium-term bonds (CTZ and BTP€i) on Tuesday, and 5-year and 10-year bonds – on Thursday. In the USA medium-term bonds with a total amount of 99 billion dollars will be sold from Tuesday to Thursday.

28-May (UTC Time)

08:00 the Netherlands to Sell Up to € bln 2023 Bonds

09:00 Italy to Sell Up to €3.5 bln 2014 and 2018 Bonds (CTZ and BTP€i)

10:00 Belgium to Sell 2018, 2023, 2032 and 2035 Bonds

17:00 the USA to Sell $35 bln 2-Year Notes

29-May

09:00 Italy to Sell Bills

17:00 the USA to Sell $35 bln 5-Year Notes

30-May

09:00 Italy to Sell 5- and 10-Year Bonds

17:00 the USA to Sell $29 bln 7-Year Notes

By MasterForex Company

Overview of the main economical events of the current day - 29/05/2013

Consumer Confidence in the USA reached a 5-year high

The US dollar showed a significant drop on Tuesday after the release of positive macroeconomic data on the back of a rally in the stock market. The DJIA rose by 0.69% and reached its record high. The USA real estate market data and consumer confidence data pleased the buyers of the American currency again. It is proved by a steady recovery of the US economy in comparison with other countries, which makes an earlier exit from the incentive programs possible – which in turn makes the dollar more attractive for investors.

CB Consumer Confidence of the USA rose up to 76.2 revised upwards from April’s 69.0. It is the highest reading since February, 2008. Further growth of optimism about the future of economy can cause an increase of consumer spending which accounts for 70% of GDP.

According to the Standard & Poor’s survey S&P/Case-Shiller Composite-20 HPI accounted for 10.87% in March year-on-year while a growth only by 10.05 was expected. Prior month data were also revised upwards. Price growth was facilitated by low mortgage interest rates, a decreased number of property alienation cases and a reduction at the housing market.

The euro and the franc fell on Tuesday. According to the French National Bureau of Statistics Insee Consumer Confidence sank to 79 which is the lowest level since July, 2008. The index was expected to grow up to 85. Switzerland's trade balance also turned out worse than expected. Trade balance surplus fell to the level of 1.73 billion Swiss francs in comparison with 1.89 billion Swiss francs in March while an increase by 2 billion was forecasted.

The yen dropped against most currencies on Tuesday on the back of the growth of Japanese stock market. Japan's Economy Minister Akira Amari said on Tuesday that "Japan's stock market is expected to leave the zone of turbulence". It boosted the share prices ad supported the USDJPY. BOJ Board Member Ryuzo Miyao also announced on Tuesday that the Bank of Japan was not going to hold a quantitative easing as long as it would be necessary until the goal of 2%-inflation would be reached.

The Canadian dollar slumped on Tuesday against the US dollar to its lowest level since June, 2012 – before Canada’s Central bank meeting which will be held on Wednesday. The meeting of the central bank of Canada will be the last one with Mark Carney as the governor of the Bank of Canada. Although interest rate is not expected to change, the Bank of Canada can change the forecast of economic growth and inflation.

By MasterForex Company

Overview of the main economical events of the current day - 30/05/2013

The dollar is going down

The dollar weakened significantly recovering from its growth on Tuesday. There were no any important data about the USA on Wednesday. One of the main causes of the adjustment decline was a fall of stock markets which influenced the decrease of USDJPY. And then the dollar continued to weaken against all currencies. Taking profit and bad labor market data of Germany had an influence on the fall of stock markets.

Unemployment change in Germany rose by 21 thousand people against the forecast of 4 thousand. The prior month reading was also revised downward from 4 thousand to 6 thousand. Unemployment rate hasn’t change and accounted for 6.9% Nevertheless, the labor market in Germany is still strong despite a deep recession in eurozone where the unemployment level was 12.1% in March. Private loans in eurozone fell by 0.9% in April against the prior month reading of -0.7%. Meanwhile Italian Business Confidence turned out much better in May than it was expected – 88.5 against 87.9 in April.

The data concerning Great Britain were not brilliant. CBI Realized Sales (CBI - Confederation of British Industry) fell to -11 in May, which is the lowest reading since January, 2012. By the end of the day the euro and the pound had risen despite some confusing data. According to the Commerzbank poll released on Wednesday, German companies are more optimistic about the outlook for the euro in the next three months than they were in April and March.

The euro growth was probably supported by an article in the German newspaper Die Welt which referring to unnamed ECB representatives reported that Jens Weidmann, Jörg Asmussen and Yves Mersch were against bond purchases on ECB balance secured by assets. Jörg Asmussen voted against rate lowering in May and Mersch opposed the use of non-standard measures. Another board member Christian Noyer announced on Tuesday that he was not sure whether reducing of deposit rate had sense. All this will complicate the head of the ECB Mario Draghi’s further easing of monetary policy although anyway sooner or later it will be necessary.

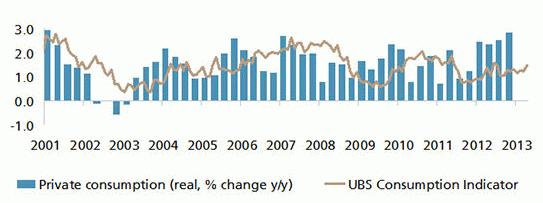

The franc rose on Wednesday on the back of consumption growth. UBS consumption indicator rose significantly in April up to 1.46 in comparison with March reading 1.24 revised downward. A positive trend was supported by the registration of new cars, consumer sentiment and demand for hotel accommodation.

Source: ubs.comThe Canadian dollar rose on Wednesday amid falling U.S. dollar and the planned meeting of the Central Bank of Canada. The Bank of Canada left the interest rate at the level of 1% having said that it “had sense” but further it may need a rate increase. Canada's GDP growth in the first quarter will be stronger than the expected 1.5% but the total and core inflation will remain subdued.

Organization for Economic Co-operation and Development (OECD) decreased its world economy growth forecast from the previous estimate 3.4% to 3.1% in its semi-annual Economic Outlook published on Wednesday. Besides the eurozone and China’s economy growth forecast was decreased. However the OECD appeared optimistic towards the USA expecting that its economy would rise in 2013 by 1.9% and by 2.8% in 2014. The forecast for Japan was also increased up to 1.6% from 0.7% and the next year estimate was 1.4%.

By MasterForex Company

Overview of the main economical events of the current day - 31/05/2013

EURUSD again trades above the 1.30 level

The dollar continued falling on Thursday amid rather weak macrostatistics data. Preliminary GDP, unemployment claims and pending home sales data turned out worse than expected. Weaker data can be considered a signal to continue the American economy incentive program, which is, no doubt, negative for the dollar.

According to the preliminary data the U.S. GDP grew in the first quarter of 2013 by just 2.4% year-on-year, not by 2.5% as expected. A slight decline of growth rate could be linked to a weaker inventories growth than it was initially expected.

The number of unemployment claims rose up to 354 thousand while the reading was forecasted to maintain at the level of 340 thousand. It is the third growth for the past four weeks, which can prove that the labor market may have lost its momentum of recovery.

According to the National Association of Realtors survey pending home sales index grew by 0.3% in April up to 106 – the highest level since April, 2012 – which hasn’t reached the forecasted growth by 1.5%.

The euro grew against the dollar on Thursday up to its 3-week high having risen above 1.30. In the first half of the day the euro was supported by the data from the European Commission. According to the data businesses and consumers in 17 countries of the euro-zone are less pessimistic about the outlook showing the first improvement of confidence since February. Economic Confidence which covers business and consumer confidence of the euro-zone rose up to 89.4 in May against 88.6 in April.

The pound and the franc also showed growth on Thursday following the euro. According to the country's largest mortgage company Nationwide Building Society, House Price Index in Great Britain rose by 1.1% in May, which became the highest annual rates of growth since November, 2011. The GDP of Switzerland rose by 0.6% q/q in the first quarter, which significantly exceeded the expected growth by 0.2%. The quicker rates of growth were mainly linked to the growth of private consumption expenditures and increased investment in the construction sector.

The Canadian and Australian dollars also strengthened on the back of rising prices for commodities. Canada’s deficit of current account decreased to 14.1 billion Canadian dollars in the first quarter in comparison with the revised upwards reading of 14.6 billion in the fourth quarter with expectations of 15.3 billion.

The number of building approvals in Australia rose by 9.1% m/m in April while the growth by 4% was expected. However Private Capital Expenditure suddenly dropped by 4.7%, while it was expected to rise by 0.5%. The number of building permits in New Zealand rose by 18.5% in April in comparison with March, which also significantly exceeded the expectations.

By MasterForex Company

Overview of the main economical events of the current day - 03/06/2013

The main events of this week

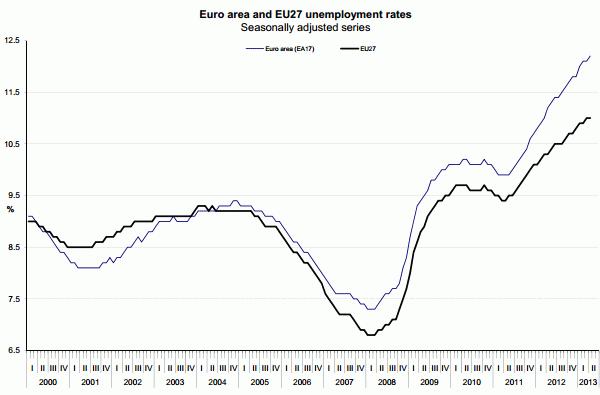

The euro dropped on Friday after the release of unemployment data in the euro-zone which reached a new record high 12.2% in comparison with 12.1% in March. In Italy unemployment rate rose up to 12% in April, which is the highest reading for 36 years. Realized sales in Germany fell by 0.4% in April - the third month in a row.

Source: epp.eurostat.ec.europa.euThe dollar grew on Friday on the back of a positive macrostatistics data release. Thus, Chicago PMI rose up to its highest level of 58.7 since March, 2012 while the level of 50 was expected. Revised upwards U. of Michigan Consumer Sentiment reached the highest reading 84.5 since July, 2007 after 76.4 in April.

At the same time, consumer income and expenditure report was a little disappointing. The incomes of the Americans didn’t change but the expenditure fell by 0.2%, which didn’t reach the forecasted readings.

Over the past week the dollar lost 0.41% according to the dollar index which shows its relation towards the basket of six major currencies. Most of all the Japanese yen rose against the dollar (+0.78%). Then follow European currencies: the Swiss franc (+0.64%), the euro (+0.50%) and the British pound (+0.49%). Commodity currencies dropped amid falling oil prices – the Canadian dollar (-0.55%), the Australian dollar (-0.83%) and the New Zealand dollar (-1.89%). But at the end of the month the dollar has shown growth in the dollar index by 1.93%. It is interesting that the US stock index DJIA rose exactly the same.

The first week of the month will be rich in macrostatistics data. Besides three meetings of the central banks, the US traditional labor market report is released on the first week and it will be one of the main events of the week. Preliminary ADP data will be received on Wednesday.

Also there will be a release of PMI, trade balance index (the USA, Canada, Australia, Germany, France, Great Britain, China) and realized sales index (Australia, euro-zone). And at the end of the week, on weekend, a large block of statistics of China will be released.

In the debt market an important day will be Thursday when the medium-and long-term bonds are sold by Spain and France. On Tuesday and Thursday Japan will sell 10-Year and 30-Year bonds.

3-Jun (time UTC+4)

12:00 the Netherlands to Sell 86-Day and 208-Day Bills

17:00 France to Sell Bills

4-Jun

07:45 Japan to Sell 10-Year Bonds

13:00 Austria to Sell 4.3% 2017 and 1.75% 2023 Bonds

13:30 Belgium to Sell Bills

5-Jun

13:30 Germany to Sell Up to EUR4 bln 2018 Bonds

6-Jun

07:45 Japan to Sell 30-Year Bonds

12:45 Spain to Sell Bonds

13:00 France to Sell 3.50% 2020, 1.75% 2023 and 2.75% 2027 Bonds (OAT)

By MasterForex Company