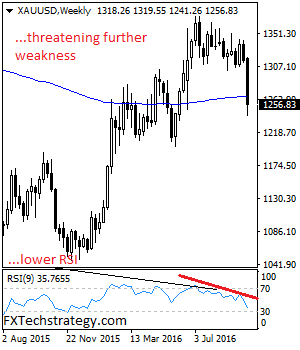

GOLD: The commodity continues to face downside pressure but with a rejection candle printed on Friday, a recovery risk cannot be ruled out. On the downside, support comes in at the 1,250.00 level where a break will turn attention to the 1,240.00 level. Further down, a cut through here will open the door for a move lower towards the 1,230.00 level. Below here if seen could trigger further downside pressure targeting the 1,220.00 level. Its daily RSI is bearish and pointing lower suggesting further weakness. Conversely, resistance resides at the 1,260.00 level where a break will aim at the 1,270.00 level. A turn above there will expose the 1,280.00 level. Further out, resistance stands at the 1,290.00 level. All in all, GOLD looks to weaken further.

- GOLD Looks To Extend Weakness On Bear Threats

- GOLD Looks To Extend Its Corrective Pullback

- GOLD Looks For Directional Bias

If you look in to the long term trend, it is currently trading near crucial level of 1250 and if this level gets breakdown then it represent a longer term bearish picture.

After taking resistance near $1380 (which is 38.2% Fibonacci retracement level of long term trend ($1910 - $1050)), the gold prices witnessed sharp selloff recently, with gold price reaching to next crucial support level of $1,250 (which is 23.6% Fibonacci retracement level of long term trend). If this level get break down then technically we could see gold prices touching its last year’s low levels.

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register