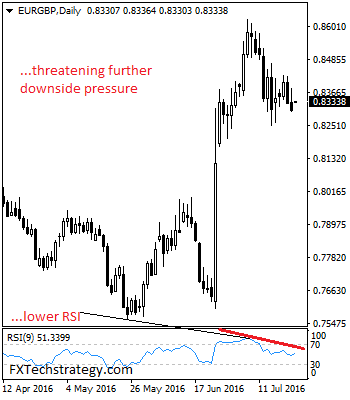

EURGBP- The cross looks to weaken further following its Thursday declines after taking back all of its intra day gains. Resistance resides at the 0.8400 level where a violation if seen will turn risk towards the 0.8450 level. On further upside, the 0.8500 level comes in as the next upside target followed by the 0.8550 level. Support comes in at 0.8300 level. Further down, support lies at the 0.8250 level where a violation will turn focus to the 0.8300 level. A break will expose the 0.8200 level. Its daily RSI is bearish and pointing lower suggesting further weakness. All in all, EURGBP remains bearish on price weakness.

- EURGBP: Puts In Temporary Bottom, Recovers Higher

- EURGBP: Retains Its Downside Pressure Bias

- Daily Technical Strategy On Currencies by FXTechstrategy

EUR/GBP: Cross Soars 1% to 2-Week Highs

The EUR/GBP pair was trading 1% stronger during the US session on Thursday as cable remained muted, while the EUR/USD pair managed to climb above the 200-day moving average. At the time of writing, the EUR/GBP cross was hovering around £0.8437.

Earlier in the day, UK house prices rose 0.5% month-on-month in July, up from 0.2% scored previously, according to Nationwide. The yearly change printed 5.2%, improving from 5.1% in June. Both measures topped expectations.

In the previous session, UK GDP rose 0.6% in the second quarter of 2016, up from 0.4% booked in Q1. The year-on-year change improved slightly to 2.2% from 2.0% scored previously.

"The BoE has limited room for maneuver before switching to negative interest rates. Therefore, we expect the central bank to leave its benchmark rate unchanged at its next meeting on August 4th, waiting for further information about the implication of Brexit for the UK economy. On the other hand, the BoE could increase the target for asset purchases without cutting rates," analysts at Swissqoute Bank said on Thursday about the Bank of England (BoE).You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register