You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

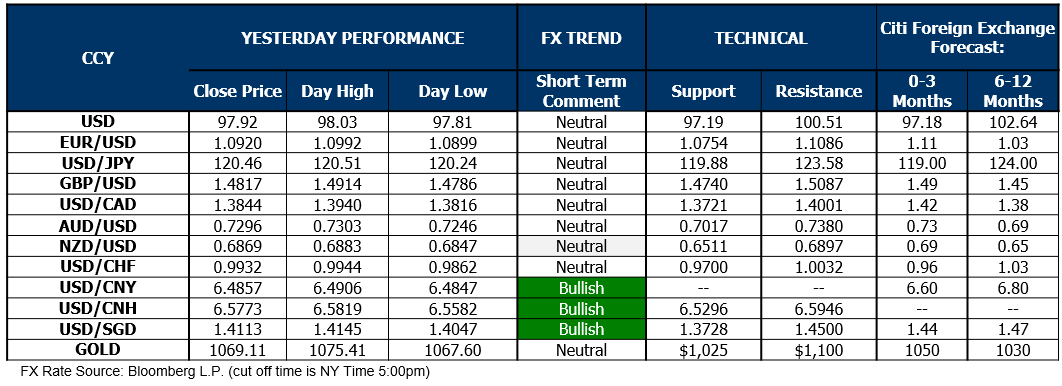

FX, Gold: Techs, Trend Signals, Forecasts - Citi

Interesting range for EURUSD

5 things to watch on the economic calendar this week

1. U.S. nonfarm payrolls report

While recent employment reports have been scrutinized for signs the Federal Reserve would begin to raise rates, the influence of the December report may be muted due to last month’s rate hike by the U.S. central bank and expectations for further rate hikes in the coming year.

2. Fed minutes

Wednesday’s minutes of the Fed’s December 16-17 meeting, when it raised interest rates for the first time in almost a decade, will be scrutinized for indications on the pace of further rate hikes in 2016.

3. Euro zone inflation data

The latest estimate of consumer inflation in the euro area will be closely watched after the latest round of easing measures unveiled by the European Central Bank in December in a bid to bolster price growth fell far short of market expectations.

4. Chinese Caixin PMI data

Surveys of Chinese manufacturing and service sector activity, due to be released on Monday and Wednesday respectively, will be closely watched amid ongoing fears over a slowdown in the world’s second largest economy.

5. U.K. PMI reports

The U.K. is to release survey data on activity in the services, manufacturing and construction sectors which will be closely watched for indications how the economy performed in the fourth quarter.

EUR/USD: Make Or Break At 1.08; GBP/USD: Target 1.46 - UOB

While the outlook for EUR is bearish in the coming days, any weakness is expected to struggle to move below the major support near 1.0800/05.

Overall, only a move back above 1.0945 would indicate the current downward pressure has eased," UOB adds.

Turning to GBP/USD, UOB notes that its current bearish phase appears incomplete and is expected to extend lower to 1.4600 in the coming days.

"Downward momentum is still strong and any rebound is expected to encounter stiff resistance near 1.4760 but only a break above 1.4840 would indicate that the bearish phase has ended," UOB argues.

FX Positioning Analysis For Major Currencies - BNPP The latest data from BNP Paribas' FX positioning analysis shows that markets continue to build GBP shorts with room for further short positioningas political uncertainty around the EU referendum.

"EUR positioning still remains neutral at +2. The large ‘client exposure’ and ‘IMM’ short exposure continues to be offset by the extreme risk reversal bullish reading.

CAD remains in heavy net short territory.CAD shorts at -35 (-50 to +50 scale) is close peak short exposure at Aug 2015 (-40)," BNPP adds.

Setups For EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD - Barclays The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are bearish against the 1.1060 range highs and would prefer to fade upticks within range. A move below our initial downside targets near 1.0795 would encourage our bearish view towards targets near 1.0730 and then the 1.0520 range lows.

USD/JPY: The break below 120.00 has prompted us to turn bearish in the short term. Our initial downside targets are near 118.00. Below 118.00 would signal further downside towards the 116.15 range lows.

GBP/USD: Having reached initial downside targets in the 1.4855 area, we now expect further weakness. Our greater targets are towards the 1.4565, 2015 lows.

AUD/USD: We look for nearby selling interest in the 0.7335 area to cap a move lower towards initial targets near 0.7095. Below there would point towards our next targets towards the 0.7015 November lows and then the 0.6930 area.

NZD/USD: Selling interest near the 0.6900 range highs is expected to cap upticks and helps to keep us bearish. We are looking for a move lower towards 0.6680 and then 0.6575 ahead of the 0.6430 November lows.

source

Here Are the Strongest Momentum FX Signals - BNPP "The strongest momentum signals continue to be long USD vs. the commodity currencies – NOK, CAD and AUD.

The USD’s bullish momentum stands at a score of +75, close to its highs for the year.

The NZD is an outlier in the commodity bloc – its momentum has turned positive due to a stronger currency and equity markets," BNPP outlines.

Setups For EUR/USD, USD/JPY, AUD/USD, NZD/USD, USD/CAD - Barclays The following are the latest technical setups for EUR/USD, USD/JPY, AUD/USD, NZD/USD, and USD/CAD as provided by the technical strategy team at Barclays Capital.

EUR/USD: A close below support in the 1.0795 would encourage our bearish view towards a revisit of the initial targets near 1.0730 and then lower to the 1.0520 range lows.

USD/JPY: We are bearish and look for a move below 118.70 towards our initial downside targets near 118.00. Below 118.00 would signal further downside towards the 116.15 range lows.

AUD/USD: We are bearish against resistance in the 0.7335 area. Our initial targets are near 0.7095. Below there would point towards our next targets towards the 0.7015 November lows and then the 0.6930 area.

NZD/USD: Selling interest near the 0.6900 range highs is expected to cap upticks and helps to keep us bearish. We are looking for a move lower below 0.6680 and then 0.6575 ahead of the 0.6430 November lows.

USD/CAD: The break above our initial upside target near 1.4005 confirms further gains. Our next targets are towards the 1.4190 area. Initial support is in the1.3800 area.

source

EUR/USD: Risk-Aversion Favors Euro S/T: Range & Outlook - BTMU The euro has recently tended to outperform against the US dollar during periods of financial market instability which have prompted liquidations of long US dollar positions, notes Bank of Tokyo Mitsubishi (BTMU).

"If investor concerns over China intensify further in the week ahead it could help to lift EUR/USD. However, the ongoing decline in commodity prices and weakening outlook for growth in emerging economies also increases the likelihood of further ECB easing. Inflation in the eurozone has already disappointed in recent months.

Short-term euro-zone yields are moving further into negative territory weighing on the euro. Fed rate hike expectations are also being pared back driven by external concerns.

However, the release of the latest payrolls report in the week ahead is expected to remain supportive for a further tightening of Fed policy and a stronger US dollar. Employment is expected to have remained solid in December and earnings growth is likely to have accelerated further," BTMU argues.

At current levels, BTMU is neutral on EUR/USD seeing the pair trading in a 1.0600-1.1050 range in the near-term.

source

Morgan Stanley Chart Of The Week: Selling Sterling Morgan Stanley picks GBP/USD as its technical FX chart of the week, where MS is bearish on the pair. MS provides some insights on the levels where investors should place their targets and stops if considering selling the pair in the medium- to long-term.

"We expect the downward momentum in GBPUSD to continue. GBPUSD has formed a bearish impulsive structure from its 1.7192 peak in 2014, currently in its 3 rd wave. This is a substructure of the 5 th wave of an impulse that began in 2007.

If this interpretation is correct, over the longer term, we would expect GBPUSD to trade below the 3 -wave low at 1.35," MS projects.

read more