Market Update GBP/USD Monday 7 Sept

GBP/USD – Important Week Ahead

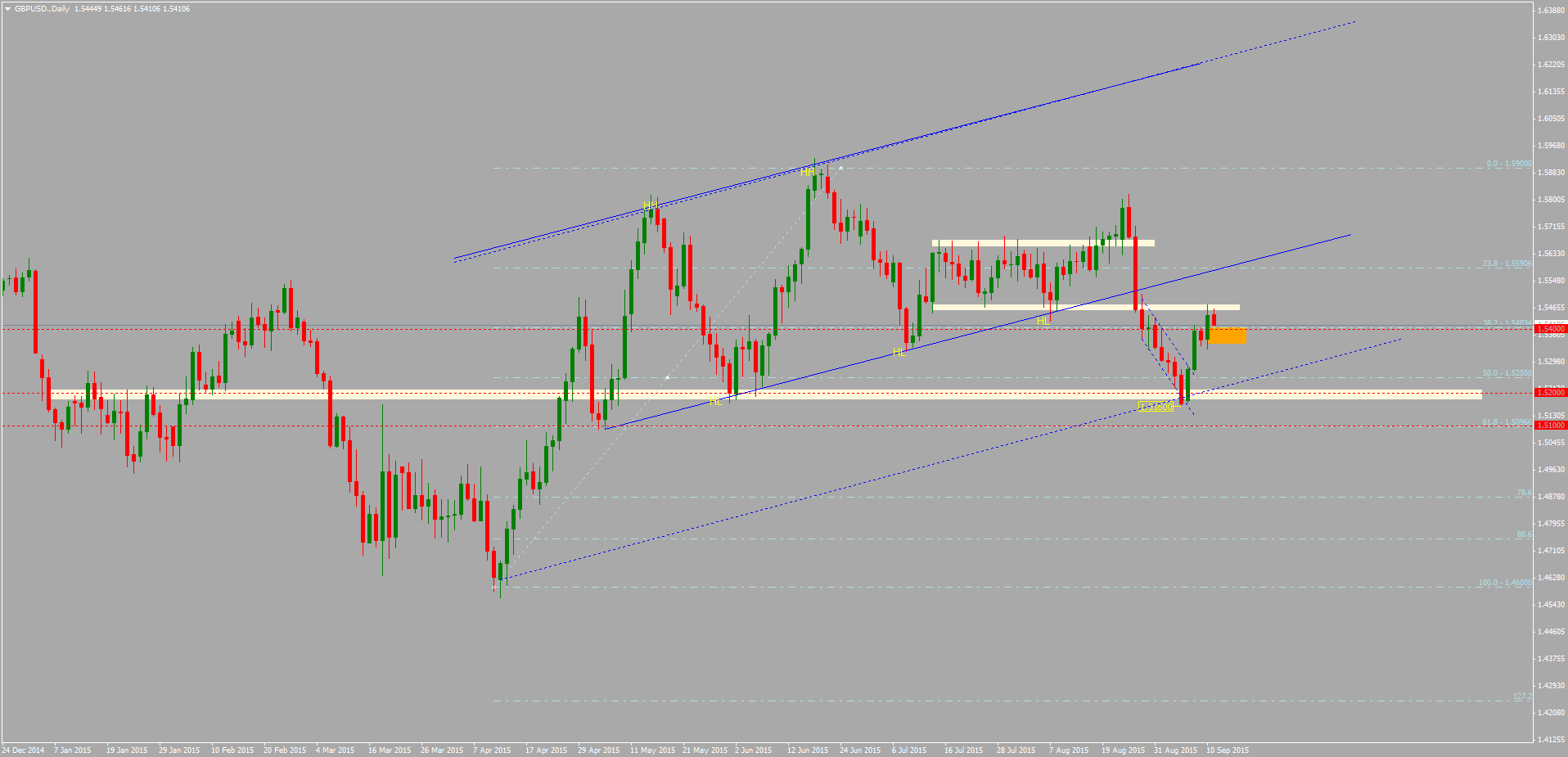

GBP/USD makes the most of the US Labor Day and hangs on to almost a 100 pip move up during the first few hours of the European session. While the US remains closed for the Labor Day holiday and economic calendar being data-empty the volatility is expected to be very low and rate to remain around 1.5250.

Following our view from last week, GBP/USD after the NFP was in-line with our expectations where we see 1.5150 as bottom of the range for this week and 1.54 as the target for buyers with 1.5280 as a resistance in current declining channel. We would like to see a break above 1.5280 (orange rectangle) and at least one H4 candle to close above 1.53 before being confident with a new wave towards 1.54.

We see current intraday support around 1.5220 (~50% retracement between Friday’s low and today’s high) with major support around current bottom around 1.5150.

There’s going to be more action later this week on GBP/USD and volatility should pick up on Wednesday with UK’s data on Manufacturing Production and Industrial Production followed by NIESR GDP Estimate and of course BoE’s Interest Rate Decision on Thursday, September 10.

Friday Market Update – GBP/USD

British Pound continues to attract buyers across the currency board following Bank of England’s remarks that the recent global turmoil have not changed the bank’s view on monetary policies.

GBP/USD rate was pushed higher during yesterday’s trade in the UK and US sessions and hit 10 day high at around 1.5470 thus advancing some 300 pips since the 1.5160 low printed last Friday.

Currently, the GBP/USD exchange rate is retracing and is likely to test support around 1.5400, which not so long ago acted as a resistance and this area is a 38.2% retracement from this year’s low to this year’s high hence is likely to attract higher volatility and sharp moves. Current technical setup suggests buying dips on GBP pairs with GBP/USD aiming to return above 1.56 to continue within the bullish channel. Long positions should be reconsidered should the market take GBP/USD below 1.5350 (orange rectangle) as then the next target for sellers will be 1.5250.

The GBP/USD data for the last 15 years shows almost 800 average pip difference between the high and low for each September and so far this year shows a 300 pip difference therefore expect to see sharp movements.

Inflation, inflation, inflation reports followed by hugely anticipated Fed’s Interest Rate Decision.

Major macroeconomic data releases next will have a great impact on currency trends for the next weeks of trade and party should begin on Tuesday with UK releasing CPI followed by US Retail sales later that day. On Wednesday we have Eurozone’s and US CPI followed by Fed’s Interest Rate Decision and Economic Projections on Thursday, September 17 therefore expect to see a few hundred pip movements on majors and crosses.

With that in mind, we strongly advise to reconsider your exposure for the next week of trade and use stop loss orders on each trade to avoid disappointments.

Tuesday Market Update – GBP/USD to enter a Demand Zone 22/09/2015

The British currency continues to attract traders from across the currency board. This week’s drops into GBP Demand Zones can prove to be a good buying opportunities as the GBP should not be affect by any of the remaining macroeconomic data releases scheduled for this week.

This week’s Demand zone for GBP/USD Buyers is between the 50% and 61.8% Fibo (Low to High of this September) and that’s around 1.5350 – 1.5400 rate. This area will attract an interest from buyers who will hope to see a new bullish wave towards August’s highs above 1.5800.

A break and Daily close below 1.5350 will negate the bullish sentiment and will signal bearish wave towards 1.5280 where the support in range trading is currently on.

Important Levels:

1.5350 – 1.5400 this week’s Demand zone for Buyers 50% - 61.8% Fibo Level between Low and High of this September, traders who will look to buy will aim to see GBP/USD above 1.58 (high of August)

1.5350 – A break and Daily Close below will signal 1.5280 as the next target for Sellers

1.5280 – A Break and Daily Close below will signal 1.5180 – 1.5200 as the next target for Sellers and an important Support for Buyers

A Break and close below 1.5180 will signal a target of lows of 1.50.

Monday Market Update - Gold 28/09/2015

Gold (XAUUSD) – Can current technical setup lead to another bullish wave?

Having found a decent support around $1100/oz, the price of gold printed two great bullish waves between $1100/oz and $1140/oz ( points A – B) and $1120/oz - $1150/oz (points C - D).

Previous retracement (point C at $1120/oz) fell onto the 50% retracement followed by a current retracement towards $1130/oz the 61.8% ‘Golden retracement’.

Gold buyers will hope not to see the price falling and trading below $1130/oz for a long period of time. Daily close below $1130/oz will negate the bullish sentiment and next target for sellers may well be the bottom of $1100/oz if support at $1120/oz will give up. For that reason do expect volatility and sharper movements around those price zones.

However, current technical setup suggests a probable third wave towards Augusts’ high at $1170/oz (point F).

There are only a couple of macroeconomic news of medium importance which can have an impact on the price of gold. Expect higher volatility and movements on the price of gold later this week with Friday’s Macroeconomics from US such us the Unemployment Rate and NFP will be out.

Let us know what you think in comments below!

Monday Market Update: Bearish pressure mounts on US Dollar 12/10/2015

There is a growing bearish pressure on US Dollar ahead of the US Inflation report scheduled for this Thursday, October 15.

Last month’s weak NFP report and FED’s dovish outlook led major currency counterparts to gain momentum and strengthen v the greenback. Aussie claims 9

[SUP]th[/SUP]consecutive day in green while Gold is looking to advance above $1200 / oz.

USD/JPY is due a break out (see USDJPY.Daily chart) with targets around lows of 116 (monthly S3) or 123.50 (monthly r3). Ideally you want to wait for a break out from the current symmetrical triangle patter and wait for retest of support/resistance but bearing in mind that most of other major currencies are also at or close major supports and resistances, the retest may be fast or none at all.

Latest turn around in the commodity market pushed price of gold towards resistance around $1170 / oz. and current technical setup suggests a likely move above $1200 / oz. last seen back in June. Intraday support is around $1150 / oz. break and close below will negate the bullish wave.

GBP/USD is likely to continue bullish momentum and progress up towards 1.5480 – 1.5500 (monthly r1) with intraday support currently at 1.5300 (monthly PP).

The upcoming reports in this week’s economic calendar do not look too promising in favour of US Dollar with Retail Sales, CPI and Jobless Claims are looking to disappoint and prolong the long awaited hike in bank rates.

Expect higher volatility and liquidity from Wednesday onwards and don’t forget to review your account for risk management and don’t forget to set stop orders.

Friday Update AUD/USD 20/11/2015

The Aussie gains momentum across the currency board and is set to test a key resistance around 0.7250 v the US Dollar as the trading week is coming to an end.

Since finding a decent support and preventing failing below 0.7000 v the US Dollar last week, the Aussie is likely to test the 61.8% retracement level (~0.7250), taking October’s high and November’s low into Fibo calculation.

We noticed an increased interest on AUD pairs but current Aussie buyers will be hoping to see a daily close above 0.7250 as this could potentially trigger further long positions towards the upper boundary of its current bullish channel.

Having checked the economic calendar there’s not much more this week that could negate the current bullish sentiment, which should continue during next week of trade.

RBA’s governor speech scheduled for next week should provide clues as to how market participants will see AUD/USD going for the next few weeks of trade but bear in mindTuesday’s and Wednesday high impact news from US.

Summary:

Daily close above 0.7250 is likely to attract further buyers aiming at the upper boundary of current bullish channel ~0.75.

Daily close below 0.71 would take AUD/USD below its current bullish channel and prompt a fast paced sell offs.

As always, we encourage traders to assess their market exposure on a frequent basis and use Stop Loss to avoid unwanted disappointments.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

GBP/USD made a significant bearish move towards 12 week low and is on track to test the low of 1.52. Weakness in GBPUSD is in line with the bearish sentiment that has come after a change in inflation expectations amid further decline in commodity prices. BoE’s Monetary Policy Committee will vote on Bank Rate on Thursday 10, a week before FED’s Rate decision and Monetary Policy Statement.

There are no more major macroeconomic news for the GBP this week and thus attention goes to the fundamentals in the US as tomorrow, Thursday Sept 3 US’ Trade Balance report followed by Friday’s NFP and Unemployment Rate will be released.

There is a growing interest in the GBP/USD as it approaches the low of 1.52, and positive data from US can easily take the rate down to around 1.51 where the 61.8% retracement (1.46 – 1.59) is currently placed and this zone represents a key support. Daily close above 1.54 would negate the bearish bias and turn market attention higher and create a chance to join a new bullish wave towards the ‘unfinished’ business at 1.60 from three months ago.

SUMMARY: Conservative buying above 1.54, selling below 1.51 with the 300 hundred pip range in between looking to set a trading range for upcoming week of trade.

To view the full version of the Analysis please visithere.