ECB Post-Mortem: We remain short EUR- BNPP

The European Central Bank refrained from more monetary stimulus in the last 2014 meeting and the euro jumped.

However, euro-zone QE is far from being shelved. The team at BNP Paribas stay short, explain why and provide targets:

Here is their view :

The ECB decision this week disappointed elevated expectations but the ECB’s language continues to get more dovish and President Draghi promised the ECB will reassess early next year and could introduce more aggressive asset purchase measures at that time, notes BNP Paribas.

“However, despite acknowledging that the outlook has worsened since the last forecasts, he declined to introduce new measures or send a strong signal,” BNPP adds.

EUR price-action near-term.

“However, price action in the 48 hours ahead of the meeting suggests a scramble to add exposure to EUR downside heading into the event. These weaker positions are at some risk now and it would not be a surprising to see a squeeze up through 1.25 near term,” bnpp argues.

EUR Risk-Reward ino 2015.

“Despite the near term upside risks, however, we think risk reward remains attractive for running EUR shorts heading into the new year,” BNPP advsies.

“President Draghi’s comments continue to show that the central bank is very focused and aware of the risks from falling inflation expectations. He does not have a consensus to take new measures at this time, but the central bank is prepared to act in Q1 if the current measures do not succeed in reversing the decline…Our economics team continues to expect the ECB to adopt broader asset purchases in Q1 in response to stubbornly low inflation,” BNPP clarifies.

In line with this view, BNPP remains short EURUSD and EURGBP and expect EURUSD to reach 1.20 by the end of Q1

EUR/USD Price Action: ECB QE Not Priced In; Here Is Why – Goldman Sachs

EUR/USD managed to recover from the lows despite the poor TLTRO and the diverging paths of monetary policies.

The team at Goldman Sachs explains why there is a large downside to the pair with sovereign QE looming:

Here is their view :

“We study tic-by-tic moves in the Euro during last week’s ECB press conference, which saw EUR/$ spike higher. We think the price action underscores our take that the single currency is not pricing sovereign QE, validating our view of significant downside in EUR/$ in the months ahead.

We think this price action is revealing in a couple ways: (i) the initial move lower in EUR/$ on “expectation” becoming “intended” underscores once again – as did the November press conference – that the ECB’s goal of expanding the balance sheet by €1trn is not yet fully priced, leaving aside the question of whether (and when) sovereign QE is coming; and (ii) the market is still distrustful that the ECB may do sovereign QE in short order given the divisions on the Governing Council. We see both things as meaningful, given our conviction that sovereign QE is coming – indeed, as we note above, President Draghi’s use of the term QE was the most ever during last week’s press conference.

EUR/USD: A Low In For The Year? Ending Wedge – Goldman Sachs

EUR/USD has made a nice recovery from the lows. Is it all over for a new fall in the world’s most popular pair?

The team at Goldman Sachs examines the wedge:

Here is their view :

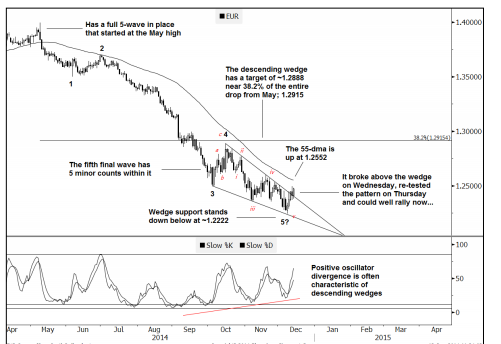

EUR/USD closed above the top of the pattern last Wednesday, re-tested the break point on last Thursday and has since turned back higher again, notes Goldman Sachs.

“All in all, it seems EURUSD is gradually making its way higher from a textbook ending wedge. An ending wedge/falling diagonal occurs primarily in the fifth wave of a 5-wave sequence which fits this chart’s count quite nicely,” GS clarifies.

“It completes on a break through the top of the pattern and frequently precedes a sharp move higher. In this case, the wedge targets a move back to the Oct. 15th high (the top of wave 4) at 1.2888 near 38.2% retrace from the May ’14 high (1.2915),” GS projects.

Further confidence in this view, according to GS, will be given by a daily close above the 55-dma at 1.2552 where the market hasn’t seen a close above this pivot since the actual May 8 th high.

This technical set-up, according to GS, suggests that EUR/USD low may already be in for the year.

“It is worth highlighting that the market has based at 1.2248 right above a trendline extended across the lows since Jun. ‘10 at 1.2230. Overall, the balance of signals seem to be suggesting that the drop from May ‘14 is now a complete 5-wave sequence. It may now be in the initial stages of a (ABC-type) corrective process,” GS adds.

Euro Dollar Forecast to Hit 1.15 by BNP Paribas

The 2015 exchange rate forecasts at BNP Paribas have been released, and it appears the euro is in line for hefty declines against the US dollar.

Forecasts for a softer euro in 2015 are not hard to find; analysts are banking on the European Central Bank (ECB) to introduce more aggressive policy actions to try and boost the moribund economy.

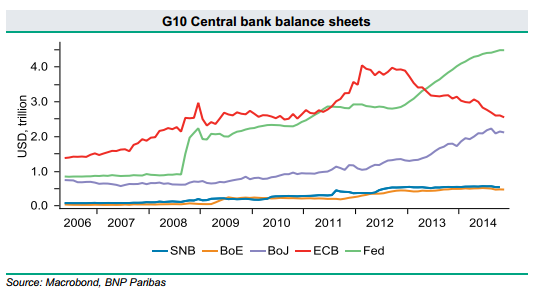

According to BNP Paribas, the theme of policy divergence that drove EURUSD lower in 2014 should persist in 2015 as the start of the Fed’s policy tightening in June contrasts with an ongoing balance sheet expansion by the ECB.

The French bank told clients:

“We expect real rate differentials to remain a useful framework for capturing the FX impact of both conventional and unconventional central bank policies.

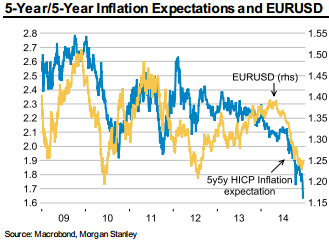

“Specifically, we think that higher US nominal rates and higher Eurozone inflation expectations will do most of the heavy lifting in moving the real rate differential against the EUR and in favour of the USD.

“Our rates strategists’ forecasts imply a widening of 2y nominal rate differentials by 125bp.

“If the ECB is successful at pushing eurozone inflation expectations higher, real rates should move even more (closer to 200bp), suggesting that the risk is for an even weaker EURUSD than we are currently forecasting.”

US Dollar to Advance Against Yen to 128

Another key forecast issued by BNP Paribas concerns the ascent of the US dollar against its Japanese rival.

Despite the fact that USDJPY has already rallied substantially, analysts believe there is more to come in 2015.

Commenting, BNP say:

“The BoJ’s ‘shock and awe’ approach has been effective in triggering quick JPY sell-offs. However the underlying story of Japanese investor outflows driven by increasingly negative interest rates at home is only starting to play out and should drive the yen lower even in the absence of further BoJ policy action.

“The risk is that the move becomes too fast for the MoF’s liking, but as we saw in late 2014, mild jawboning merely slows the USDJPY uptrend.”

A target of USD/JPY @ 128 has been advised.

We Stay Short EUR/USD; More Reasons To Be Short EUR – BNPP

If you needed more reasons to understand the euro’s move south and EUR/USD grind lower, the team at BNP Paribas provides explanations.

And, they also have a trade setup for EUR/USD:

Here is their view :

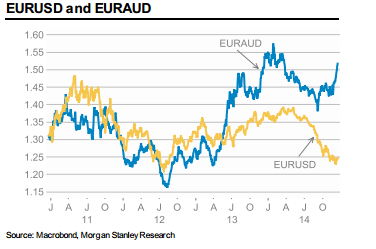

October’s balance of payments data continues to suggest real flow support for the EUR is waning, notes BNP Paribas.

“Deterioration in eurozone portfolio flows is a key transmission mechanism through which falling relative real yields push EUR lower. Friday’s eurozone current account data revealed a weaker reading of €20.5bn (SA) for October, down from €32bn in September. However, the current account surplus was easily recycled through portfolio and FDI outflows. The broad basic balance moved further into negative territory, to €-32.5bn, from €-30.6bn in September,” BNPP explains.

What Is The Likelihood Of A EUR/USD Squeeze Into Year-End? - BNPP

Following the failure of Greece’s second vote for President on Tuesday, a third rejection on 29 December will lead to general elections early next year with the risk being (an anti-establishment) Syriza-led government, notes BNP Paribas.

"However, with Greek debt already restructured and contagion dangers tamped down by OMT and QE expectations, we do not expect markets to return to pricing existential tail risk for the EUR again in 2015," BNPP argues.

"Of more significance for the EUR is the continued collapse in EUR front-end rates. EONIA fixed at a new record low Tuesday of -0.077%, in marked contrast to the squeeze higher we saw heading into last yearend and against expectations in the aftermath of low TLTRO uptake," BNPP adds.

"US-Eurozone rates are markedly diverging heading into year-end now, which should limit the scope for a squeeze higher in EURUSD before the start of 2015," BNPP projects.

In line with this view, BNPP maintains a short EUR/USD position from 1.2520 targeting 1.18, with a stop at 1.28.

EUR To Fall To 1.12 Without QE Or 1.05 With QE - Morgan Stanley

EUR is the most extreme short-positioned currency in the G10, notes Morgan Stanley.

"However, despite the latest readings of the MS FX Positioning Tracker showing there has been scaling back of EUR short positions, the EURUSD rebound has remained limited," MS adds.

Short-lived corrections:

"In recent months, there have been a couple of examples of short EUR-position adjustment resulting in only limited correction rebounds. This we believe is evidence of the more structural outflows now developing from the Eurozone, keeping the EURUSD downtrend intact," MS argues.

However, MS notes that EUR rebounds on several of the crosses looked more pronounced, keeping the EUR relatively higher on a trade-weighted basis.

The case for QE:

"This could increase market expectations that the ECB will announce QE in early 2015, capping any further EUR gains. Other indicators are also putting the pressure on the ECB to take further action, including the Eurozone 5-year/5-year Inflation expectations, which have also continued to fall sharply," MS adds.

Politics matters too:

"The political uncertainty building within Europe is set to be a major theme over the coming year, we believe, where several elections are likely to highlight a shift away from mainstream parties towards smaller, often more EMUskeptical political parties, throughout Europe. This is likely to add to the longer-term EUR bearish theme, in our view," MS expects.

EUR/USD forecasts for 2015: 1.12 without QE:

"As a result, we expect the EUR to come under continued pressure over the coming year and reiterate our view of EURUSD extended towards the 1.12 area. This base case projection assumes no QE from the ECB and is formed around the scenario that the current announced measures are set to weaken the EUR via portfolio outflows, increased bank lending (EUR used as a funding currency) and currency hedging of outstanding positions," MS projects.

EUR/USD forecasts for 2015: 1.05 with QE

"However, if the ECB does move to QE in the coming months, this would likely take us to our 1.12 target more rapidly and put the focus on our EUR bear case scenario, where we project EURUSD down to 1.05 for end-2015," MS adds.

All market makers agree that Euro is going to fall - that should mean something

EUR/USD To Start Its Descent To 1.15; We Stay Short – BNPP

After all the falls in EUR/USD, is there still time for a short? All those 2015 predictions are getting closer as 2014 draws to an end.

The team at BNPP sees the descent to 1.15 starting soon, explains and provides a chart:

Here is their view :

Policymakers will continue to dominate the foreign exchange markets in a busy H1 2015, says BNP Paribas.

“Monetary policy divergence trades remain our favoured strategies and the rhetoric has reinforced this as 2014 draws to a close. We expect downside in EURUSD and EURGBP, while USDJPY should rise, and we think the best performing trades will position for this,” BNPP projects.

Specifically for EUR/USD, BNPP still sees the start of quantitative easing by the European Central Bank (ECB) in 2015 which will start to close the balance sheet gap with the Federal Reserve.

Meanwhile, BNPP thinks the USD will lead the G10 FX Pack in 2015.

“The USD will continue to find yield support: the spread between the two-year US Treasury yield and comparable German and Japanese bonds has reached new multi-year extremes…Anticipation of Fed policy tightening by Q3 of next year should continue to keep US front-end yields increasingly supported and yields are likely to become progressively “unglued” at shorter maturities as lift-off approaches,” BNPP argues.

“Given this, we think the EURUSD will begin its descent to 1.15,” BNPP projects.

In line with this view, BNPP maintains a short EUR/USD position in its portfolio going into 2015. The trade entered at 1.2520 with a stop at 1.28 and a target at 1.18.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The euro dollar exchange rate could eventually succumb to a low of 1.10 by the time November 2015 comes about.

A set of forecasts on the EUR/USD for 2014-2015 warns of significant weakness ahead with Barclays reckoning the figure of 1.10 is achievable.

We also catch a glimpse of analyst expectations from Reuters, Goldman Sachs and HSBC.

For reference, the euro to dollar exchange rate (EUR/USD) is quoted as being at 1.2528 at the time of writing.

Draghi Drives the Long-Term Agenda

The Governor of the European Central Bank (ECB) delivered another broad-side on the euro at the start of the new week and reminded markets that it is ready to act in order to boost Eurozone economic stagnation.

Draghi gave a clear signal that the ECB could begin buying eurozone government debt if its existing stimulus measures don’t bring inflation back to target.

It is the threat of full-blown quantitative easing that has reminded currency markets that the supply of euro to the market is likely to increase significantly just as the US Federal Reserve and Bank of England look to ease back on supply.

This differential is what is sending the euro lower against both the dollar and pound.

Banks Forecast Losses for the Euro Longer-Term

Looking at the year-ahead framework for the euro dollar exchange rate we note the banks, as shown in the forecast table above, are wary of steep losses for the shared currency,

“There is still a two-speed Eurozone when it comes to their economies, but the problem is that the northern states are now either growing very slowly or stagnating – France is a prime example,” says a note from Danske Bank.

There has also been a lack of change in the employment framework and the need for flexibility and reduced costs.

Danske say:

“It therefore comes as no surprise that the universal view of the banks is that the euro will weaken against sterling and the US dollar over the next twelve months.

“It is still very difficult to know when the major movements will be, but the most likely drivers will be when the suggested QE for the Eurozone is formalised and/or when interest rates are raised in the UK and/or the US.”

Key Eurozone Economic Indicators Provide a Worry

A flow of official data showing worryingly steep falls in some key economic indicators, notably industrial production in Germany and other major euro member states, led to heightened worries that the region was in the midst of falling into another recession.

“Inflows of money into Eurozone-focused exchange traded funds rapidly reversed, with net outflows recorded in August and September,” says Williamson.

But is Economic Sentiment Stabilising?

At the close of the preceeding week a ‘short squeeze’ in the euro was seen and euro-dollar bounced off support and edged towards the 1.27 region.

It would appear that all the negativity towards the shared currency may already be reflected in the current euro exchange rate valuations and those hoping for a heavy fall may have to bide their time.

Chris Williamson, Chief Economist at Markit tells us why the euro has benefited from buying interest over recent days:

“Investors have shown greater interest in the Eurozone in recent months, according to ETF fund flow data, in a major change compared to the summer.

“The better than anticipated expansion of the economy in the third quarter goes some way to validate the improved sentiment towards the single currency area, though the still-subdued pace of expansion signalled by October’s PMI readings suggest recent ECB stimulus has yet to make an impression of eurozone growth.”

source