You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

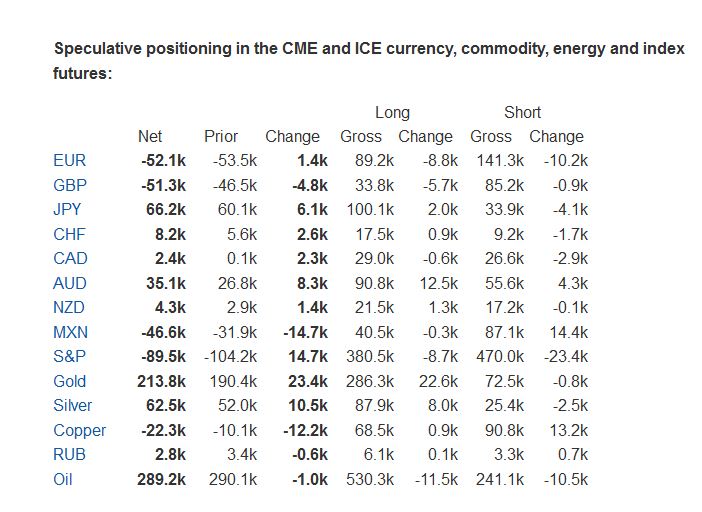

Commitments of Traders: Speculators More Bullish on Japanese Yen; Less Bearish on Euro

Takeaways From This Week's COT Report - CAD, AUD, NZD At Bullish End Of 52 Week Range Data in this report cover up to Tuesday Apr 5 & were released Friday Apr 8.

What remained of the aggregate USD long position was halved in the week ended April 5th with a $2.9bn decline to $2.9bn—its lowest level since May 2014.

Sentiment improved for all currencies with the exception of GBP as CAD shifted back to neutral for the first time since June 2015. Investors added to bullish positions in JPY, AUD, CHF, and NZD. EUR, GBP, and MXN are now the only currencies held net short.

A 10th consecutive week of short covering has pushed CAD sentiment back to neutral for the first time since June 2015. Sentiment for CAD, AUD, and NZD is at the bullish end of its 52 week range.

EUR saw the largest w/w change in positioning with a $1.5bn narrowing in the net short to $7.6bn. EUR bears continue to cover their positions, and the outstanding number of short contracts has fallen to its lowest level since October 2015. EUR bulls have also shown an increasing level of confidence, building their positions at an accelerated pace over the past three weeks.

JPY is the largest held net long at $6.8bn following a $0.8bn w/w build. Risk was added to both sides and we can only assume that the freshly built shorts were forced to cover in response to the subsequent JPY gains later in the week. Also note that gross JPY longs have climbed to a fresh record high.

source

CFTC Commitments of Traders: Yen longs extend to most since at least 1992 CFTC weekly positioning data as of the close on April 12, 2016 for Forex futures

The yen position is awfully crowded and one idea floating around is that there will be pressure to cover ahead of the BOJ meeting on April 28.

Separately, the gold net long is the highest since Aug 2011 at +66K.

CFTC - Commitments of Traders: Speculators More Bullish on JPY, Gold, AUD; More bearish on GBP

CFTC Commitments of Traders: Yen longs increase to the largest long position on record CFTC weekly positioning data as of the close on April 19, 2016 for Forex futures

The JPY position is the largest long on record going back to 1992.

The EUR shorts were trimmed by 5K to the -47K. The level is nearly equal to the position from Feb 23rd. That was the smallest short position since June 2014.

In other currencies:

CFTC Commitments of Traders: AUD bets rise to highest in three years Weekly CFTC positioning data in the Commitments of Traders report for the close on Tuesday, April 26, 2016:

Note that this report doesn't reflect the Fed decision on the BOJ decision; both came after the release. It does show how specs were positioned going into those events.

The jump in AUD longs is what stands out here. That's a crowded position and the most-long in three years.

CFTC: Speculators Less Bearish on EUR, GBP; More Bullish on AUD, CAD, Gold, Silver

CFTC Commitments of Traders: AUD bets rise to highest in three years

Weekly CFTC positioning data in the Commitments of Traders report for the close on Tuesday, April 26, 2016: