It depends on the strategy! There is no fixed rule!

EDIT: Also see the following related poll/thread: https://www.mql5.com/en/forum/93930

It depends on the strategy! There is no fixed rule!

EDIT: Also see the following related poll/thread: https://www.mql5.com/en/forum/93930

I used to thought so until recently I tried another trailing method and seems to make my ea more profitable

So I'm checking out what others are experiencing

As stated, it depends on the strategy and in addition, also depends on the type of trailing - fixed, stepped, PSAR, Donchain, Chandelier, Fractals, etc.

Agree. That's not a yes or no question.

In Market on this website there is a trailing stop EA called YF Trailing Stop (among several others) that I find is very useful for several reasons:

it has several types of trailing stops not as a fixed number but as an additional stop by moving average, SAR, parallel lines, etc which are all individually configured.

The trailing stop EA can be put on a separate chart from your trading chart which acts on all positions for that pair or CFD but it can be configured in various ways to ignore some orders.

It can remain ON for new orders to close with the exit of a position. It has an on-chart indication of trailing or not trailing.

This way you can use your hard stop if you like to have it as an emergency backup but also have a trailing option functioning on the position to exit at a better price.

It is a lot less trouble and more reliable than the built in trailing stop on the trade tab.

In Market on this website there is a trailing stop EA called YF Trailing Stop (among several others) that I find is very useful for several reasons:

it has several types of trailing stops not as a fixed number but as an additional stop by moving average, SAR, parallel lines, etc which are all individually configured.

The trailing stop EA can be put on a separate chart from your trading chart which acts on all positions for that pair or CFD but it can be configured in various ways to ignore some orders.

It can remain ON for new orders to close with the exit of a position. It has an on-chart indication of trailing or not trailing.

This way you can use your hard stop if you like to have it as an emergency backup but also have a trailing option functioning on the position to exit at a better price.

It is a lot less trouble and more reliable than the built in trailing stop on the trade tab.

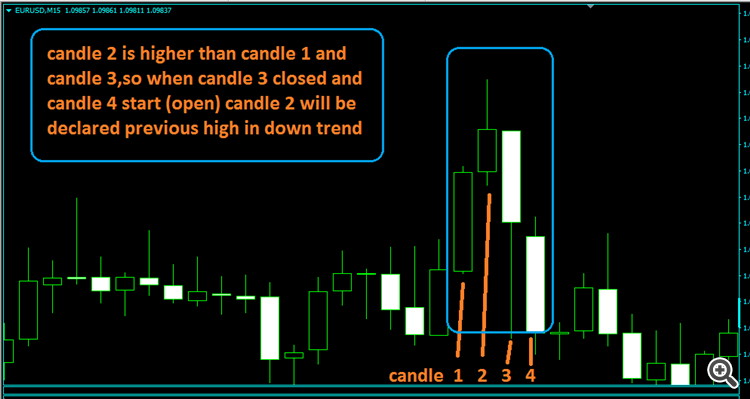

Would you like post that YF Trailing stop EA,i like see ..... and as for as i seen and experienced,i do not saw any Trailing EA or code in some standard EA that work on the way (in buy trend trailing should be move up behind market price by previous low,one step back than current/latest previous low for to give space market breathing,so trade may not cut/close early .... and in sell trend it should trail by previous high .... and the way previous high/low are declared there no and never any chance to be repaint or shift the states of previous high/low in all two up/down trend .... let me explain a bit,high/low are determined by/with 4 candles,candle 1,2,3 and 4,when candle 2 is higher than candle 1 and 3 ,here we take value of close price ,means when close price value of candle 2 is higher than close price of candle 1 and 3 (it will be decide when candle 4 open/start forming) in down trend,it will be a previous high in down/sell trend and same formula for up/buy trend..... your negative comments are welcome for to improve the idea.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use