Go to the CodeBase to find the indicators, for example:

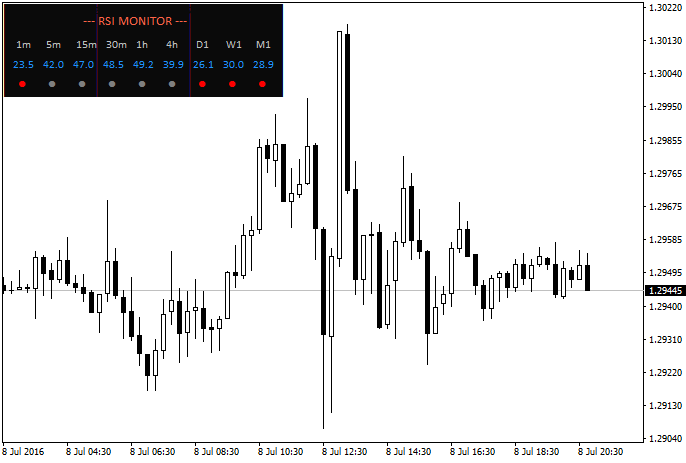

RSI Monitor with alerts - indicator for MetaTrader 4 :

If you trade with RSI indicator, here is another way to use it. This indicator will draw a small panel that shows all RSI values on all timeframes and will alert you when the price enters the Oversold, Overbought zones.

or use search to find RSI alert indicators for example.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2014

Sergey Golubev, 2014.04.21 17:09

How To Use The RSI IndicatorLearn the basics of the Relative Strength Index in just about 6 minutes!

This RSI indicator is a widely-used momentum oscillator that measures the strength and speed of a market's price movement by comparing the current price of the security against its past performance. The RSI can be used to identify overbought and oversold areas, support and resistance levels, and potential entry and exit signals.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read March 2016

Sergey Golubev, 2016.03.02 08:27

Technical Analysis for the Trading Professional: Strategies and Techniques for Today's Turbulent Global Financial Marketsby Constance Brown

"Now in its second decade, Technical Analysis for the Trading Professional is the number-one go-to guide for market technicians seeking to improve their market timing skills with the most up-to-date tools and techniques. This second edition provides an updated look at unique formulas and key indicators, while retaining all the foundational material that made the previous edition an instant classic.

Technical Analysis for the Trading Professional has been enhanced and expanded to bring you fully up to date on all the essentials, including:

- Dominant trading cycles

- Moving averages

- Fibonacci projections

- Gann Analysis

- Relative Strength Index and stochastics

- Dominant trend lines

- Price projections

- Elliott Wave Principle

- Volatility bands

- Composite Index"

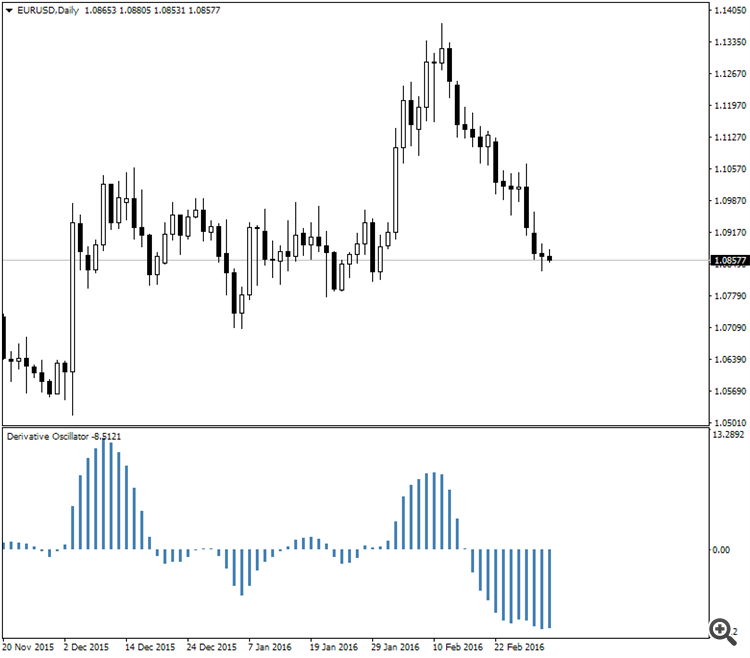

Constance Brown's Derivative Oscillator was published in her this book. The oscillator uses a

14-period RSI . The RSI is then double smoothed with exponential moving

averages . The default settings for the smoothing periods are 5 and 3.

In a second step a signal line is generated from the smoothed RSI by

calculating a simple moving average with a period of 9. The Derivative

Oscillator is calculated as the difference between the smoothed RSI and

the signal line and displayed as histogram.

The formula is:

EMA(EMA(RSI(14), 5)), 3) - MVA(EMA(EMA(RSI(14), 5)), 3), 9)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hey brand new to trading cant believe ive found a massive community. Any way I can set up MT5 so that I get an alert when a currency pair reaches certain parameters? For example RSI value of 90 or above?

Thanks

Dave