Anyone has experience please share to me.

I test my EA with 99.9% model quality and i want to know :

Is the real account will get a result same or nearly the same as 99.9% model quality result?

Thank you. In my ea I set slippage to 3 and max spread to 15 point.

Between testing I saw order modify error and order ordersend error too.

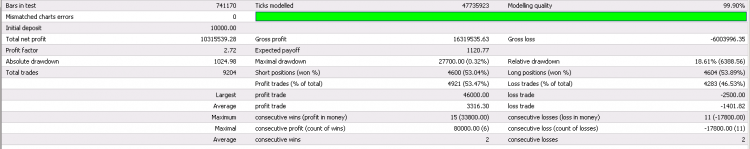

But the result is good as below.

Thank you. In my ea I set slippage to 3 and max spread to 15 point.

Between testing I saw order modify error and order ordersend error too.

You didn't answer my questions . . . slippage is not implemented/simulated in the Strategy Tester, so if your trades are slipped by a pip or two how will that affect your performance ?

99.9% is a meaningless figure, it just means that you used tick data, it is simply the figure used to show you that you used tick data, it could just have easily been 1245%

Your performance looks good, what date range is this over ? how many pairs have you repeated this on ? is this optimized at all ?

I suggest you to backtest with fixed lots, that gives you more realistic results.

Why is it more realistic ?

If you have a profitable EA, do you let all your profit on the account for years ?

If I'm looking for income, no, if I'm looking for capital growth then yes. either way I would never use fixed lots.

The figures I looked at were average profit trade, average loss trade and win rate. Break even WR needed is 1401.82 / ( 1401.82 + 3316.30 ) = 29.7% actual WR 53.47% the difference is significant and is a cause for optimism . . . assuming the Strategy isn't massively curve fitted.

If I'm looking for income, no, if I'm looking for capital growth then yes. either way I would never use fixed lots.

The figures I looked at were average profit trade, average loss trade and win rate. Break even WR needed is 1401.82 / ( 1401.82 + 3316.30 ) = 29.7% actual WR 53.47% the difference is significant and is a cause for optimism . . . assuming the Strategy isn't massively curve fitted.

Why ?

I want to know exactly how much I am risking on any trade and conversely when I have a winning trade I want to know that I am using the largest position size, in accordance with my risk tolerance, to benefit optimally from the winning trade.

I also want the benefits of compounding.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Anyone has experience please share to me.

I test my EA with 99.9% model quality and i want to know :

Is the real account will get a result same or nearly the same as 99.9% model quality result?