Ouch! Cant help you with your problem, but I suggest you do not trade through high impact interest rate announcements by the Reserve Bank. I stayed out of the market yesterday for that exact reason. I must say I "guessed" the direction correctly and would have made close to a 1000 point gain, but that would have been a 50-50 gamble. I suggest deVries forex calendar

https://www.mql5.com/en/code/10459

It has a bug or two (after a couple of days constant running causes the terminal to stall - just restart the indicator), but generally works well.

Hi All, I have attached a screenshot from MT4 showing what happened yesterday when the AUS/USD

spike down. You can see that stop loss at 1.04135, 1.04255 and 1.04289 were all hit on 1st May, 04.29 hrs.

My question is, is this a broker problem ?

Can EAs be written to prevent such a thing ? e.g controlling the slippage, spread etc

Ironically, the stop loss levels were hit but not the take profit levels.

Hmm...are we really at the mercy of brokers ?

Your Pending Buy was opened when the Spread opened and the Ask (Buy at Ask) rose quickly . . . . you existing Sell orders are closed by a Buy . . . the spread opened and Ask climbed hitting the SL of your 2 Sell orders . . . then price fell and the Bid hit your Buy's SL

If I'm not mistaken there was AUD related news yesterday at this time . . . this usually causes the Spread to open . . .

If I'm not mistaken there was AUD related news yesterday at this time . . . this usually causes the Spread to open . . .

Hi All, I have attached a screenshot from MT4 showing what happened yesterday when the AUS/USD

spike down. You can see that stop loss at 1.04135, 1.04255 and 1.04289 were all hit on 1st May, 04.29 hrs.

My question is, is this a broker problem ?

Can EAs be written to prevent such a thing ? e.g controlling the slippage, spread etc

Ironically, the stop loss levels were hit but not the take profit levels.

Hmm...are we really at the mercy of brokers ?

Hip

The thing was that, I already had sell positions before the spike. And when it spiked down I expected to be profiting. Unfortunately, from what I understand the spread widened and the stop-loss for those sell positions were hit.

However, I was actually running an EA that would continuously place sell stop orders if the sell orders will stopped out.

I thought that this will enable me to catch the spike down. But looks like the wide spread can prevent the EA from re-placing the sell stop orders.

So I never got the chance to catch the spike down, after my original sell positions were exited.

The thing was that, I already had sell positions before the spike. And when it spiked down I expected to be profiting. Unfortunately, from what I understand the spread widened and the stop-loss for those sell positions were hit.

However, I was actually running an EA that would continuously place sell stop orders if the sell orders will stopped out.

I thought that this will enable me to catch the spike down. But looks like the wide spread can prevent the EA from re-placing the sell stop orders.

So I never got the chance to catch the spike down, after my original sell positions were exited.

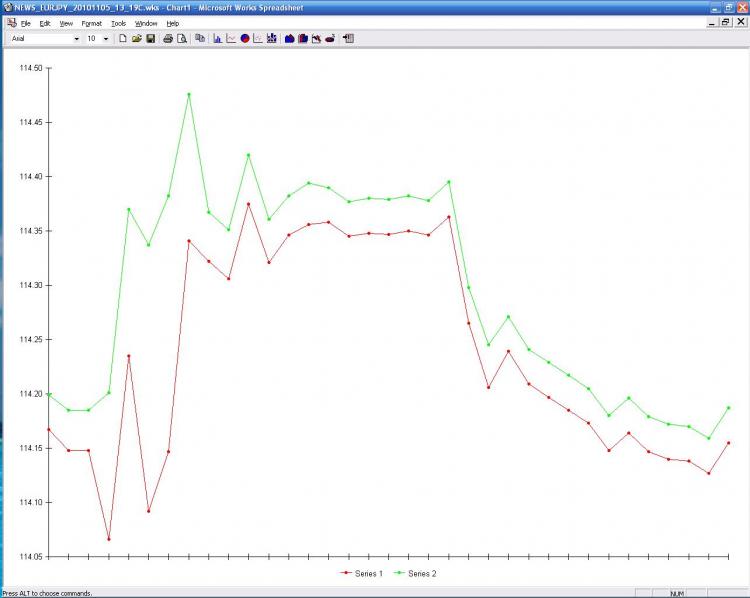

The key thing to trading News spikes is to log the data tick by tick so you can figure out what happened and adjust accordingly.

This was a non-farm payroll event. It cost me money :-(

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi All, I have attached a screenshot from MT4 showing what happened yesterday when the AUS/USD

spike down. You can see that stop loss at 1.04135, 1.04255 and 1.04289 were all hit on 1st May, 04.29 hrs.

My question is, is this a broker problem ?

Can EAs be written to prevent such a thing ? e.g controlling the slippage, spread etc

Ironically, the stop loss levels were hit but not the take profit levels.

Hmm...are we really at the mercy of brokers ?

Hip