- AUDUSD Technical Analysis 11.08 - 25.08 : Ranging

- Which is a better indicator ?

- Press review

I can not say anything about Silver because of this spike :

because indicators are not showing anything reasonable in this case.

As to H4 timeframe so this is bearish as a primary trend (price is below kumo; kumo = cloud of Ichimoku indicator), and bearish as secondary too (no any correction or rally was started yet). As to the future so I can not say anything in exact way ... it may be ranging market condition so the price will be within 19.53 and 19.96 support/resistance levels.

Ichimoku cloud is thin one so the price can easy break the border of this cloud to go to primary uptrend but it will depends on fundamental news events (economic calendar related).

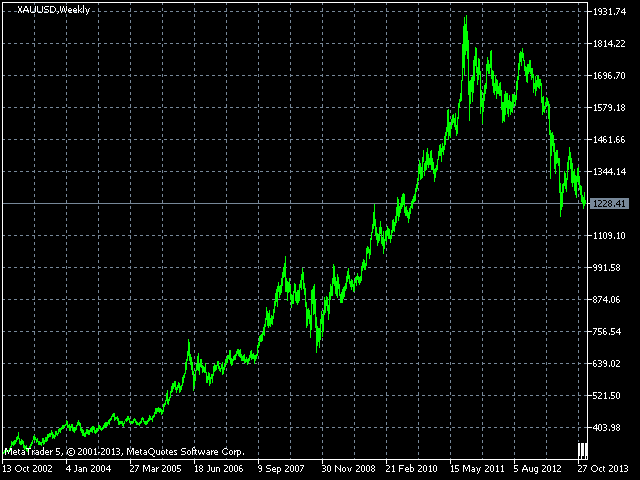

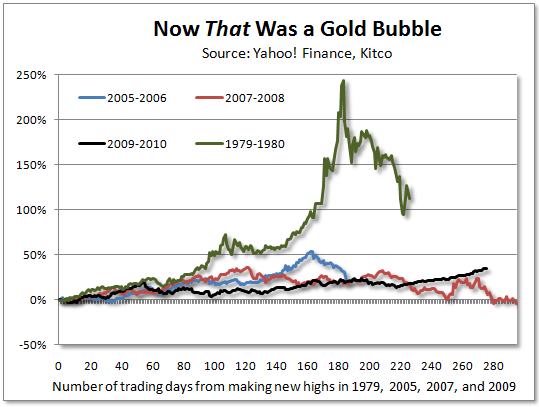

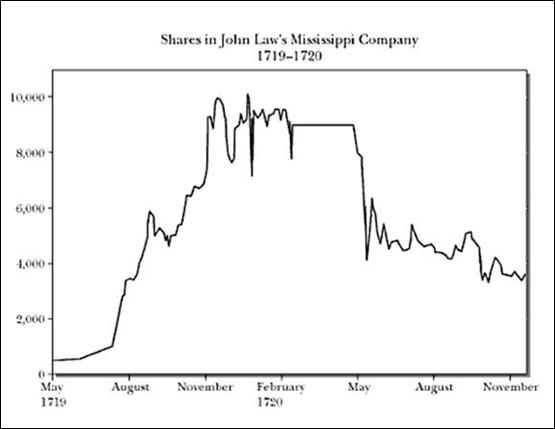

Judging by the exponential shape that the gold chart takes at some point, it seems to me it is a bubble!

*Click here to go the website where I took the chart above from

Thank you Sirs,

you have confirmed my opinion. Is still early,flat at the moment. Probably bearish primary trend is close to the end.

Thank you Sirs,

you have confirmed my opinion. Is still early,flat at the moment. Probably bearish primary trend is close to the end.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use