Recommendations for choosing an adviser on the Market

- Significant price does not guarantee the quality of the adviser

-

You must have the offer "Rent", otherwise it seems that the author is

afraid of disappointment when the adviser works on real accounts

-

The number of parameters of the adviser should not be too large. For

example, no more than 20. It is unlikely that you will be able to master

the management of an advisor with a large number of parameters, you

will have to contact the author for settings in .Set files. And this

means that you have only one parameter left - the Magic number. It is

advisable to understand how to manage it before buying an advisor

-

Do not trust advisers with artificial intelligence and neural networks

that foresee market behavior. The very possibility of foresight has no

scientific basis, because foresight is an exact knowledge of what will

happen in the future. You can only talk about assumptions or accept: "If

the sunset is red in the evening, tomorrow will be windy." And what

will happen tomorrow, we will see tomorrow. All advisers have artificial

intelligence, so they make assumptions about the direction of the

market and, on this basis, form buy or sell signals. As for neural

networks, they also assume on the basis of an algorithm that is formed

implicitly and cannot be analyzed.

- Testing the EA on data older than one year does not make sense, as the market situation is changing.

- Determine the size of the desired growth of the Deposit per month and

the real growth per month, which can provide Advisor. To do this, you

need to test the EA on an interval of one month. If the work of the

adviser is not predictable for the growth of the Deposit per month, it

is hardly worth spending time and money. If the expert Advisor uses

Money Management = Persentage, it usually provides a testing schedule

for several years, since all profits are generated in the last year of

testing, when the Deposit and lot size reach significant sizes.

According to these test results to assess the real growth of the Deposit

per month is not possible. In addition, trading a lot of significant

size, in addition to the potential profit carries significant risks,

since all transactions can not be profitable (except for the use of

martingale), so triggering a Stop Loss with a large lot leads to the

loss of a significant share of the Deposit.

- Estimate the number of trades that the EA makes per week. If this value

is less than five, that is, less than one per day, it is difficult to

expect a more or less significant increase in the Deposit per month.

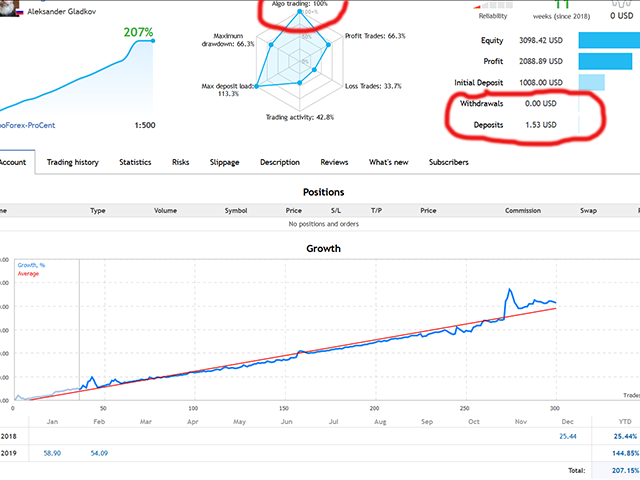

- It is imperative that the

adviser has a signal of his work on a real account at the present time.

It is worth paying attention to the indicator Algo trading = 100%. If

its value is less than 100, then the advisor is helped manually. If the signal has the amount of Deposits and Withdrawalls, it is possible to manipulate the signal to cheat the

Growth indicator for a beautiful chart. If there is no signal, it turns out that the author himself does not

risk trading on a real account. And if he tried, the results were not so

attractive to publish.